You may also like...

The Sapeurs Of Congo: What they Teach Us About Dignity, Style, and Survival

An exploration of the Sapeurs of Brazzaville and Kinshasa, where fashion and everything clothing is a philosophy. Read a...

Co-Parenting When You Don’t Agree on Parenting Styles

This article explains why co-parenting disagreements happen, how they affect children, and offers tips to co-parent effe...

Is the Grammy Still the Gold Standard? What Nigerian Artists' Losses Reveal About Western Validation

A deep dive into Nigeria’s Grammy night heartbreak, examining what repeated losses by Nigerian artists reveal about West...

Apps That Don’t Crash? Thank Containers and Microservices!

Learn the tech behind apps that just work! This article explains how containers and microservices make apps reliable, sc...

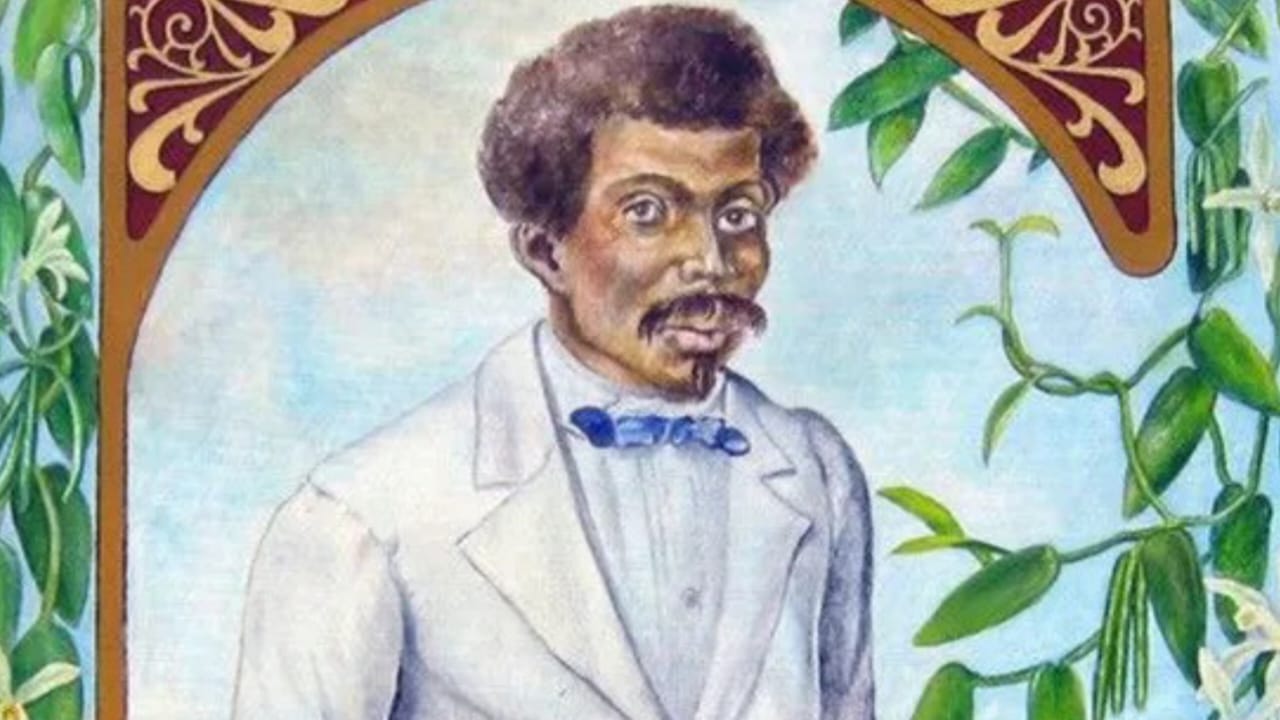

Before Vanilla Was Everywhere, There Was Edmund Albius

Before vanilla became a global staple, a 12-year-old boy named Edmund Albius changed history. This piece explores the or...

Are Movie Remakes Ruining Original Cinema

Movie remakes dominate modern cinema, from Hollywood to Nollywood. While some bring fresh perspectives, others fail to c...

We Want Respect But Won't Give It: The Hypocrisy of Food Shaming

A sharp look at the hypocrisy of food shaming as Nigerians mock other cultures’ cuisines online yet demand respect for t...

Who Really Powers Nigeria’s Fintech Boom? A Look Beneath the Apps

Chams made huge turnover in profits at the end of their 2025 auditing and this is what you should know about them. Read...