Ghana Unleashes Crypto Crackdown: New Mandatory Registration & Licensing Regulations Spark Debate

Ghana is taking significant steps to regulate its rapidly expanding cryptocurrency industry, driven by a surge in digital asset adoption and concerns over its impact on national financial stability. The Bank of Ghana has initiated a comprehensive regulatory process, beginning with a mandatory registration directive for all Virtual Asset Service Providers (VASPs) operating within the country.

Effective immediately, all VASPs offering services to individuals residing in Ghana, whether through a physical presence or a digital platform, are required to register with the Bank of Ghana by August 15, 2025. This directive applies to a broad range of activities, including virtual asset exchange services, wallet custody, settlement or transfer services involving virtual assets, and services related to the issuance or sale of virtual assets, such as initial coin offerings (ICOs) and stablecoins. The primary objective of this registration exercise is to identify and assess entities involved in virtual asset-related activities, forming a crucial initial step in developing a robust legal and regulatory framework that aligns with current market developments and international standards.

It is important to note that while registration is compulsory, it does not constitute a license to operate, nor does it imply legal recognition or approval from the Bank of Ghana. Non-compliance with this directive may lead to severe regulatory action or exclusion from future licensing opportunities. The Bank has also indicated its prerogative to issue further instructions as the outcomes of this ongoing process unfold.

The broader context for these regulatory moves stems from the substantial growth of the cryptocurrency market in Ghana. According to reports from June 2024, approximately 17.3% of Ghanaian adults, equating to around 3 million people, own digital assets. This widespread usage, much of which remains largely unreported, has raised significant concerns for the central bank regarding its implications for the national financial system and monetary policy. Unrecorded cryptocurrency transactions are not adequately reflected in national accounts, thereby hindering the Bank of Ghana's ability to implement effective monetary policies and manage economic controls.

Governor Johnson Asiama of the Bank of Ghana has confirmed the government's plans to license cryptocurrency platforms, a move that is anticipated to be enshrined in a new regulatory framework presented to Parliament by September 2025. This initiative is designed to achieve multiple critical objectives: generating revenue from the burgeoning digital assets sector, helping to stabilize the national currency (the Ghanaian cedi, which has experienced notable volatility, appreciating over 40% against the US dollar in 2025 after a nearly 20% depreciation in 2024), improving transaction oversight, and reinforcing economic controls. The unchecked use of digital assets, with transactions reaching US$3 billion in Ghana over the 12 months leading to June 2024, has intensified pressure on the central bank to establish clear guidelines. The planned framework aims to bring greater transparency and accountability to Ghana's emerging digital assets market, fostering sustainable growth while safeguarding the country's overall financial stability.

Recommended Articles

Ghana's Crypto Crackdown & Licensing Surge

The Bank of Ghana has mandated registration for all Virtual Asset Service Providers (VASPs) by August 15, 2025, as part ...

US Stablecoin Law: Global Finance Braces for Major Regulatory Shifts

The U.S. has enacted its first major federal cryptocurrency law, the GENIUS Act, which aims to regulate stablecoins and ...

You may also like...

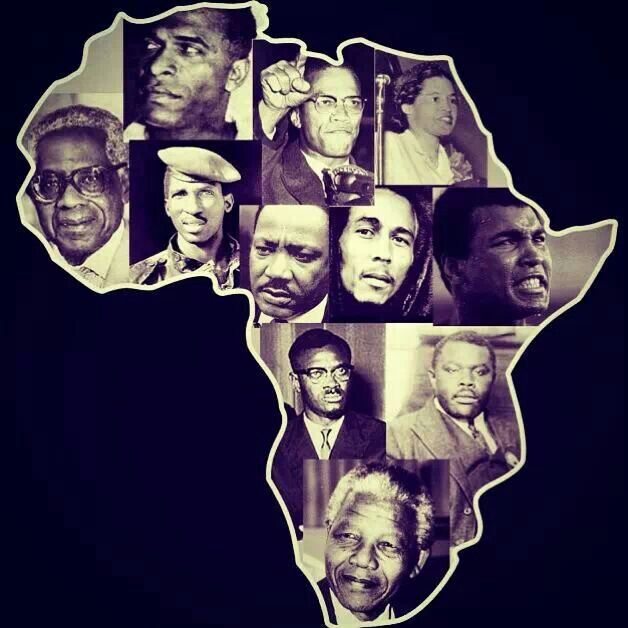

Why Do Africans Become More African After Leaving Africa?

Why do Africans abroad suddenly embrace their roots with pride? From Afrobeats in London to Yoruba weddings in New York,...

Boxing Icon's Son in Legal Turmoil: Julio Cesar Chavez Jr. Faces Cartel Allegations & Deportation Drama!

Mexican boxer Julio César Chávez Jr. has been deported from the U.S. to Mexico, where he was immediately jailed for alle...

Super Falcons Make History: Nigeria Crowned WAFCON Champions for 10th Time in Thrilling Win!

)

Nigeria's Super Falcons made history by clinching their 10th Women's Africa Cup of Nations title with a spectacular 3-2 ...

Paolo Sorrentino's 'La Grazia' Dazzles Venice, Earns Raves

Paolo Sorrentino's latest film, 'La Grazia,' captivated the Venice Film Festival, earning a four-minute standing ovation...

KPop Demon Hunters Ignites Oscar Buzz, Captivates Audiences

The animated film "KPop Demon Hunters" has emerged as a record-breaking global phenomenon, topping Netflix viewership ch...

Naira Marley Breaks Silence: Explosive Defense in Mohbad Case Rocks Nigeria!

Naira Marley has released a documentary sharing his side of the story regarding the tragic death of his former signee, M...

Fans Buzzing as Reading & Leeds Festival Teases Major Secret Headliners!

Anticipation is high for the 2025 Reading and Leeds Festivals, with widespread rumors of secret sets from bands like Wol...

Britpop Backlash: Oasis Reunion Fuels Fan Fury, Ticketmaster Under Fire!

Oasis is set to embark on a highly anticipated reunion tour with Andy Bell confirming his involvement, playing 41 dates ...