June 2025 CPI: Why a 0.3% Food-Price Rise Feels Bigger Than It Looks

Food prices rose 0.3% in June, but for many shoppers, inflation still feels worse. Here’s why trust ... More in grocery pricing hasn’t caught up with the data.

The Washington Post via Getty ImagesIn June, food prices rose 0.3%, according to new data from the Bureau of Labor Statistics—about the same as April, and slightly faster than May’s 0.1% bump. On paper, that might look like stability. But at the grocery store, most shoppers aren’t feeling it. Even modest increases can feel like food inflation and carry emotional weight when trust still hasn’t caught up with the numbers.

A 0.3% increase may not seem like much—until you realize that for a family already stretched thin, it compounds. It’s the kind of quiet rise that doesn’t make headlines but continues to erode confidence. More importantly, it shows how even slight food inflation can carry emotional weight, especially when wages, rent, and utilities aren’t keeping pace.

Food away from home rose even more—0.4% in June—and those increases tend to hit lower-income households hardest. Eating out is often the first thing cut from a stretched budget. Yet it’s also one of the last remaining affordable luxuries for many—a small act of agency in an otherwise limited menu of choices.

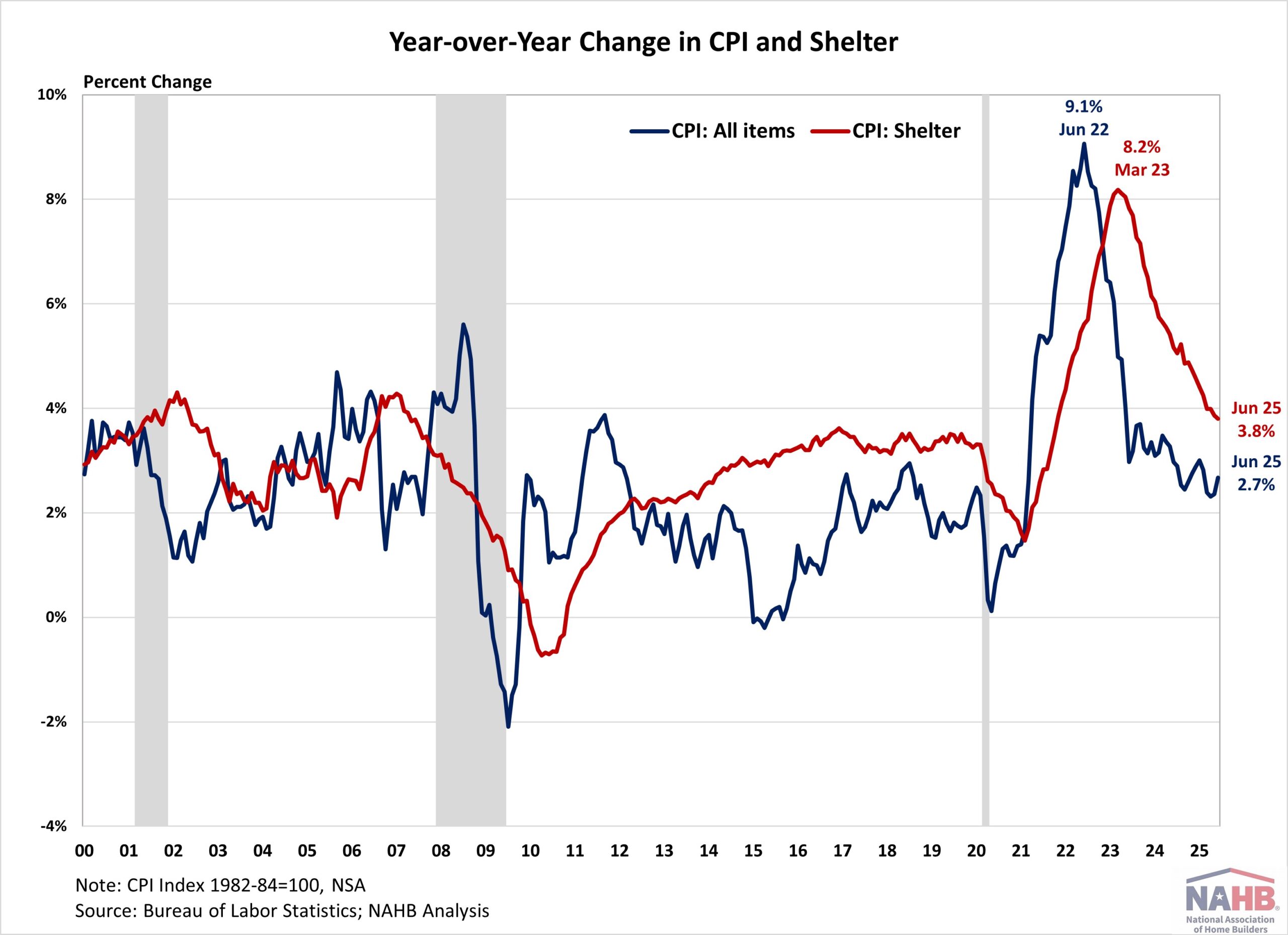

Year over year, food prices are up 3.0%. That’s nowhere near the double-digit jumps from 2022 or 2023, but it’s still enough to shift how people shop and eat. It’s not a shock, it’s a slow drip and that’s often harder to adapt to. They’re what’s driving long-term changes in grocery habits—like the rise of store brands, DIY pantry cooking, eating at home and a deeper mistrust of food pricing overall.

This month’s CPI also underscores a familiar tension: the official data shows moderation, but many shoppers don’t feel any real relief. That mismatch helps explain why food inflation stories continue to perform well, why social media is full of “then vs. now” grocery hauls, and why fast food backlash keeps cycling. The math may work, but the math isn’t the memory.

Even as categories like new and used vehicles showed price declines, those aren’t the expenses people feel every week. Groceries are. They’re a recurring emotional barometer. So even “just” a 0.3% rise feels outsized when paired with record heat, utility spikes, and student loan interest quietly accruing in the background.

