How Crossword Bookstores turned the page in a struggling book retail market

Crossword Bookstores unarguably emerged as the biggest book retailer in the country after its acquisition by Shoppers Stop in 2005. While it was one of the first to introduce the ‘book browsing experience’ in India in the early 1990s, the retail chain began to struggle over the years as it was battered by the onslaught of e-commerce.

The final nail in the coffin was the Covid pandemic. Shoppers Stop shuttered 12 Crossword stores in 2020-2021 before the retail major ultimately sold the loss-making venture to its then-largest franchisee, ABH.

Since the takeover, ABH has managed to turn the company around in just a few years, expanding its store network and bringing it back to profitability after years of losses.

ABH’s turnaround strategy was simple: The company tapped into emerging trends, such as those from social media platforms like TikTok, to draw young readers, while refocusing on its ‘book-first’ identity at the same time.

It also enhanced the in-store experience by introducing premium book-related merchandise and partnering with coffee chains, creating a more attractive environment for customers.

“While TikTok is banned in India, the trends on the platform trickle down to India through other social media channels,” says Aakash Gupta, CEO of Crossword Bookstores. “For instance, these days books on ‘bookstores’, cats, Korea and Japan are trending. We try to keep abreast of these trends and curate our titles accordingly.”

The strategy has paid off. Crossword Bookstores now has 120 stores in 36 cities, up from just 70 stores at the time of the 2021 acquisition.

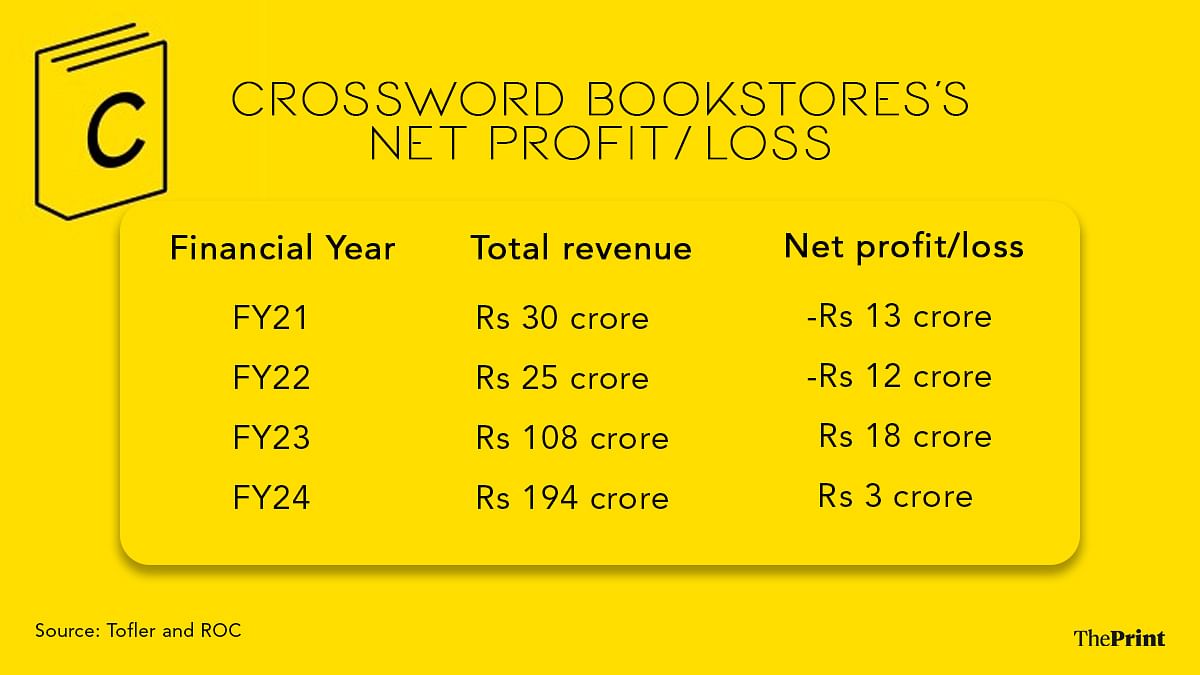

The company reported a net profit of Rs 3 crore in the 2023-24 financial year compared to a loss of Rs 12 crore in 2021-22, according to business intelligence platform Tofler. Its total revenue also jumped from Rs 25 crore to Rs 194 crore during this period.

