'Made in USA' Crypto Coins Surge as Trump Signs Stablecoin GENIUS Act

“Top Made in USA” crypto assets are recording bullish momentum following the U.S. House of Representatives’ passage of three key crypto bills yesterday, and one of bills passing into law today.

The "Crypto Week" bills included the broader markets structure-focused CLARITY Act and the Anti-CBDC Surveillance State Act, as well as the GENIUS Act, which U.S. President Donald Trump just signed into law today, July 18. The stablecoin bill had already passed in the Senate last month, making it the most advanced among the three bills in focus for Crypto Week.

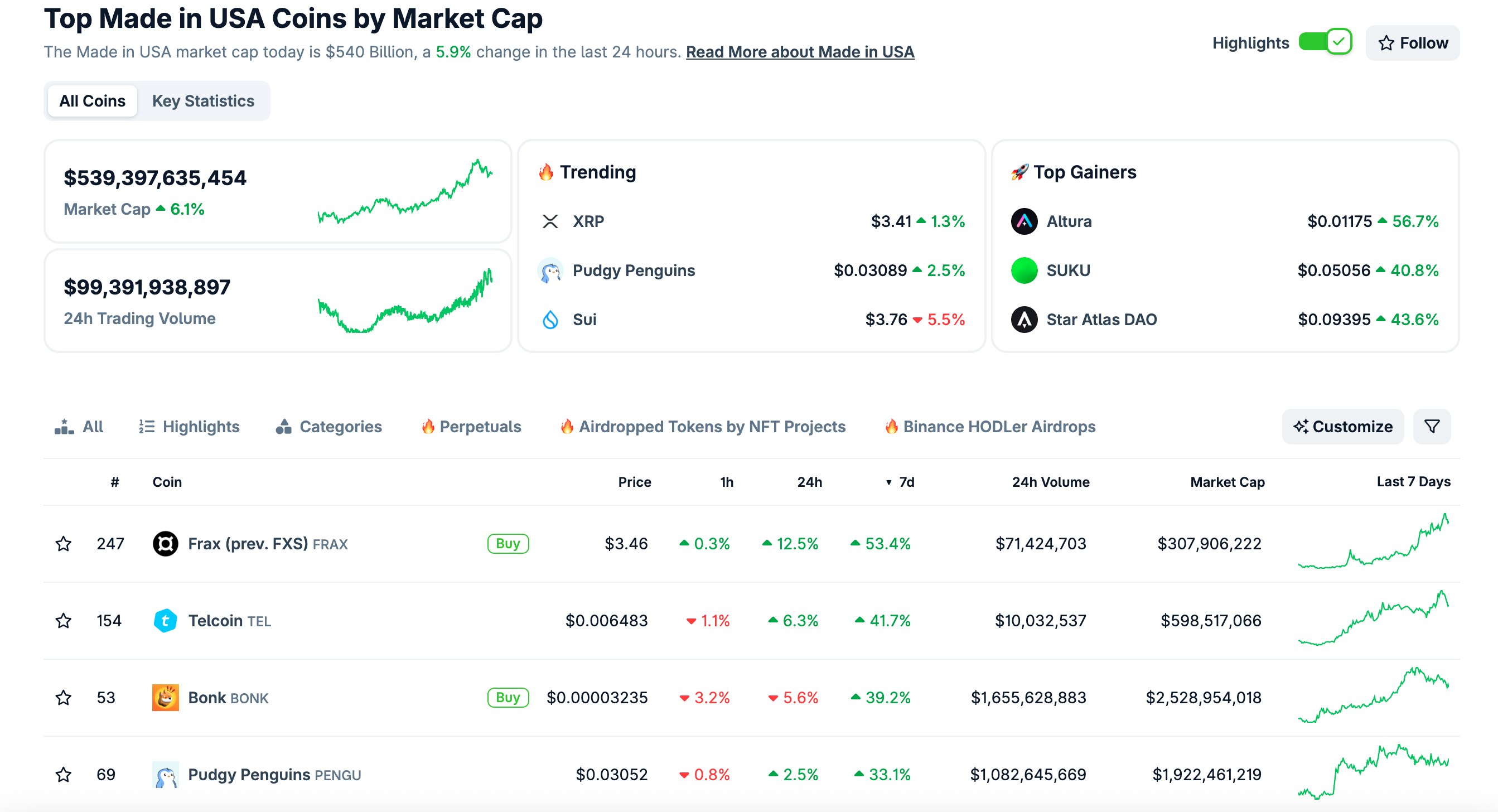

The combined market capitalization for the top U.S.-made assets, per CoinGecko data, currently stands at $542 billion, a 6.5% increase over the past 24 hours. This category comprises digital assets with ties to the United States, namely those founded by U.S.-based companies or headquartered within the country.

Top earners on the day include Uniswap’s UNI, which surged nearly 16% to $10.14, and Telcoin (TEL), which is up 7% today to $0.0065. Another top-gainer in the sector today is Optimism (OP), which recorded an increase of 8% to $0.75.

Multiple assets rallied in the double-digits on the weekly timeframe, likely on Crypto Week activity and anticipation of the bills’ passage. The top weekly earner is Frax (FRAX), which soared over 54% to $3.44. TEL is also a top gainer on the week, recording a 42.5% gain, while Solana memecoin Bonk (BONK) in third place, up 41.4%.

An honorable mention includes Pudgy Penguins (PENGU), which has soared nearly 35.2% on the week to $0.03. Today’s increase pushed PENGU’s monthly growth to 235%. However, PENGU's gains are likely tied to the Securities and Exchange Commission acknowledging the filing of the Canary Capital spot PENGU ETF on July 10.

Top U.S.-made crypto by market cap weekly top performers. Source: CoinGecko

Experts say the rally leading up to the House’s vote during Crypto Week, and immediately following the passage of the bills, underscores how important regulatory clarity is for digital assets in the U.S.

"The rally we're seeing right now with ‘Made in USA’ coins is critical because it reflects growing investor confidence that the US is finally moving toward regulatory clarity,” Mike Cahill, CEO of Douro Labs, adding:

“These assets are deeply tied to US innovation and enforcement narratives, so when legislation progresses—even incrementally—it reduces perceived existential risk.”

Cahill added that markets are reacting to the “possibility that US-based projects will soon operate on more equal footing with global competitors, under clearer rules,” which is a good sign for the industry in general, he argued.

“Crypto Week can be remembered as an inflection point: the moment when the U.S. decisively moved to embrace crypto for what it is: a powerful technological innovation that can make markets faster, more efficient, and more accessible,” Ian De Bode, chief strategy officer at Ondo Finance, echoed in comments shared with The Defiant:

“The passage of these bills would send a powerful signal: that the United States is not only open for business in the digital asset space, but ready to lead.”

De Bode explained that institutional adoption rests on clear rules. “Regulatory clarity has consistently been the missing piece preventing full institutional participation,” he said. “The demand from traditional institutions to participate in the digital asset ecosystem is strong, but they have been sidelined by legal uncertainty, and need legal clarity to engage at scale.”

Now that bills made headway in the House, there's a strong likelihood of accelerated adoption. “We expect this to translate into a meaningful boost in sentiment across both retail and institutional markets,” De Bode said. “Investors will increasingly view on-chain assets not just as speculative instruments, but as core components of a modern, regulated financial system.”

Meanwhile, the broader cryptocurrency sector’s market capitalization reached $4 trillion for the first time ever earlier today. Since then, it has slightly retraced to $3.88 trillion, a 4% decrease on the day, according to CoinGecko.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...