Major Player Alert: Charles Schwab Eyes Bitcoin Trading by 2026 After Huge Crypto Interest Spike!

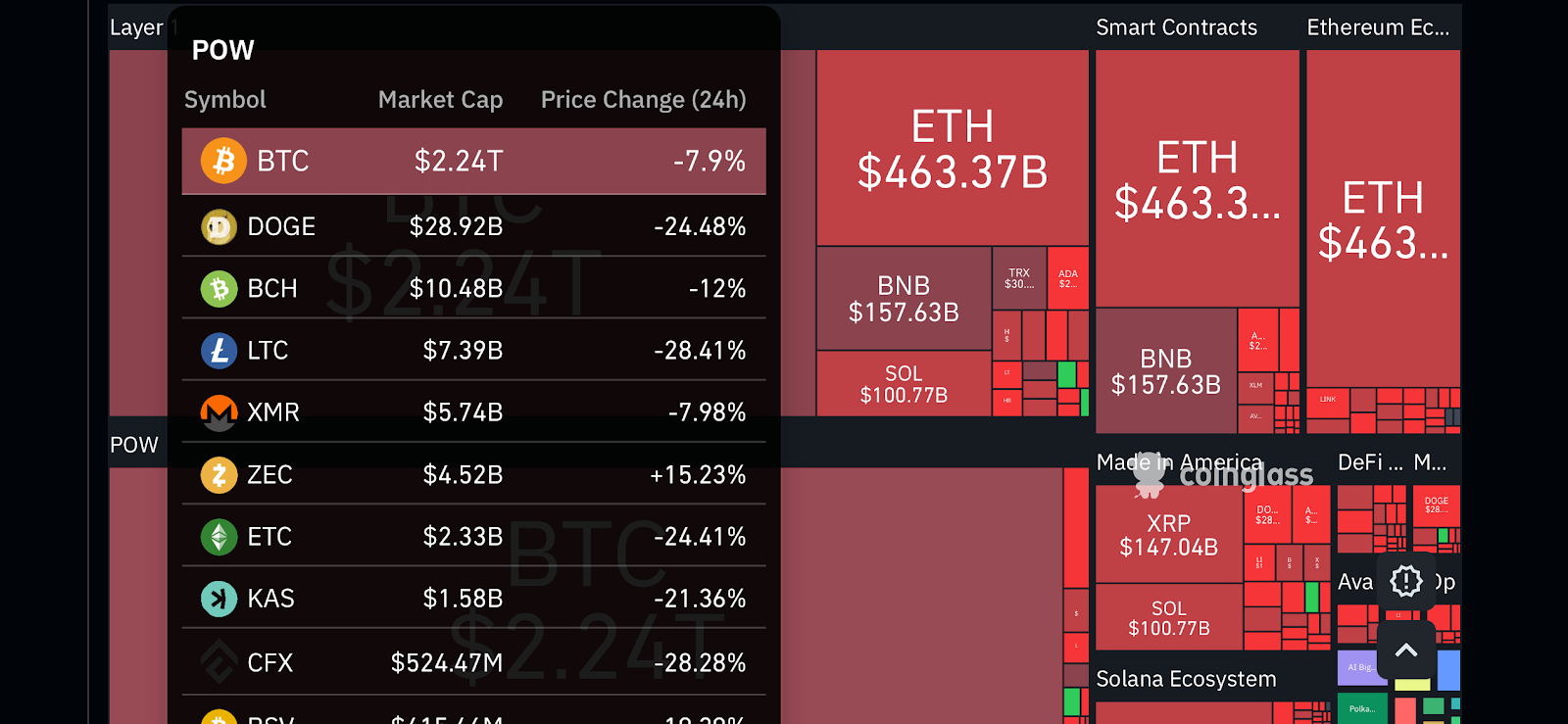

Charles Schwab is experiencing a significant surge in retail investor engagement across its crypto product offerings, with CEO Rick Wurster reporting a 90% year-over-year increase in visits to the company's crypto platform. This robust activity highlights a strong investor appetite for Bitcoin ETFs, Bitcoin futures, and other crypto exchange-traded products (ETPs), with Schwab clients now holding approximately 20% of all crypto ETPs in the U.S.

In response to this escalating demand, Charles Schwab is actively expanding its suite of crypto investment options and educational resources. The company is committed to providing a comprehensive client experience, blending seamless digital access with traditional support channels such as phone calls and branch offices. A major development on the horizon is the planned introduction of spot Bitcoin trading in the first half of 2026, a strategic initiative confirmed by Wurster during Schwab’s third-quarter earnings call. This move aligns with earlier announcements to offer Bitcoin and Ethereum trading, driven by client requests to consolidate crypto holdings within Schwab. The earnings call also revealed impressive financial performance, with $134.4 billion in net new assets, marking a 48% year-over-year increase, and total client assets reaching $11.59 trillion, up 17% year-over-year, alongside a 30% jump in daily average trades.

Schwab's overarching strategy, as articulated by Wurster, focuses on making crypto accessible and understandable to a broader audience. This involves providing advanced trading platforms like ThinkorSwim while also offering essential guidance for new investors, underscoring a deliberate push to integrate digital assets into mainstream finance.

Beyond Charles Schwab, the broader traditional finance sector is increasingly embracing digital assets. Morgan Stanley, for instance, recently released a report advising clients to allocate between 2% and 4% of their portfolios to crypto, primarily Bitcoin, based on individual risk profiles. The report lauded Bitcoin as a scarce asset akin to "digital gold," suggesting its legitimate role in diversified investment strategies. It also recommended quarterly portfolio rebalancing and gaining exposure through exchange-traded products to effectively manage volatility. This guidance coincided with Bitcoin achieving a new all-time high of approximately $126,200.

