Innovate to avert payment fraud, CBK to Travel industry players

By Brian TIROK

Stakeholders in the travel industry ecosystem are being urged to ring – fence their payment processing models using high-tech solutions for complex financial transactions if they are to make their businesses safer, efficient and more profitable.

This comes amid rising fears among travellers who are concerned about the rising cases of payment fraud.

Juanita Omanga, Deputy Director, Digital Payment Services Division at the Central Bank of Kenya says digital fraud, phishing scams, and cross-border payment delays were some of the common cases being reported by not only the individual travelers but was also a major concern for airlines and small travel agencies, saying tackling the problem was “a shared responsibility.”

“With continuous innovation, strategic partnerships, and a strong regulatory framework, we can create a payment ecosystem that is secure, efficient, and accessible to all,” said Omanga.

Digital payment fraud in the travel industry involves fraudsters using stolen or compromised payment information to make unauthorized purchases of travel services online or through travel agencies. This includes booking flights, hotels, and other services, leading to financial losses and reputational damage for businesses.

Indeed, a study by travel payment specialist, Outpacye from Amadeus, surveyed 4,500 travellers across five markets and found a growing demand for improved payment security, as two-thirds of travellers are concerned about payment fraud being on the rise.

The study made clear the increasing importance travellers place on secure payments, highlighting it as a key factor for influencing purchasing decisions, with over 70% of travellers stating that they would choose a travel company based on its strong reputation for secure commerce.

Separate study by Juniper Research, a research, forecasting, and consultancy agency, also found that 46% of all payment fraud Is targeted at the airline industry – highlighting a serious challenge for travel companies to prevent security problems without introducing additional obstacles to the payment experience, which can also dissuade travellers from purchasing from a company if it is not efficient.

She spoke Wednesday during the opening of the 2nd annual Kenya Travel Industry Payment Summit (KTRIPS) by the Kenya Association of Travel Agents (KATA) successfully hosted which ends Thursday 27.

KATA CEO, Mr. Nicanor Sabula, underscored the growing importance of secure and efficient digital payment solutions for the travel industry.

“Payment systems are no longer just about processing transactions; they have become integral to enhancing customer experiences, driving business growth, and ensuring security in an increasingly digital landscape.”

The summit explored emerging payment technologies such as mobile money platforms, card and contactless payments, and blockchain for secure cross-border transactions. With Kenya processing over KES 8.1 trillion ($62 billion) in mobile money transactions in 2023, these solutions are crucial to improving efficiency in travel-related payments.

Key discussions also addressed fraud prevention, regulatory compliance, and emerging technologies such as Central Bank Digital Currencies (CBDCs).

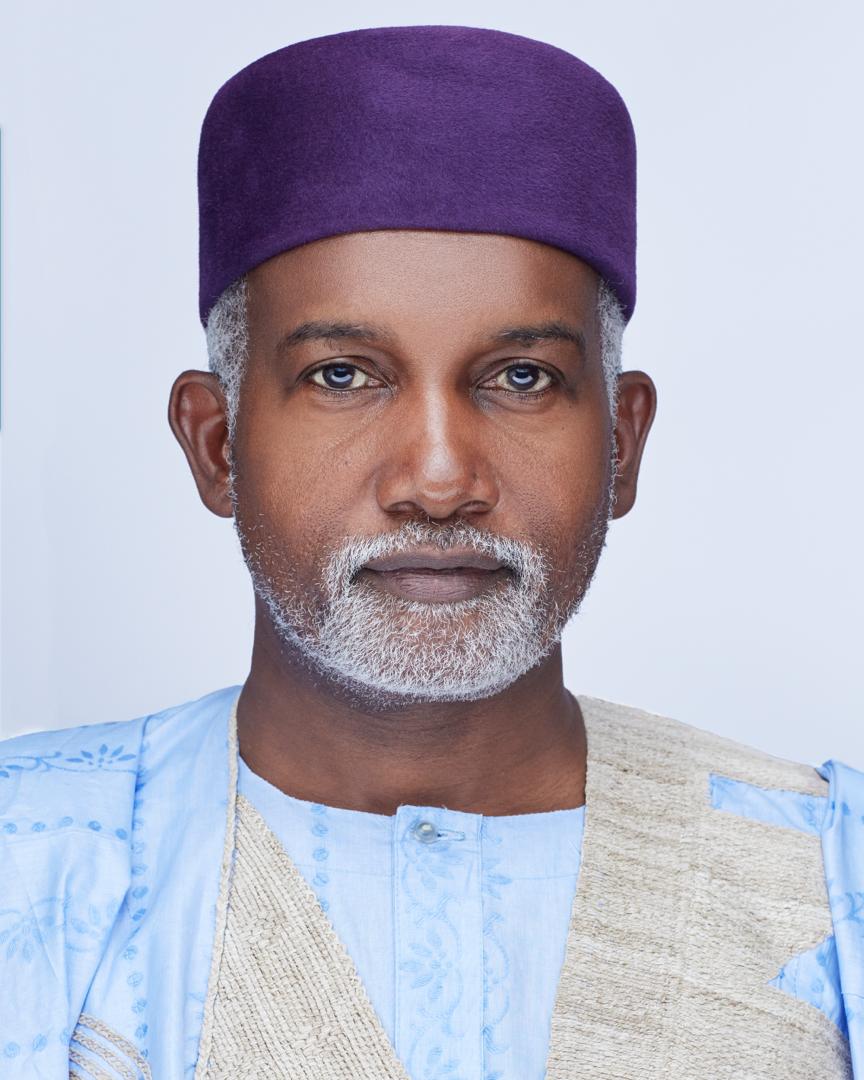

KATA Chairperson, Dr. Joseph Kithitu, said that digital transformation is crucial for Kenya’s travel industry to remain competitive.

“Business has moved digital, and so has payment. The travel industry cannot afford to be left behind,” he stated. Dr. Kithitu shared key industry statistics, noting that Kenya accounted for 2.67% of total Middle East and Africa air travel sales in 2024, amounting to $566.8 million, reflecting a 2.11% growth from the previous year.