Hollywood Shake-Up! Paramount Launches $108 Billion Hostile Bid for Warner Bros. Discovery, Threatening Netflix Deal

The proposed acquisition of Warner Bros. studios and its streaming business, HBO Max, by Netflix has ignited a significant industry debate and drawn the attention of high-level political figures, including President Donald Trump. On Sunday, President Trump confirmed a recent White House meeting with Netflix co-CEO Ted Sarandos, where the Warner Bros. Discovery (WBD) deal was a central topic. Trump expressed concerns about the potential market share of a combined Netflix with Warner Bros. and HBO Max, stating it "could be a problem" and indicating his direct involvement in the regulatory review process.

President Trump elaborated on the red carpet of the Kennedy Center Honors event, asserting that the Netflix deal, announced Friday as an $83 billion proposed agreement, would necessitate a thorough review. He emphasized that he would be personally involved in the decision-making process. Sarandos, described by Trump as "a fantastic man" and "a great person," visited the Oval Office the previous week to discuss the transaction. Despite his respect for Sarandos, Trump reiterated his apprehension regarding the substantial market share the merger would create.

The blockbuster pact would significantly expand Netflix's already massive customer base, adding Warner Bros. Discovery's 128.0 million streaming subscribers from HBO Max, Discovery+, and its sports-streaming services to Netflix's over 300 million. This deal is characterized as both a horizontal merger between rival streaming services and a vertical merger, integrating a massive distribution pipeline for Warner Bros. content. It also raises concerns about potentially shrinking the marketplace for content producers. The transaction is expected to undergo review by the Justice Department and the Federal Trade Commission, though the FCC is not anticipated to play a role. Sarandos, while speaking to Wall Street analysts, expressed optimism for regulatory approval, projecting the deal to close in 12-18 months and asserting its pro-consumer, pro-innovation, pro-worker, pro-creator, and pro-growth nature. He conveyed to President Trump that even combined, Netflix would approximate Google's YouTube in the U.S. in size, retaining less TV market share than other media conglomerates.

In a dramatic turn, David Ellison’s Paramount Skydance launched an all-cash tender offer to acquire all outstanding shares of WBD for $30 per share on Monday, directly challenging the Netflix proposal. This offer, which mirrors terms previously submitted to WBD's board on December 4, aims for the entirety of Warner Bros. Discovery, including its extensive TV business encompassing CNN, TBS, and TNT. Paramount's bid boasts an enterprise value of $108.4 billion, significantly surpassing the $82.7 billion enterprise value of Netflix's offer, which Paramount described as a "volatile and complex structure" valued at $27.75 per share in a mix of cash and stock.

Paramount Skydance's offer is backed by a robust financial consortium, including Oracle co-founder Larry Ellison, RedBird Capital Partners, and an aggregate of $24 billion from the sovereign wealth funds of Saudi Arabia, Qatar, and Abu Dhabi. Additional funding commitments include Jared Kushner’s Affinity Partners, Chinese internet company Tencent with $1 billion, and $54 billion in debt commitments from Bank of America, Citi, and Apollo Global Management. Paramount structured the deal to ensure the Middle Eastern sovereign wealth funds and Affinity Partners would forgo governance rights, including board representation, to avoid review by the Committee on Foreign Investment in the United States (CFIUS).

Paramount asserted that its offer provides a "superior alternative" offering more certain and quicker completion, alleging that the WBD board's recommendation of the Netflix transaction was based on an "illusory prospective valuation" of a prospective TV networks spin-off, named Discovery Global, that is "unsupported by the business fundamentals and encumbered by high levels of financial leverage." The WBD board had previously rejected several prior offers from Paramount, including a $26.50/share all-cash bid on December 1, before ultimately selecting Netflix.

The industry's reaction to the Netflix-WBD news has been varied. Seth Rogen and Evan Goldberg, executive producers of the Apple TV comedy “The Studio,” commented that their fictional studio executive character would react with "dread fear," fearing that successful companies could still be sold off. While Goldberg entertained the idea of AMC, the world's largest exhibition chain, acquiring WBD as an unconventional move to prevent Netflix from shrinking exhibition windows for Warner Bros. films, Rogen expressed personal skepticism about the deal happening.

President Trump's public statements on the deal occurred against the backdrop of his decision to host the 48th Kennedy Center Honors ceremony in Washington, D.C. Upending decades of tradition, Trump introduced the event and its honorees, who included Sylvester Stallone, KISS members Gene Simmons, Paul Stanley, and Peter Criss, singer-actor Michael Crawford, country superstar George Strait, and disco diva Gloria Gaynor. Trump also noted significant changes in the Kennedy Center's staffing and operations, alongside some characteristic, outspoken remarks directed at Washington's social elite and self-deprecating humor about his hosting role. Notably, there was no traditional video tribute to Stallone, a departure attributed to the previous producers bowing out after leadership changes at the Kennedy Center.

You may also like...

Nigerian Star Ajibade's Heroics Propel PSG to Cup Final Dream

Super Falcons captain Rasheedat Ajibade made a remarkable return from injury, scoring in Paris Saint-Germain Women's com...

Forest Unleashes New Era: Vítor Pereira Takes Helm as Head Coach

)

Nottingham Forest has appointed Vitor Pereira as their new head coach on an 18-month deal, tasked with leading the club ...