Crossword Bookstores reported a net loss of Rs 13 crore in 2020-21, according to Shoppers Stop’s annual report and Tofler.

In its bid to bring readers back, one of the key elements of ABH’s strategy was to stay on top of social media trends while curating books for its stores.

For instance, books and TikTok may seem like chalk and cheese, but the social media app has played a key role in bringing young adult readers to books.

A case in point is US-based young adult and romance writer Colleen Hoover, who has written over 20 novels in the past decade, but shot to fame after her books were featured on BookTok, a community of readers on TikTok.

The company relies on its data and feedback from store officials and publishers for the curation of titles.

Since acquiring the bookstore chain from Shoppers Stop, ABH has strived to make Crossword Bookstores a ‘book-first’ brand again much to the delight of book lovers.

It has refurbished all old stores and shifted the balance towards books rather than merchandise. In addition, it has also taken measures to reduce non-book items and replace them with book-related merchandise.

“The new management went back to the book basics, which really worked. It has brought back the charm of a neighbourhood bookstore,” says media and communications professional Devina Joshi, an avid book reader and frequent visitor to Crossword’s Kemps Corner store.

At the time of acquisition, Crossword Bookstores generated 40 percent of its revenue from merchandise sales and the rest from books. Since then, the company has reduced its share of merchandise and now garners about 35 percent of its revenue from merchandise and 65 percent from books, shares Gupta.

It is trying to position its merchandise in the premium category and has tied up with stationery brands such as Spain’s MILAN and Italy’s Legami, among others. The company also plans to introduce its own stationery products.

Most Crossword Bookstores also have a dedicated section for children’s books as the category brings in most of its business. According to Gupta, children’s books account for 40 percent of its book sales.

Furthermore, to offer readers flocking to its stores an enhanced experience, the company has tied up with new-age coffee chains such as Third Wave Coffee and Blue Tokai.

“Going ahead, you will see coffee being a big play within our stores. We plan to introduce it to even smaller shops as it goes with our ethos of the bookstore experience,” says Gupta.

In its marketing push, Crossword Bookstores has become the official bookstore partner for the Jaipur Literature Festival and reintroduced the popular Crossword Book Awards.

Going ahead, the company plans 300 bookstores in the country. ABH plans to focus on the top 50 cities for its store expansion and tap underpenetrated markets such as Delhi and south India.

Also Read: Faqir Chand & Bahrisons aren’t just bookshops now. They’re selfie spots, meet-cute hubs

Pune-based businessman and ardent reader Dinesh Gupta, whose family is into the manufacturing of steel barrels, has fond memories of visiting Crossword Bookstores’ first store at Mahalaxmi in Mumbai in the early 1990s with his family.

“Those times were different. There were no malls then, no department stores, especially no such large bookstores in the country. It was only when visiting abroad that you would find bookstores where you could browse at leisure,” Gupta reminisces.

“So, when this huge Crossword Bookstores spanning over 10,000 sq ft opened, it became our first stop as a family whenever we visited Mumbai from Pune.”

Dinesh Gupta’s family-run venture Agarwal Business House later went on to acquire the franchisee rights to open Crossword Bookstores’ first store in Pune in 1998 and many other cities to emerge as its biggest franchisee.

The company was running 40 Crossword stores in the country, more than its then-parent Shoppers Stop’s 26 stores, at the time of the acquisition in 2021.

Crossword Bookstores was founded by college dropout R. Sriram and K. Anita in 1992 with seed capital from publisher and book distributor company India Book House, known for publishing children’s books such as Adventures of Tintin in India and Amar Chitra Katha.

Its first store in Mahalaxmi shared premises with India Book House. The store was later shifted to Kemps Corner in Mumbai. The bookstore, which housed a café and encouraged consumers to browse books, soon found a loyal fan base in the book-reading community.

“Crossword’s first store was something never seen before. They encouraged people to hang around. I would spend two to three hours there sitting and leafing through books,” remembers non-fiction writer and entrepreneur Rashmi Bansal, who has written nine books on entrepreneurship.

“I discovered many great books through their recommendation section which was called ‘Sriram Recommends’.”

The store’s popularity led it to expand to Pune, Jaipur and Bangalore. This was a time when independent bookstores such as Bahrisons, Strand Book Stall, Higginbothams and Landmark ruled the book retail business.

