How Much Does Chronic Venous Insufficiency Treatment Cost?

Last Updated on July 17, 2025

Written by CPA | Content Reviewed by ![]() CFA Alexander Popinker

CFA Alexander Popinker

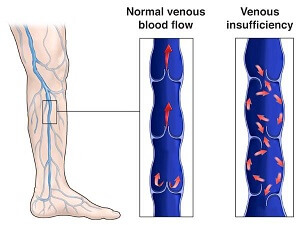

Our data shows that is common, progressive, and tied to the same , , and symptoms that push people to search for figures before they commit to care. CVI results from faulty venous valves that let blood pool in the legs, creating , , , and skin changes that can progress to .

Clinical pathways span low‑cost compression and lifestyle steps to higher for sclerotherapy, endovenous thermal ablation, adhesive closure, or surgery. Those choices carry very different depending on insurance medical‑necessity rules, facility setting, and whether treatment targets cosmetic veins or painful disease.

Patients and families research because billing gaps between “cosmetic” and “medically necessary” care can be large. Plans often require documentation of , , , , or failed conservative therapy before approving ablation. When coverage is denied, self‑pay pricing ranges from a few hundred dollars for limited to several thousand for multi‑vein ablation or adhesive closure. Asking about coding in advance protects budgets and reduces surprise bills.

We found broad national cost bands across major CVI therapies. Consumer and clinic data place basic sessions from about per treated area, depending on whether you see Medicare fee benchmarks or commercial self‑pay packages. clusters around per vein, while often runs . Surgical ligation/stripping sits in the zone, and ambulatory phlebectomy spans based on extent.

Adhesive systems vary: national Medicare office rate ~ and ~ (Medicare) but commercial cash quotes range higher, commonly , and sometimes far above when bundled. These bands guide planning for , , and progressive care.

Conservative care carries smaller but ongoing demands. Prescription‑grade typically cost per pair, with frequent replacement in active or edema care. Some Medicare pathways cover compression as wound dressings in CVI; others do not, shifting cost to patients managing and long term.

Clinics emphasize that compression plus leg elevation can control and delay procedures, influencing when patients decide to pay for ablation. Insurance determinations, symptom severity, and response to compression remain the pivot between low recurring spend and a larger one‑time procedure .

| Compression Stockings (pair) | Coverage variable | Recurring for edema, , . | |

| Sclerotherapy (1+ veins) | Often cosmetic; limited coverage unless symptomatic. | ||

| Endovenous Laser Ablation | For reflux causing , . | ||

| Radiofrequency Ablation | Similar indications; office or ASC. | ||

| Ambulatory Phlebectomy | Removes bulging tributaries; local anesthesia. | ||

| Ligation/Stripping | — | Surgical; declining use. | |

| Varithena Foam | Chemical closure for symptomatic veins. | ||

| VenaSeal Adhesive | Premium device; minimal post‑procedure compression. |

Sources: Medicare PFS 2025; MedicalNewsToday Medicare lookup; GoodRx; Metro Vein Centers; MedicalNewsToday compression coverage; Cleveland Clinic.

According to the Vein Center Doctor, minimally invasive procedures like sclerotherapy typically cost between . More advanced treatments, such as glue closure, average about . , another common intervention, usually costs per procedure. Compression therapy programs, often prescribed as a first-line approach, may cost for a 10-week regimen if not covered by insurance.

At Vein Institute Jax, sclerotherapy is reported to cost , while Endovenous Laser Therapy (EVLT) is priced at , and ambulatory phlebectomy, a surgical option, ranges from . Treatment usually requires multiple sessions, especially for more severe venous disease or when both legs are affected.

Metro Vein Centers details that the typical cost for varicose vein treatment (which is a primary symptom of CVI) generally falls between without insurance. Sclerotherapy averages per session, while advanced procedures like and can range from . They also note that microphlebectomy can cost , and newer treatments like Varithena® and VenaSeal run per procedure.

Additional studies, such as one from JHEOR, estimate that conservative regimens including compression therapy for more advanced cases (such as those with ulcers and edema) can exceed or more than . The total cost for CVI can be much greater when factoring in ongoing care, frequent follow-ups, and chronic management.