Berlinale Unleashes Global Cinema, From Political Statements to Blockbuster Deals!

The 2026 Berlin Film Festival and European Film Market are vibrant hubs for global cinema, featuring significant presenc...

Megan Thee Stallion's Heart Revealed: New Romance with Klay Thompson Takes Center Stage!

Megan Thee Stallion is embracing her "Lover Girl" era, a phase that emerged unexpectedly after a period of intense self-...

Foo Fighters Drama: Josh Freese Breaks Silence on Shocking Exit!

Veteran percussionist Josh Freese has addressed his unexpected dismissal from Foo Fighters in May 2025, nearly a year af...

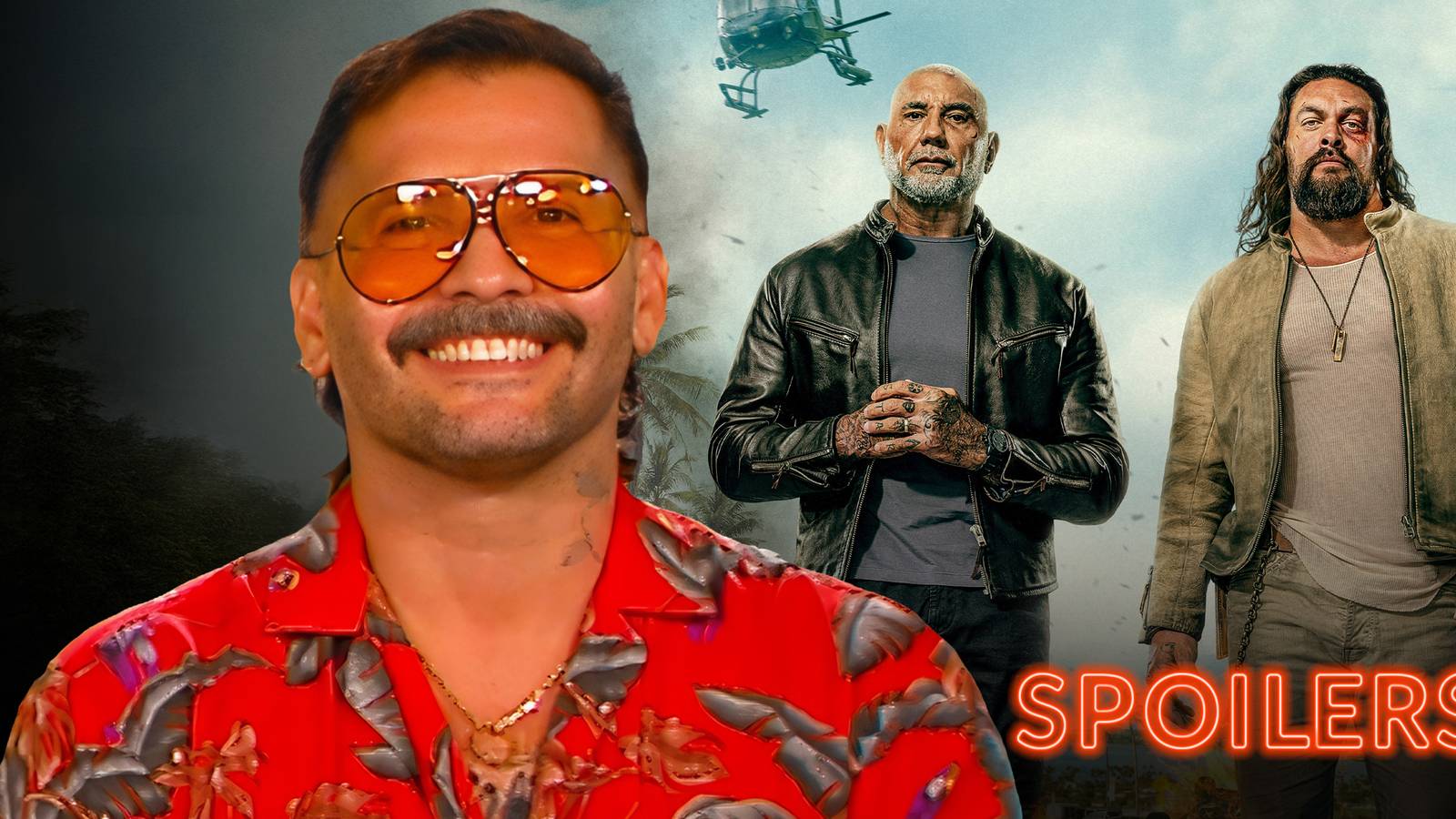

Director Unpacks 'The Wrecking Crew' Finale, Hints at Future Thrills

Director Ángel Manuel Soto discusses his latest action-comedy, <em>The Wrecking Crew</em>, in a spoiler-filled interview...

Inside 'The Pitt': Stars Reveal Shocking Episode 6 Death Aftermath

In an exclusive interview, Gerran Howell and Isa Briones discuss their characters' evolution in <i>The Pitt</i> Season 2...

AU Leaders Convene to Tackle Africa's Looming Conflict and Climate Catastrophes

The 2026 African Union Summit in Addis Ababa focused on critical challenges facing the continent, including pervasive co...