Government Eyes Tech Giant: Trump Admin Seeks 10% Intel Stake, Largest Investor Role

Potential Government Stake in Intel

The Trump administration is reportedly in advanced discussions to acquire a significant equity stake in Intel Corp., with plans to potentially take approximately a 10% ownership. This strategic move could position the United States government as the beleaguered chipmaker’s largest shareholder. The proposed investment involves converting some or all of the grants that Intel is slated to receive from the US Chips and Science Act into equity. Intel is designated to receive a combined $10.9 billion in Chips Act grants, intended for both commercial and military production, an amount roughly sufficient to fund the targeted 10% holding. At Intel’s current market value, such a stake would be valued at approximately $10.5 billion.

Market Reaction and Stake Uncertainty

Despite the detailed nature of these discussions, the precise size of the stake and the ultimate decision by the White House to proceed with the plan remain fluid. Initial market reactions to the news were mixed; Intel shares experienced a rally after Bloomberg News first reported the discussions last week, representing their best weekly gain since February. However, following Monday’s detailed report on the ongoing talks, Intel’s shares saw a dip, falling as much as 5.5% and later 3.7%.

Wider Implications for the Chips Act

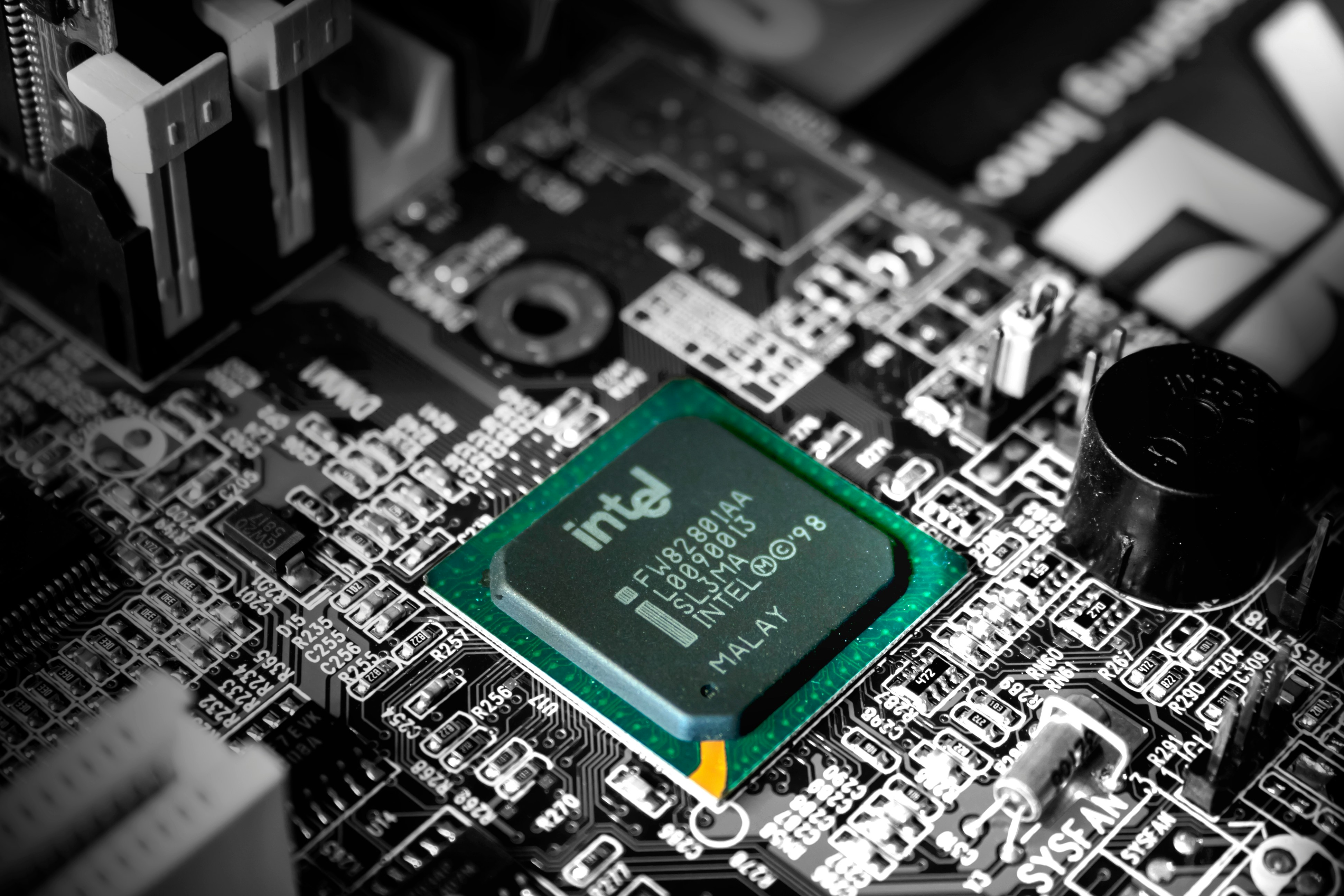

Image Credit: Unsplash

A White House official has also indicated the broader possibility of converting other Chips Act awards into equity stakes across various companies. However, it remains unclear whether this concept has gained widespread traction within the administration or if it has been broached with other potentially affected companies. This potential investment in Intel fits into a broader pattern where the Trump administration has adopted a more assertive role in strategic sectors. Previous examples include the Defense Department taking a $400 million preferred equity stake in the US rare-earth producer MP Materials Corp, making the Pentagon its largest shareholder, and an agreement to receive a 15% share of certain semiconductor sales to China, as well as a "golden share" in United States Steel Corp. following its proposed sale to a Japanese competitor.

Intel’s Current Challenges and Revival Efforts

Image Credit: Unsplash

