Shravin Bharti Mittal Joins UK's Wealth Exodus Amid Tax Overhaul Targeting Non-Doms

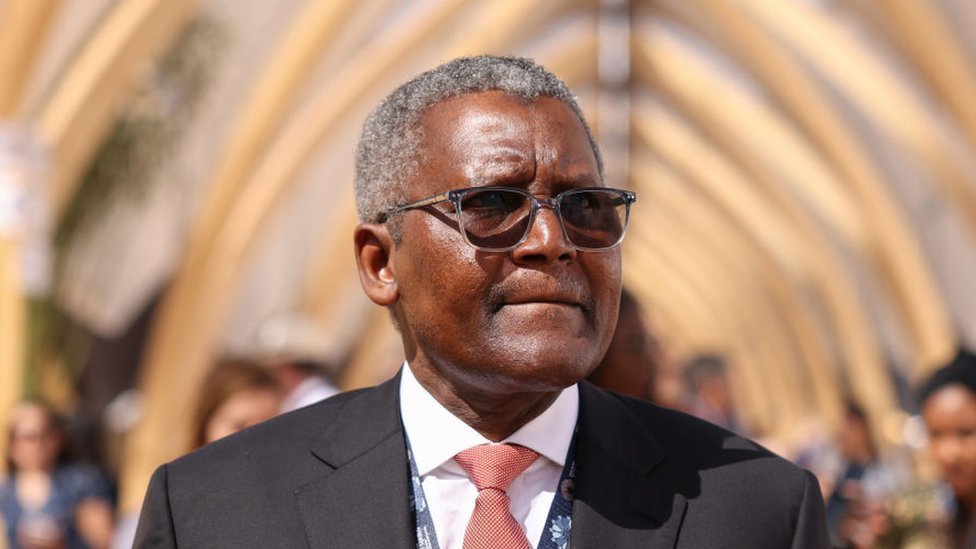

Shravin Bharti Mittal, 37, heir to India’s $27.2 billion Bharti family fortune and a major shareholder in BT Group Plc, has relocated from the United Kingdom to the United Arab Emirates, joining a growing wave of ultra-wealthy individuals exiting Britain following sweeping tax reforms. The move, confirmed through filings for Bharti Enterprises, highlights the fallout from the UK’s decision to abolish its 226-year-old non-domiciled (non-dom) tax regime, which previously allowed foreign-born residents to avoid UK taxes on overseas income for up to 15 years .

Mittal, son of Bharti Enterprises founder Sunil Bharti Mittal, now lists the UAE as his residence after years in Britain. In April 2025, he established an Abu Dhabi branch for his London-founded investment firm, Unbound, which focuses on fintech, logistics, and enterprise software. His sister, Eiesha Mittal, has assumed his former role at Bharti Global, the family’s investment arm holding a 24.5% stake in BT Group, one of Britain’s largest telecom providers . The Bharti Mittal family’s net worth, estimated at $27.2 billion by the Bloomberg Billionaires Index, places them among India’s wealthiest dynasties.

The Conservative government’s March 2024 decision to scrap non-dom status—a regime long criticized for favoring the wealthy—was compounded by Labour Chancellor Rachel Reeves’ July 2024 elimination of inheritance tax breaks on overseas assets. These changes mandate that non-doms pay UK taxes on global income and assets held in trusts, effective April 2025. Analysts warn the reforms could backfire economically: the Centre for Economics and Business Research estimates that losing even 25% of Britain’s 74,000 non-doms would cost the UK more in lost investment and spending than the projected £2.7 billion annual tax gain .

“The UK’s latest tax regime is seen as a trigger for wealthy non-doms to explore more favorable jurisdictions,” said Gianpaolo Mantini, a partner at wealth advisory firm Saltus. “There will certainly be an exodus—these individuals are already tax mobile” . Mittal’s departure follows high-profile exits including Egyptian billionaire Nassef Sawiris (relocating to Abu Dhabi and Italy) and members of the Lazari property dynasty (now based in Cyprus) .

Mittal’s relocation highlights concerns that the tax overhaul could undermine Britain’s appeal as a global financial hub. As managing director of Bharti Global, he played a key role in the family’s 2024 acquisition of a BT Group stake from French-Israeli billionaire Patrick Drahi. His exit coincides with broader fears that dwindling non-dom residency will deter foreign capital and talent. The UK’s non-dom population contributed an estimated £7 billion annually in taxes and supported sectors like real estate, luxury goods, and philanthropy .

The Bharti family’s UK ties run deep. Shravin began his career in London as a JPMorgan investment banking analyst after graduating from the University of Bath. His firm, Unbound, headquartered in London since its 2017 founding, has backed startups like Indian fintech giant Pine Labs and British logistics platform Sorted . However, the UAE’s zero-income-tax policy and streamlined business regulations now offer a compelling alternative for mobile billionaires.

Shravin Mittal’s professional trajectory mirrors the globalized ambitions of India’s corporate elite. After roles at Airtel Africa and SoftBank’s Vision Fund, he launched Unbound in 2017 with backing from Bharti Global, sovereign wealth funds, and conglomerates. The firm’s portfolio spans three continents, emphasizing tech-driven sectors poised for digital transformation .

Despite his UAE shift, Mittal retains influence over Bharti Enterprises’ UK assets, including the BT stake. Analysts suggest his move symbolizes a strategic pivot toward Asia and the Middle East, where Bharti’s telecom arm, Airtel, serves over 500 million customers across 18 countries . Britain faces a reckoning: as wealthy non-doms depart, policymakers must balance tax fairness with sustaining London’s status as a magnet for global capital—a challenge exacerbated by post-Brexit economic headwinds .

In summary, Shravin Bharti Mittal’s relocation underscores a pivotal moment for Britain’s economy. As the UAE and other tax-friendly nations attract disaffected billionaires, the UK’s gamble on taxing its wealthiest residents may reshape its financial landscape for years to come.