Further demonstrating this institutional shift, U.S. Bank announced the formation of its new Digital Assets and Money Movement organization. This specialized division aims to accelerate the development of and grow revenue from emerging digital products and services, including stablecoin issuance, cryptocurrency custody, asset tokenization, and digital money movement.

The growing confidence in digital assets is also evident in the rising institutional holdings within Bitcoin ETFs, which reached $870.7 million in Q3 2025, marking an increase of $117.3 million from the previous quarter. These developments collectively signal a robust and accelerating trend of traditional financial institutions integrating cryptocurrency into their core offerings and investment advice.

You may also like...

Rooney Blasts 'Crisis Mode' Liverpool: Champions Lacking Leadership and Salah's Form a Major Concern

Defending Premier League champions Liverpool are in a worrying slump, having lost four consecutive matches. Former Engla...

Real Madrid Stuns Barcelona with Clasico Masterclass; Mbappe, Bellingham Shine

Europe's top football leagues delivered a weekend of high drama, featuring Real Madrid's controversial El Clásico victor...

Daily Show Drama: Jon Stewart's Battle for Creative Freedom Amid Paramount-Skydance Merger

Jon Stewart revealed at the New Yorker Festival that he is actively seeking to extend his contract at “The Daily Show” d...

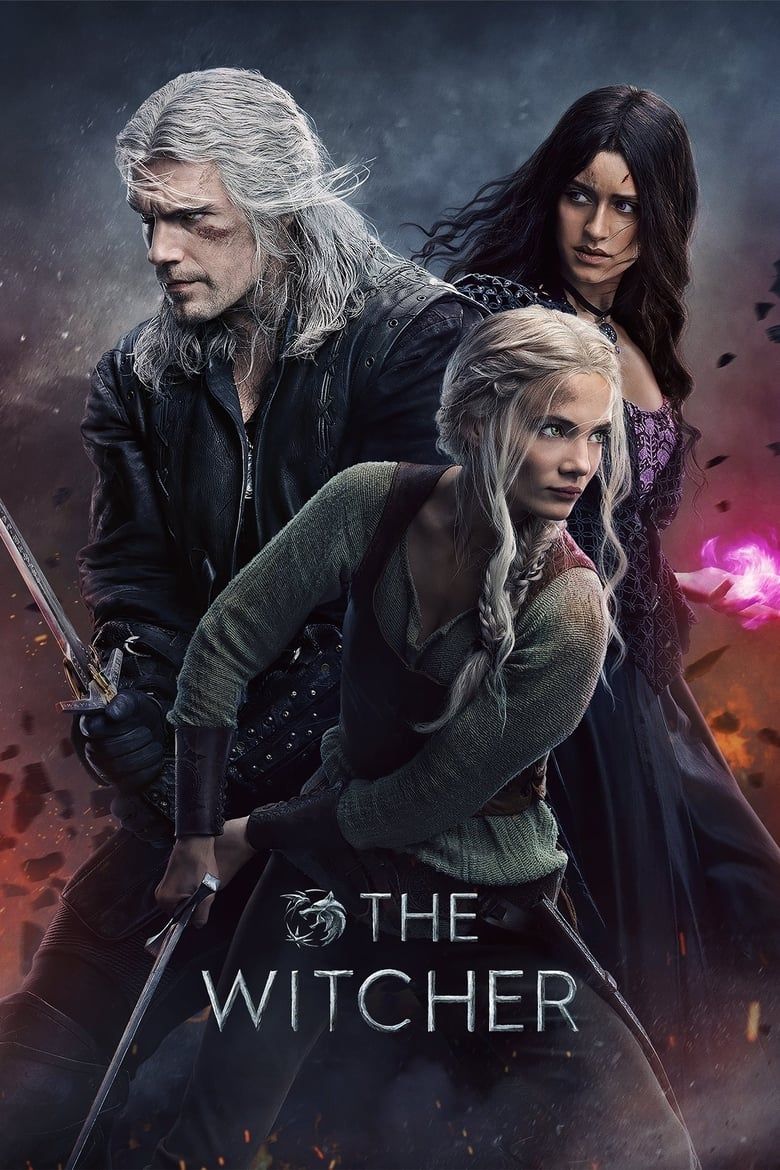

Hemsworth Breaks Silence: The Weight of Replacing Cavill in Witcher Season 4

Liam Hemsworth will debut as Geralt of Rivia in The Witcher Season 4 this Fall, replacing Henry Cavill. Hemsworth shared...

Mzoe 7's 'Fela Kuti' Spectacle: Zimbabwean Artist Redefines Music & Drama!

Mzoe 7's recent one-man show at the Bulawayo Theatre has redefined performance standards, captivating audiences with a m...

Zimbabwean Duo Bantu & Dr. Chaii Seize Apple Music's Isgubhu Spotlight!

Award-winning Zimbabwean artists Bantu and Dr. Chaii are the latest Apple Music Isgubhu cover stars, celebrated for thei...

Caroline Flack Tragedy: Mother's Heartbreak Over Texts Found on Lewis Burton's Phone

Caroline Flack's mother, Christine, is heartbroken by newly resurfaced questions surrounding texts found on Lewis Burton...

Strictly's Claudia Winkleman's Daughter: A Decade On From Horrific Halloween Accident

After 12 years, Claudia Winkleman is stepping down from Strictly Come Dancing to prioritize her family, including her da...