Intel’s current business landscape is characterized by stagnant sales, ongoing losses, and challenges in regaining its technological leadership within the industry. New CEO Lip-Bu Tan is focused on reviving the company, with a primary emphasis on cost reductions and job cuts. Coinciding with these developments, SoftBank Group Corp. has independently announced its intention to purchase $2 billion worth of shares in Intel. It remains uncertain, however, whether government support will significantly boost Intel’s business performance. Grant money from the Chips Act was originally structured to be disbursed incrementally as companies meet negotiated project milestones; Intel had already received $2.2 billion in grant disbursements as of January. It is unclear whether this disbursed amount would be incorporated into a potential equity stake, if further tranches have been received, or the timeline for future funding under an equity arrangement.

Leadership and White House Engagement

Recent interactions between Intel’s CEO, Lip-Bu Tan, and President Donald Trump have also drawn attention. Last week, Tan met with Trump at the White House, a meeting that occurred after Trump had publicly criticized Tan due to his past connections to China and called for his removal. Following their meeting, President Trump commendably described Intel’s chief as having “an amazing story,” and despite earlier criticisms, Tan is expected to retain his position.

You may also like...

Shocking Claims: Star Striker Victor Osimhen Faces Lifelong Medical Battle!

Turkish football doctor Ahmet Çakar has made serious, unconfirmed claims about Nigerian striker Victor Osimhen's lifelon...

Breaking: Boxing Legend Tyson Fury Confirms Comeback, Return Date Set!

Boxing promoter Frank Warren has confirmed that Tyson Fury is planning a return to the ring next year, despite his earli...

Jared Leto's 'Tron: Ares' Ignites Furious Debate: A Sci-Fi Masterpiece or a Buggy Disaster?

Disney's latest attempt to revitalize the "Tron" franchise, "Tron: Ares," aims to simplify its narrative while retaining...

Michael Mann's 'Heat 2' Officially Ignites: Blockbuster Sequel Finds New Home at Amazon MGM!

Michael Mann's long-awaited "Heat 2" is officially moving forward, finding a new studio home at Amazon MGM-owned United ...

Diddy's Pardon Plea Ignites Firestorm: 50 Cent Slams Trump Confirmation

Sean "Diddy" Combs' recent 50-month prison sentencing for federal prostitution law violations has taken a new turn with ...

Zach Bryan's ICE Lyrics Spark White House Backlash: 'Americans Disagree'

Zach Bryan has ignited a political firestorm with a snippet of an unreleased song critical of ICE, drawing swift condemn...

J.Lo & Ben Affleck: Hollywood's Power Couple Lights Up Red Carpet Once More

Jennifer Lopez and Ben Affleck reunited on the red carpet for the New York City premiere of 'Kiss of the Spider Woman,' ...

One Direction Star Louis Tomlinson's Raw, Emotional Farewell to Liam Payne

Louis Tomlinson has opened up about the profound grief following the tragic death of his friend and former One Direction...