MARKET WATCH: Indian billionaire rings up gains on talk he plans to raise BT stake

Updated:

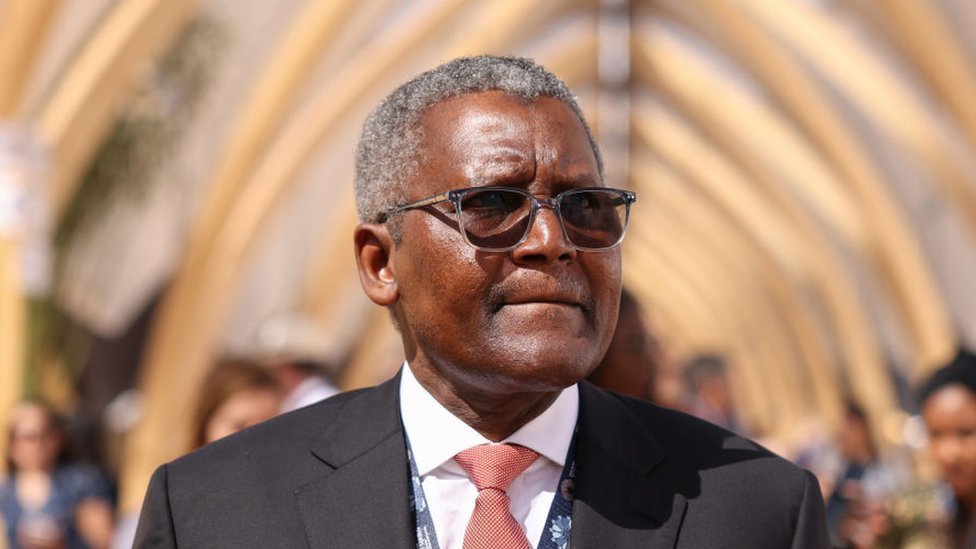

BT shares rose as reports suggested an Indian billionaire is planning to increase his stake after taking a 24.5 per cent holding.

Sunil Bharti Mittal became the biggest shareholder in BT last year after buying the stake held by embattled French tycoon Patrick Drahi.

According to the FT, he has suggested he could expand his stake, which is held through his firm Bharti Enterprises. BT also benefited from an upgrade from analysts at HSBC who raised the target price to 220p from 200p. Shares gained 1.6 per cent, or 2.5p, to 161.2p.

The FTSE 100 added 0.3 per cent, or 24.94 points, to 8705.23 and the FTSE 250 inched up 0.4 per cent, or 69.86 points, to 20,097.77.

IT software services provider Bytes Technology was the biggest riser across the two benchmarks, up 17.8 per cent, or 73.8p, to 488.2p, after a strong trading update. It was followed by Computacenter (up 11 per cent, or 256p, to 2590p) after it said it was well-placed to make progress in 2025.

Pawnbroker H&T rose 2.7 per cent, or 10p, to 388p after posting a 10 per cent rise in annual profits to £29.1million.

Telecom tycoon: Sunil Bharti Mittal became the biggest shareholder in BT last year after buying the stake held by embattled French tycoon Patrick Drahi

Easy investing and ready-made portfolios

Free fund dealing and investment ideas

Flat-fee investing from £4.99 per month

Get £200 back in trading fees

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.