Innovative Nigerian Startup Tackles Foreign Banks' Distrust with Groundbreaking Solution!

Before artificial intelligence became a ubiquitous term, it was already integral to various daily products. Google Maps, for instance, leveraged AI to predict traffic and optimize routes as early as 2008. In Nigeria, fintech firm Aella, which joined Y Combinator after Paystack, integrated AI into its lending processes by 2017. Werner Vogels, Amazon’s CTO, once lauded Aella’s work as the future of banking. Wale Akanbi, Aella’s former CTO, recounted how machine learning tools enabled the startup to reduce lending decision times to a mere four minutes, a feat he found fascinating.

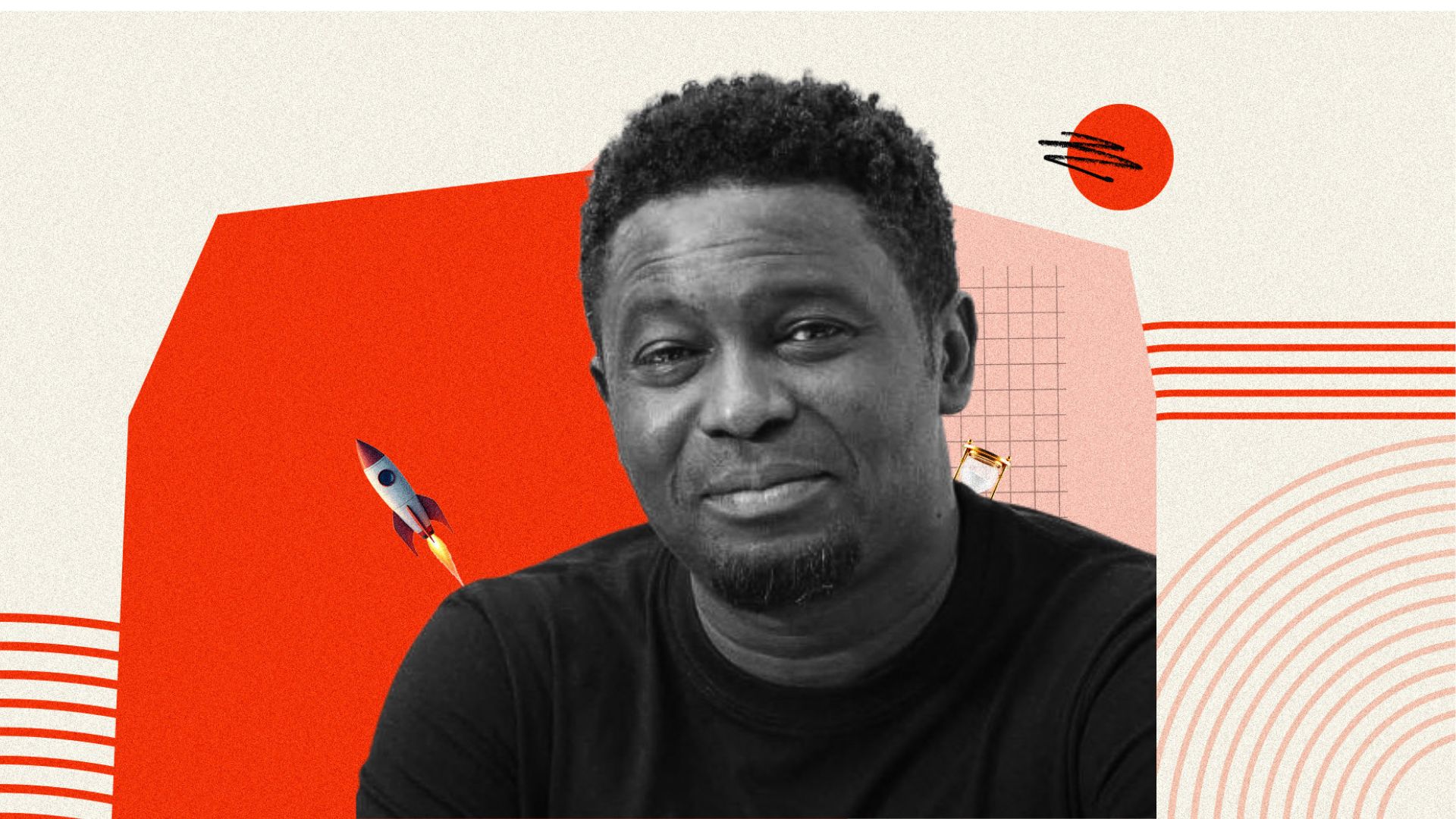

Akanbi is now channeling his technological prowess into his new venture, Bleyt. This startup aims to revolutionize cross-border transactions and remittances, specifically by allowing Nigerians to port their transaction and credit histories when they move or travel to other countries. While Bleyt may appear to be just another fintech, it addresses a critical and underserved problem for its target demographic of emigrants and frequent travelers.