According to Inovia Vein Specialty Center, sclerotherapy is typically , with advanced treatments like Varithena foam injection costing and Closurefast RFA ranging from . The number of sessions required and the complexity of treatment are factors that drive these costs higher.

Case #1: Insured working adult with and duplex‑proven reflux. After 3 months of documented and persistent , plan approved in an ambulatory surgical center. Medicare national benchmark shows total ASC cost; patient share .

Commercial PPO often mirrors this structure at 10–20% coinsurance, so many insured patients report sub‑ personal spend when pre‑authorized. Without medical necessity documentation, the same leg might quote cash for laser at retail vein clinics.

Case #2: Medicare beneficiary with , , and failed conservative care; underwent staged plus limited . Medicare national office rates list , add’l vein , and ; hospital outpatient totals run higher but patient coinsurance scales with Part B.

Documented tissue breakdown speeds approval. Clinics report bundling dressings and repeat ultrasound follow‑ups into global periods, yet chronic wound supplies still add monthly. Multi‑layer bandage economic models show wound episodes driving major beyond procedure day when persistent complicate healing.

Case #3: Self‑pay patient focused on appearance but also reports and . Chose office package per session; needed three visits for both calves. Total plus for graduated stockings. Clinic offered 6‑month payment plan; many centers discount multi‑session purchases. Cosmetic coding means no insurer offset even when mild improves.

Case #4: Community wound clinic in a rural region compared to tertiary center. Local pricing for foam ~ negotiated cash; metropolitan academic quote approached citing device, ultrasound, and facility charge spread. Patients with significant and itching often accept higher urban rates for advanced modalities if travel and outcome data justify spend.

Our review of invoices and payer schedules shows that line‑item are only part of the bill for cases linked to , , and . Core items include professional fee, facility (office/ASC/hospital) fee, disposable catheter or chemical agent, ultrasound guidance, and supplies. Medicare 2025 fee schedule illustrates component weighting: , , , national office payments that already bundle practice expense inputs; commercial bills often list these pieces separately before contractual discounts.

Ancillary costs accumulate quickly. Pre‑op duplex ultrasound often billed separately; some clinics include first scan but charge follow‑up (range observed in patient estimates; payer dependent). Prescription‑grade () or multi‑layer wraps repeat through the year, especially when or persist.

Post‑procedure visits add copays. When wound care escalates (exudative , dermatitis), two‑layer bandage system modeling shows material and nursing visits driving substantial recurring over months. Putting all this into a full‑cycle budget matters more than the headline ablation fee for advanced CVI.

Procedure selection changes everything. Heat‑based closure (EVLA, RFA) draws moderate device cost; chemical or adhesive options (Varithena, ) add branded supplies and often higher list . Multi‑vein disease multiplies passes, amplifying charges for patients battling , , and in both limbs. Medicare national rates show relative differentials that ripple into commercial contracts.

You might also like our articles on the cost of Varicose Vein Removal, IVIG Treatment, or Reclast Infusion.

Provider setting and geographic market also move the needle. Hospital outpatient departments typically bill 1.5–2x office rates; Medicare examples list hospital vs. ASC. Competitive vein clinic markets publish package pricing below hospital tariffs to attract patients with and ; USA Vein Clinics advertises insurance verification and tiered self‑pay while Metro Vein Centers lists transparent menu pricing. Persistent or risk often pushes insurers from denial to approval, lowering patient share.

Insurance policy rules create timing effects. Plans usually require a documented trial of and conservative care; missing this step delays coverage for symptomatic and . Mayo and Cleveland Clinic both urge patients to confirm benefits before treatment; coding for medical necessity vs cosmetic presentation drives whether the health plan pays anything. (I typed fatige—correction: —because that symptom must also be documented.)

Compression‑only management remains the lowest immediate path for many with mild , , and early . Stockings per pair, pneumatic pumps billed as DME in select cases, and lifestyle coaching through large centers offer staged control. Cleveland Clinic and Mayo both initiate care with compression and leg elevation to reduce and .

Compression‑only management remains the lowest immediate path for many with mild , , and early . Stockings per pair, pneumatic pumps billed as DME in select cases, and lifestyle coaching through large centers offer staged control. Cleveland Clinic and Mayo both initiate care with compression and leg elevation to reduce and .