On July 14, the U.S. Department of Commerce officially terminated the 2019 Suspension Agreement on fresh tomatoes from Mexico, reinstating a 17.09% antidumping duty. This trade shift directly impacts one of summer’s most symbolic foods.

Mexico supplies roughly 70% of the U.S. fresh tomato market. Analysts expect the new tariff could lead to a 6–10% rise in retail tomato prices, though the CPI may not reflect the impact until later this summer. For shoppers, though, it will be felt far sooner—in the price of tomatoes per pound, in the switch from fresh to canned, or in skipping making a dish altogether. It’s a reminder that monthly reports like CPI doesn’t always catch what’s actually happening on the ground or in people’s kitchens. A spike in tomato prices might not move the next inflation report, but it still changes what gets made for dinner.

If you’re trying to understand where consumer behavior is heading—especially for brands, retailers, and policymakers—this month’s CPI makes it clear: the public is still recalibrating their expectations. And they’re doing it not just based on price but on trust.

That gap between official numbers and emotional reaction is echoed by Jayson Lusk, head of agricultural economics at Purdue University. In a recent farmdoc daily article published by the University of Illinois, Lusk notes that “consumer anxiety is increasingly driven by food prices and tariffs, not inflation as a general economic concept.” In other words, the thing we call inflation is no longer abstract—it’s become deeply personal. And new policy moves, like the tomato tariff, can reignite that anxiety faster than macro data can soothe it.

Until the experience of shopping aligns more closely with the headlines about “cooling inflation,” expect more skepticism, more shift toward value-based shopping, and more resonance with stories that validate the emotional experience of food inflation.

We talk a lot about inflation as if it’s a macroeconomic fact. But food inflation is also a feeling—one that lingers longer than a 0.3% increase. And in 2025, it’s not just about prices—it’s about trust, habits, and how we learn to live with food inflation in real time.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...