The genesis of Bleyt stems from Akanbi’s personal struggles. In 2021, during a trip to the UK with his family, he faced significant challenges spending money. He resorted to sending Naira to a friend in the UK and using the friend’s card for all payments. Attempts to open a UK bank account were met with denial, not due to his financial profile, but simply his country of origin. Even after successfully opening a Wise account, it was later flagged, necessitating weeks of providing extensive proof for various transactions. These issues weren't new to Akanbi; he observed similar difficulties as far back as 2019 when purchasing items from foreign e-commerce platforms often required trusting friends abroad with passwords. Realizing these frustrations persisted among his friends in 2024, he decided to take action.

Akanbi acknowledges the existence of other solutions like LemFi, MonieWorld, and Taptap Send, but argues they fall short. He points out that these platforms still demand a first-party deposit from an account registered in the user’s name, a fundamental hurdle for individuals unable to open a local bank account in the first place.

Bleyt operates by providing users with access to multi-currency accounts supporting Naira, Dollars, and Pounds, alongside an instant virtual card. Users can spend Naira in Nigeria, and upon traveling abroad, the platform automatically detects the location change, enabling seamless spending as if they never left. This frictionless experience is facilitated by Bleyt requesting and analyzing users’ financial data after sign-up, with their consent, to create a comprehensive credit profile. This credit profile is pivotal, allowing Nigerians immigrating to countries like the US to bypass the need to build credit history from scratch. Instead, they can effectively transfer their existing Nigerian creditworthiness, gaining immediate access to credit abroad, circumventing the typical six-month waiting period.

Implementing this solution is complex, requiring Bleyt to forge partnerships with lenders in various countries and meticulously navigate diverse regulatory landscapes—a challenge Akanbi identifies as one of the toughest aspects of development but also a key differentiator from competitors.

Bleyt leverages advanced technology, deploying AI to power the underwriting component of its credit system, akin to Akanbi’s earlier work with Aella. AI efficiently sifts through financial records to generate accurate credit profiles. For cross-border transactions, Bleyt utilizes stablecoins, a rapidly mainstreaming technology in global finance, as evidenced by Circle onboarding fintechs like Flutterwave and Onafriq, and Nigeria’s SEC recognizing their importance. While customers do not directly interact with stablecoins, Bleyt uses them for real-time on-ramping and off-ramping across different countries, offering a more efficient and cost-effective alternative to traditional methods like SWIFT. Akanbi explains that stablecoins minimize middlemen, thereby reducing transaction fees and offering more favorable exchange rates compared to many fintech platforms that bake extra costs into their services.

Despite being in beta, Bleyt has demonstrated immense demand, with 54,000 individuals signing up for the waitlist within three months ahead of its planned full launch in October 2025. The company has been bootstrapped so far, with a pre-seed funding round currently in progress. Bleyt is also integrating with new partners to accommodate a larger user base and has secured a Money Service Business (MSB) license in Canada. Initially, revenue will be generated from transaction fees. However, Akanbi envisions a broader future where lending becomes a core platform feature, empowering Nigerian immigrants to do more than just send money, eventually enabling them to purchase homes abroad using the robust credit history and financial footprint built through Bleyt.

You may also like...

Haaland's UCL Rampage: Brace, Record, and X-Rated Fury Rocks European Football!

Manchester City were held to a frustrating 2-2 draw against Monaco in the Champions League, despite Erling Haaland's two...

Manchester United's Managerial Maze: Amorim on the Brink, Solskjaer's Ghost Looms

Ruben Amorim faces unprecedented pressure at Manchester United as inconsistent results and a low Premier League standing...

Real-Life Couple Justin Long & Kate Bosworth Unleash 'Coyotes' Horror Comedy, Securing UK Deal

Real-life partners Justin Long and Kate Bosworth star in the new horror comedy and survival thriller “Coyotes,” a film t...

Kenyan Star Bahati Ignites Firestorm with Provocative New 'Seti' Track!

Bahati has ended his musical hiatus with the controversial new song "Seti," featuring explicit content that deviates fro...

Global K-Pop Domination Ignored by Grammys? A Critical Look

Korean pop music has achieved global megaforce status, dominating charts and captivating millions of fans worldwide. Des...

One Direction Reunites! Global Pop Idols Confirm Massive New Project

One Direction stars Louis Tomlinson and Zayn Malik are reportedly reuniting for a Netflix road trip documentary, set to ...

Royal Arrival: Victor & Henrietta Thompson Welcome Baby Princess Zivah!

Gospel singer Victor Thompson and his wife, Henrietta, have joyfully welcomed their baby girl, Zivah Ufuoma Tamunopakiri...

Viral Sensation: M&S 'Cuddle' Jumper Takes Autumn by Storm at Just £26

Discover the M&S Textured Crew Neck Jumper, a viral sensation perfect for colder days. Praised for its luxurious feel, v...