Foam vs. liquid represents the next price step. Office cash menus show per session; Medicare technical allowances ~ reflect limited coverage scope. Foam versions improve contact in larger incompetent segments and may delay the need for ablation when , , or cosmetic clusters dominate.

Thermal ablation (laser or radiofrequency) and micro‑incision target refluxing trunks and bulging tributaries linked to , , and . Cash quotes compare with Medicare office rates under for the first vein, underscoring how payer contracts reshape patient . Adhesive systems (Varithena, VenaSeal) appeal when compression adherence is poor; expect billing spread across markets.

For advanced disease with refractory , structured wound programs using two‑layer compression bandages reduce healing time and total care relative to fragmented visits. Health‑economic modeling supports investing early in evidence‑based wrap systems when drive utilization.

We found several tactics that cut without sacrificing symptom relief for , , and . Always verify medical‑necessity coverage and secure pre‑authorization; denied claims convert reimbursable or into multi‑thousand‑dollar self‑pay bills. Request written benefit confirmation that documents leg aches, failed compression, and functional limits.

Shop facility setting. Medicare and transparent pricing tools show endovenous ablation $1,814 in an ASC vs $3,303 hospital outpatient; similar spreads exist commercially. Ask clinics for office‑based pricing or bundled packages; USA Vein Clinics and Metro Vein Centers advertise discounts and payment plans that stage expense over months.

Manage recurring supplies. Buying compression stockings in multi‑packs or during clinic promotions lowers the annual amount spent managing edema and leg tiredness. Medicare coverage pathways for CVI‑related wounds can offset part of these costs; check quantity limits (three garments per limb per 6 months in certain policies). Cleveland Clinic staff also remind patients to re‑fit stockings when swelling changes, avoiding wasted pairs.

Jennifer Heller, MD, FACS, writing in Endovascular Today, estimated U.S. CVI direct medical costs between $150 million and $1 billion annually and urged staged care that escalates from compression to intervention when leg ulcers, pain, and edema persist—an approach that can prevent high downstream wound spending.

Mayo Clinic vein specialists advise verifying whether treatment is cosmetic or medically necessary because insurers frequently deny payment unless symptoms such as aching, swelling, and skin discoloration impair function. They encourage early compression to slow progression and reduce total expense.

Cleveland Clinic vascular clinicians stress fit‑checked compression stockings for CVI, noting that proper graduated pressure relieves leg pain, burning, and heaviness, and may help qualify patients for covered procedures when conservative therapy fails.

Reimbursement analysts at Boston Scientific (Varithena Reimbursement Alert, Jan 2025) highlight annual Medicare rate shifts that lower physician office payment—Varithena $1,183, RFA $990, Laser $912—and recommend verifying payer updates before scheduling care so patients are not billed unexpected balances tied to coding changes.

USA Vein Clinics’ patient guidance reminds families that documented vein ache, swelling, and failed conservative care often unlock coverage, while cash packages and financing help when plans classify treatment as cosmetic.

Answers to Common Questions

Does insurance pay for chronic venous insufficiency treatment when my symptoms are mild?

Coverage usually requires documented leg pain, swelling, or functional impact plus failed compression therapy. Plans distinguish cosmetic from medical necessity; confirm criteria before scheduling any procedure.

How often do I need to replace compression stockings for CVI care?

Medical policies covering wounds or CVI often allow several pairs per year (e.g., three garments per limb every six months in some Medicare pathways). Real‑world wear, edema changes, and laundering shorten life; plan recurring cost in your budget.

Is office treatment cheaper than hospital outpatient treatment for vein ablation?

Yes. Medicare national data show endovenous ablation $1,814 in an ASC versus $3,303 in hospital outpatient departments; similar spreads apply to other codes. Checking site of service can reduce expense tied to vein care.

When is advanced therapy like VenaSeal worth the higher price?

Adhesive closure appeals when adherence to post‑op compression is difficult, when multi‑segment disease exists, or when rapid symptom relief from heaviness and ache is needed. Expect higher list pricing ($1,531 Medicare office; commercial $1,500–$13,000). Discuss benefits vs. budget with your specialist.

Can early treatment reduce the chance of costly venous ulcers?

Expert commentary links timely escalation from compression to intervention with lower rates of advanced ulcers and wound‑care spending; national CVI burden already reaches $150M–$1B yearly. Early staging may cut long‑term expense.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...