Kenya's Economy Shifts: Central Bank Dives into Tenth Rate Cut!

The Central Bank of Kenya (CBK) has implemented its tenth consecutive interest rate cut, reducing the benchmark rate by 25 basis points to 8.75 percent from 9.00 percent. This decision, announced by the Monetary Policy Committee (MPC) on February 14, 2026, aims to stimulate credit growth and bolster lending to the private sector, reinforcing earlier measures designed to support economic activity.

This latest rate reduction comes amidst a favorable inflation environment. Kenya's year-on-year inflation decreased to 4.4 percent in January, a slight decline from 4.5 percent in December. Crucially, this rate remains comfortably within the Central Bank's target range of 2.5 percent to 7.5 percent, providing policymakers with the flexibility to prioritize economic growth.

Kenya's economy has demonstrated robust expansion, consistently growing at approximately 5 percent annually. The Central Bank projects further growth, forecasting 5.5 percent for the current year and 5.6 percent in 2027. This is an increase from an estimated 5.0 percent last year, though the 2025 outlook was slightly revised down from 5.2 percent due to weaker agricultural output experienced in the third quarter of the previous year. Agriculture continues to be a pivotal driver of output and employment, making the economy susceptible to weather-related shocks, with meteorological authorities flagging a potential drought that could impact food supply and inflation later in the year.

In addition to the rate cut, the CBK also narrowed the interest rate corridor around the policy rate. It was reduced to plus or minus 50 basis points from the previous 75 basis points. This move is intended to enhance monetary policy transmission by strengthening the link between the policy rate and interbank market rates, thereby improving the effectiveness of the central bank's actions.

The rate cuts reflect the easing inflationary pressures and a concerted effort to support credit availability in a challenging global economic landscape. Lower borrowing costs are expected to facilitate access to financing for small businesses and households. However, the extent to which these cuts translate into lower lending rates for consumers will depend on factors such as bank balance sheets and prevailing risk conditions. Furthermore, the central bank anticipates the current account deficit to narrow to 2.2 percent of GDP in both 2026 and 2027, an improvement from 2.4 percent in 2025, suggesting that the country's external balances are expected to remain manageable.

You may also like...

Nigerian Star Ajibade's Heroics Propel PSG to Cup Final Dream

Super Falcons captain Rasheedat Ajibade made a remarkable return from injury, scoring in Paris Saint-Germain Women's com...

Forest Unleashes New Era: Vítor Pereira Takes Helm as Head Coach

)

Nottingham Forest has appointed Vitor Pereira as their new head coach on an 18-month deal, tasked with leading the club ...

Berlinale Unleashes Global Cinema, From Political Statements to Blockbuster Deals!

The 2026 Berlin Film Festival and European Film Market are vibrant hubs for global cinema, featuring significant presenc...

Megan Thee Stallion's Heart Revealed: New Romance with Klay Thompson Takes Center Stage!

Megan Thee Stallion is embracing her "Lover Girl" era, a phase that emerged unexpectedly after a period of intense self-...

Foo Fighters Drama: Josh Freese Breaks Silence on Shocking Exit!

Veteran percussionist Josh Freese has addressed his unexpected dismissal from Foo Fighters in May 2025, nearly a year af...