The growing readership in the country also led to corporate interest in the segment and departmental store chain Shoppers Stop acquired Crossword Bookstores in 2005 for about Rs 25 crore.

Trent, Tata’s retail arm, too, bought over Landmark Bookstores in the same year, while Reliance Retail forayed into the segment by launching TimeOut in 2008.

Even as corporates entered the segment, the e-commerce juggernaut took several retail segments, especially book retail, by storm.

According to experts, though readership did not go down in the country, readers started buying from e-commerce channels due to heavy discounts offered on these channels. This led to a decline in sales of physical book retailers.

“Flipkart launched in 2007 and it pushed books as a category initially to ease consumers into online buying and this significantly impacted Crossword Bookstores’ business,” says a former executive of Crossword Bookstores.

According to the executive, whose tenure with Crossword Bookstores lasted over a decade, Amazon’s entry in 2013 and its heavy discounting strategy proved to be a massive blow for Crossword and the book retail industry in general.

The Amazon effect was playing out globally also. Barnes & Noble, the largest bookseller in the US, witnessed a decline in sales which led to store closures in the 2010s. In 2014, the retailer closed its flagship store on Fifth Avenue in New York, which was launched in 1932.

The threat loomed large for Indian booksellers, too. In the mid-2010s, as Crossword Bookstores struggled with the advent of e-commerce, other bookstore brands shut shop. Reliance shut TimeOut in 2014 and Trent also started divesting its stake in Landmark stores the same year.

“There was also this big fear of how e-readers, specifically Amazon-owned Kindle, would impact us then,” said the former Crossword executive quoted above.

The corporate takeover took away the ‘personal touch’, essential to the book business, from Crossword Bookstores and its founder R. Sriram quit in 2006.

Furthermore, Shoppers Stop took a strategic misstep and opened several large Crossword stores ranging from 8,000 to 20,000 sq ft after the acquisition, which led to mounting struggles for the business.

“These large stores created huge panic in terms of profitability and sales per square foot as e-commerce players entered the segment. So, they had to quickly reorient themselves by right-sizing the stores and then rework on the category mix too,” says the executive quoted above.

To make matters worse, music and movie CDs as a category, which contributed 20 percent to the business, saw a sudden downturn with digitisation, adding to the bookseller’s woes.

Crossword Bookstores, in an attempt to get back on track, shifted its focus from books and started selling other products such as stationery, electronics and travel accessories.

“It was doing a little bit of everything to increase profit margins, with the store becoming a bit merchandise-heavy,” says Devina Joshi. “I dare say it was beginning to lose the plot, pun intended.”

The strategy took away the core target group of ‘book lovers’ from Crossword stores and impacted its sales. The retailer eventually discontinued its popular Crossword Book Awards and Crossword membership programme which contributed 60 percent to their sales during its heyday.

While the business was already on shaky ground and Shoppers Stop had started looking for a buyer in the late 2010s, the Covid pandemic sealed its fate and it was eventually sold off to its largest franchisee ABH in 2021.

It isn’t just Crossword but bookstores across the country are finding their footing now after the Covid crisis. According to experts, though e-commerce has a major share of the book retail market in India, retail stores, too, have stood their ground.

E-commerce and physical retail today have an equal share in the book retail segment in India, says Manoj Satti, Senior Vice President, Sales and Product and Division Head, Penguin Select.

“E-books never gained much momentum in India and have a share of 7-8 percent in overall book sales in the country. Audiobooks have a 2 percent share and the rest is divided equally between offline and online,” he says.

Amazon is the biggest player in the online segment with close to 85 percent of online book sales in the country, he adds.

Digital fatigue is also helping the segment by sending consumers back to bookstores and helping their revival.

While the pandemic period marked the closure of several stores, the ones that have survived now are expanding. Bookstores such as Bahrisons Booksellers, Om Book Shop and Starmark have launched new stores in recent years.

Not everybody is optimistic. “Bookstores have found their niche in India. Though there will always be a market for books both globally and in India, it will not be a place where you will find many players doing well,” says a former managing director of Shoppers Stop.

(Edited by Sugita Katyal)

Also Read: Delhi’s Urdu Bazaar is dying. Mughlai sells, not Manto & Mirza Ghalib