Heart Paydays Reports Surge in U.S. Demand for Personal

Chicago, July 14, 2025 (GLOBE NEWSWIRE) --

The demand for affordable personal loans in the United States has increased dramatically in mid-2025. As inflation pressures households and more consumers seek emergency funds, online lending platforms that offer streamlined, low-interest loan access are stepping in to fill the gap. Heart Paydays is one such platform now experiencing accelerated demand from borrowers across the country.

Market Trends in Personal Lending (2025)

Recent consumer lending reports show that U.S. households are turning to unsecured personal loans more frequently to cover rising expenses in 2025. Loan applications for amounts between $1,000 and $5,000 have increased over 30% compared to the same period last year, particularly in mid-sized cities and rural regions underserved by traditional banks. Digital loan platforms are leading the charge in meeting this demand.

Fintech lenders are capitalizing on improved underwriting algorithms, mobile-optimized interfaces, and automated compliance to bring near-instant approvals to the mass market. Analysts tracking financial behavior in 2025 forecast that digital personal loans will exceed $270 billion globally by year-end, a sign that borrowers are actively moving away from legacy credit channels.

Consumer Behavior Shifts: Why Low Interest Loans Are in Demand

Borrowers today are more cautious. They want transparent lending terms, fast disbursements, and lower overall borrowing costs. Traditional payday loans and credit cards often carry high APRs, while low-interest personal loans are being seen as a smarter option for those needing fast, flexible financing.

Economic pressures, including delayed wage growth and rising housing costs, are also driving U.S. consumers to seek manageable debt with predictable repayment. According to recent search data, interest in "low interest personal loans near me" and "fast emergency loan approval" rose 47% in Q2 2025 across mobile platforms.

What Is a Low Interest Personal Loan?

A low interest personal loan refers to an unsecured loan with a below-average annual percentage rate (APR). These loans typically have fixed interest rates and repayment terms between 6 and 24 months. While actual rates vary based on creditworthiness and lender policies, platforms like Heart Paydays help consumers access offers that may be more affordable than legacy borrowing options.

Borrowers can often select from multiple offers and tailor repayment options to match their monthly income cycle, rather than being forced into short-term balloon repayment schemes. This flexibility, combined with automated loan processing, makes personal loans a viable safety net for many in 2025.

The Rise of Mobile-First Lending Platforms

Over 76% of loan applications on Heart Paydays are now submitted via mobile devices. Consumers want to apply, get approved, and receive funds—all without visiting a bank. This shift toward mobile-first lending reflects larger changes in how Americans manage their personal finances.

The frictionless experience of applying online—without paperwork, branch visits, or intrusive interviews—is no longer a novelty. It's an expectation. Borrowers rank speed of funding and privacy as two of the most important criteria when choosing a lending platform.

Heart Paydays Platform Overview

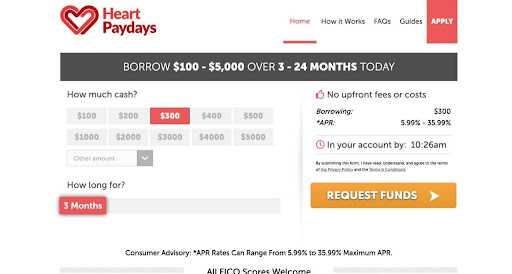

Heart Paydays is a digital loan connection service that matches U.S. borrowers with third-party lenders. The platform is designed for speed, security, and accessibility. It supports applicants with fair to poor credit and provides multiple repayment term options.

Unlike direct lenders, Heart Paydays allows users to compare pre-qualified offers from a wide network of financial institutions in a single session. This minimizes unnecessary credit inquiries and provides a streamlined route to the most appropriate funding options.

Key Features and Benefits

Borrower Profiles

The platform primarily serves employed adults aged 25–55 who have monthly income but may not qualify for traditional bank loans. Many users are gig workers, renters, or small business owners who need liquidity quickly.

Demographic data from Heart Paydays indicates that a majority of users fall within the $35,000–$75,000 annual income range, with the highest loan demand clustered in states like Texas, Ohio, Florida, and Georgia. Suburban and exurban areas now outpace urban centers in application volume, reflecting a broad shift in borrowing needs across income levels.

Use Cases

Common uses for these loans include:

Loan disbursement data from Heart Paydays shows that over 40% of loans issued in June 2025 were for $3,000 or less, suggesting the platform plays a vital role in mid-sized expense management.