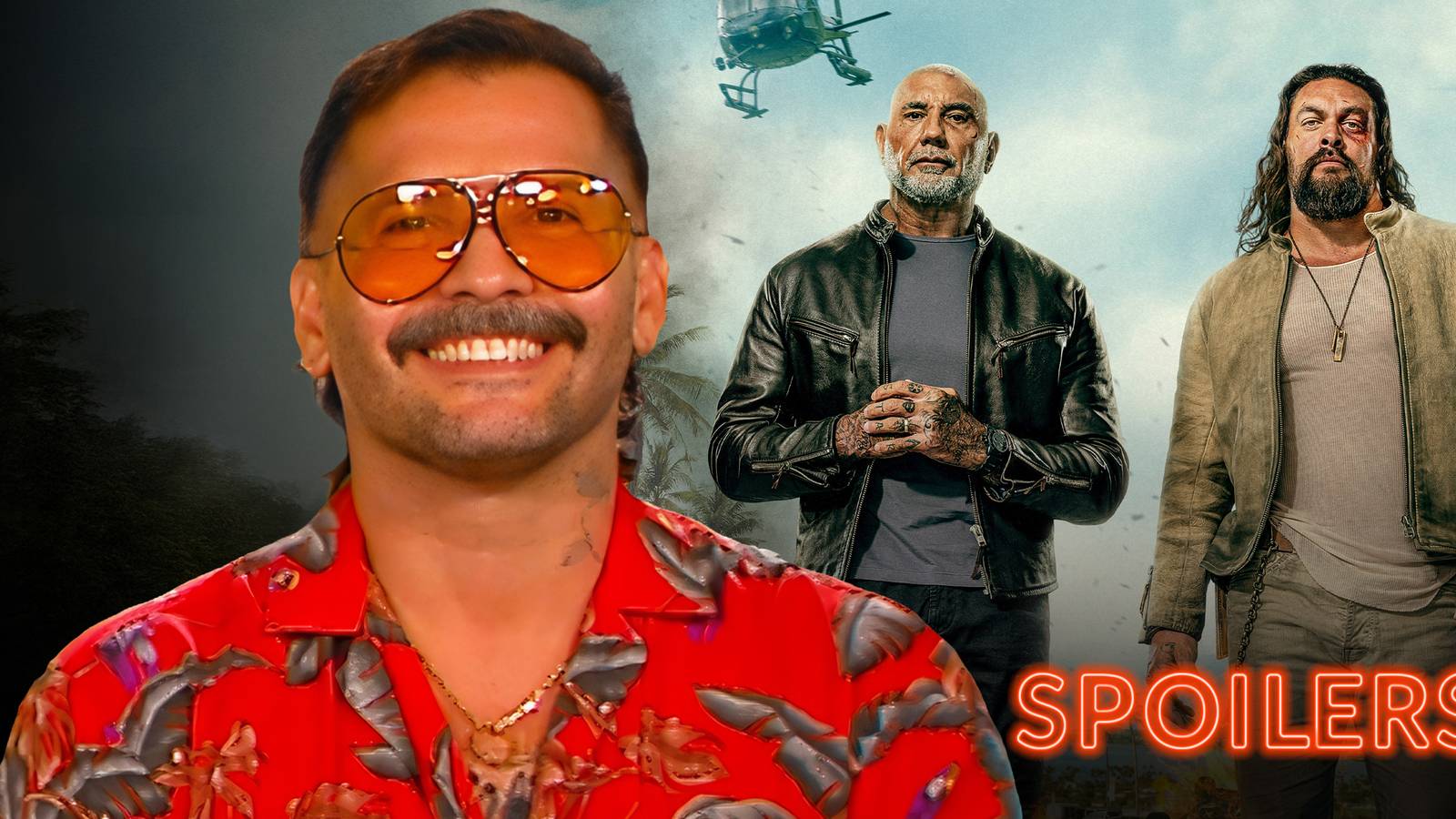

Director Unpacks 'The Wrecking Crew' Finale, Hints at Future Thrills

Director Ángel Manuel Soto discusses his latest action-comedy, <em>The Wrecking Crew</em>, in a spoiler-filled interview...

Inside 'The Pitt': Stars Reveal Shocking Episode 6 Death Aftermath

In an exclusive interview, Gerran Howell and Isa Briones discuss their characters' evolution in <i>The Pitt</i> Season 2...

AU Leaders Convene to Tackle Africa's Looming Conflict and Climate Catastrophes

The 2026 African Union Summit in Addis Ababa focused on critical challenges facing the continent, including pervasive co...