Step-by-Step Application Process

Applicants are encouraged to verify details such as APR, fees, and prepayment terms before proceeding. Approval timelines vary depending on lender response time and applicant documentation.

Eligibility Requirements

Eligibility does not guarantee approval. Qualification depends on additional factors including lender criteria, repayment history, and reported income stability.

Loan Terms and Repayment

Borrowers choose from flexible terms ranging from 3 to 24 months. Fixed monthly payments help users manage repayment and avoid the ballooning interest common with other products.

Repayment calculators are available on lender sites to help users estimate their monthly dues based on loan amount, term length, and interest rate. Late payment fees, if any, are disclosed prior to acceptance of any loan offer.

Credit Score Flexibility

Unlike banks, Heart Paydays works with borrowers who may have a credit score in the 580–680 range. The platform emphasizes ability to repay over credit history alone.

This accessibility opens up financial options for users who may have limited credit histories, recent setbacks, or thin files. In many cases, borrowers improve their credit profiles over time by responsibly managing and repaying loans initiated through Heart Paydays’ network.

Financial Literacy Tips

Borrowers are encouraged to use loan offers as financial bridges—not long-term dependencies. Responsible borrowing supports both short-term relief and long-term stability.

Pros and Cons of Low Interest Loans

:

:

Frequently Asked Questions

Yes, many borrowers with fair or poor credit are approved daily.

Some lenders may charge origination or late fees. Read all terms.

Often within 24 hours of approval.

Checking offers typically uses a soft credit pull. Acceptance of an offer may trigger a hard inquiry.

Most offers range from $300 to $5,000 depending on income and creditworthiness.

Regulatory Considerations and State-by-State Lending Variance

Loan availability and terms can vary significantly based on the borrower’s state of residence. Each U.S. state sets its own regulations for maximum allowable interest rates, minimum loan amounts, and licensing requirements for third-party lenders. As such, consumers applying through Heart Paydays may see differences in loan offers depending on local rules and compliance limitations.

For instance:

Applicants are encouraged to check their state-specific lending rules and disclosures before accepting any offer. Heart Paydays only partners with lenders who are fully licensed and compliant with state and federal regulations.

This regulatory landscape is part of why loan matching platforms like Heart Paydays are increasingly preferred: they help consumers navigate lender eligibility requirements across jurisdictions while minimizing unnecessary application attempts or declined offers.

July 2025 Summary

With rising costs and reduced savings rates, many Americans are relying on personal loans as financial bridges. Heart Paydays is helping thousands connect to more affordable solutions—with a focus on speed, simplicity, and credit accessibility.

Borrowers in 2025 are more informed, digitally savvy, and focused on transparency. Platforms like Heart Paydays will continue to meet these needs through expanded access, automated tools, and consumer-friendly lending models.

Disclaimer and Disclosure

This article is for informational purposes only and does not constitute financial advice. Loan terms, availability, and approvals vary by lender and individual qualifications. Heart Paydays does not directly issue loans. This article may contain affiliate links, and a commission may be earned if a reader applies through one of these links. Readers should consult a financial advisor before making financial decisions.

Heart Paydays is not a lender. It acts solely as a connection service. Neither the author nor the publisher guarantees the accuracy of third-party information presented herein.

Recommended Articles

HVO (Hydrotreated Vegetable Oil) for Data Center Backup

The HVO (Hydrotreated Vegetable Oil) for data centers backup market is rapidly evolving, driven by the global demand for...

Tattoo Removal Industry Report 2025: Regional Investment

Driven by rising disposable incomes and non-invasive procedures, advancements like picosecond lasers are enhancing effic...

Electronic Toll Collection Market Forecast and Company

The electronic toll collection market is projected to surge, reaching USD 15.20 billion by 2030 with an 8.3% CAGR. Key g...

Analysts Behind The Sunday Times Rich List Rank Xpertnest

Curated and compiled by Robert Watts — renowned compiler of The Sunday Times Rich List — for Business Leader, this recog...

Asia-Pacific Off-Highway Electric Vehicle Analysis Report

The Asia-Pacific off-highway electric vehicle market is predicted to expand significantly, rising from $1.83 billion in ...

Global Semiconductor Market Size Worth USD 1.2 Trillion by

According to Precedence Research, the global semiconductor market size was valued at USD 584.17 billion in 2024 and is p...

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...