Ghana Central Bank's Crypto Clampdown: New Laws to Control Digital Remittances

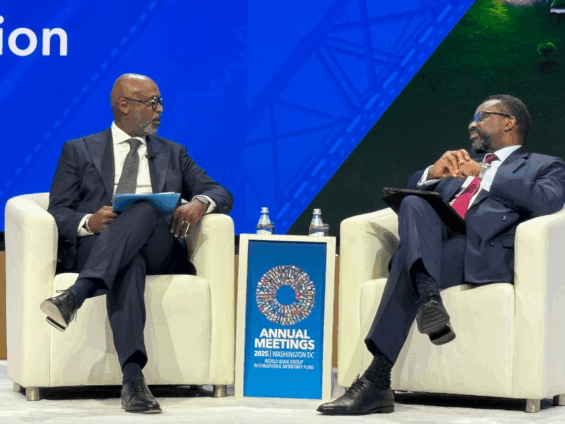

Ghana's financial landscape is experiencing a significant shift, with diaspora remittances increasingly flowing through cryptocurrency channels, bypassing traditional banking systems. Dr. Johnson Asiama, Governor of the Bank of Ghana (BoG), confirmed this trend during the IMF/World Bank Spring Meetings in Washington, D.C., noting a discernible diversion of funds towards virtual assets and stablecoins. “Crypto is one area. We always knew that the phenomenon was there,” Dr. Asiama stated, likening cryptocurrency to “the air we breathe” due to its pervasive, often unseen presence.

The central bank first became aware of this shift when official remittance inflows through regulated financial institutions saw an unexpected decline. This coincided with a period of appreciation for the local currency, the cedi. Dr. Asiama explained that the strengthened cedi meant that senders from the diaspora were receiving lesser amounts in local currency terms, prompting them to seek alternative channels for transfers. This led to a substantial portion of remittances being routed outside conventional banking channels.

Further investigations by the Bank of Ghana revealed that parallel market dealers were actively utilizing stablecoins and other virtual assets to facilitate these cross-border transfers into the country. This confirmed the central bank's earlier suspicions regarding the widespread and active use of virtual assets for terminating remittance inflows within Ghana’s financial system. Dr. Asiama underscored that this development solidified the BoG's understanding of cryptocurrency's importance, indicating that it could no longer be ignored.

In response to this evolving financial ecosystem, the Bank of Ghana has taken decisive steps toward regulation. With crucial technical assistance from the International Monetary Fund (IMF), the BoG has drafted a comprehensive new Virtual Assets Bill. This legislation aims to provide a robust regulatory framework for cryptocurrency operations in Ghana, thereby safeguarding the financial system from emerging risks and ensuring transparency. The bill is currently on its way to Parliament and is anticipated to be enacted and take effect before the end of December.

However, Dr. Asiama cautioned that the mere passage of a law is only the initial step. He emphasized the critical need to effectively track and monitor digital flows to maintain financial integrity and ensure compliance. To this end, the Bank of Ghana is actively developing the necessary expertise and manpower. It is also in the process of establishing a new department specifically dedicated to regulating and overseeing Ghana's rapidly evolving digital finance ecosystem. The Governor reiterated the central bank’s determination to build institutional capacity and establish proper oversight for virtual assets, asserting that cryptocurrency has become too significant to be overlooked.

Recommended Articles

Ghana's Groundbreaking Crypto Legalization Set to Reshape African Digital Economy by 2025!

Ghana is set to legalize and regulate cryptocurrencies by December 2025, marking a significant policy reversal driven by...

Ghana Central Bank Fires Back: Governor Defends FX Market, Assures IMF Exit

Ghana's foreign exchange market is experiencing significant pressure due to a combination of large energy sector payment...

African Lending Revolution: AGI Boss Predicts Interest Rate Plunge as Banks Brace for Change

The Association of Ghana Industries is optimistic that recent policy rate cuts by the Bank of Ghana, reducing the rate t...

Ghana's Economy Gets a Shot in the Arm: BoG Slashes Key Policy Rate!

The Bank of Ghana's Monetary Policy Committee has reduced the policy rate by 350 basis points to 21.5%, citing forecasts...

Fintech Freeze: Regulators Suspend Major Remittance Players Over Breaches!

The Bank of Ghana has suspended eight companies and UBA Ghana Limited for violating remittance guidelines, effective Sep...

You may also like...

Data Is the New Palm Oil: Why African Nations Must Protect Their Digital Gold

Africa generates massive amounts of data daily, yet much of this digital wealth flows abroad. Protecting and leveraging ...

Sweden’s Bankless Shift: Can a Cash-Free Society Redefine Global Finance?

Sweden’s journey to becoming a cashless society isn't just another story. Read on how digital payments, mobile banking, ...

China’s Social Credit Saga: Surveillance, Trust, and the Future of Freedom

China’s social credit system blends surveillance, data, and control. Is it trust-building or a digital cage — and what...

The Unsexy Businesses That Actually Make Money: Nigeria’s Hidden Millionaires

While social media glorifies tech startups and influencer fame, Nigeria’s quiet millionaires are making their fortunes i...

From “God When” to “God Did”: How Hustle Culture Became a Religion

As African youth chase the gospel of hustle and soft life, a new faith has emerged, one built on ambition, affirmations,...

GMOs and the Future of Food: Can Biotechnology Feed Africa and the World?

Can GMOs feed Africa and the world? Read about the promise, risks, and future of biotechnology in tackling hunger, clima...

The Chains of Nepotism: Meritocracy and the African Job Market

Nepotism continues to dominate Africa’s job market, sidelining merit and talent. In today’s world “who you know” oversha...

The Waiting Season: What Happens to Young Nigerians After NYSC

For thousands of Nigerian graduates, the real challenge begins after the NYSC uniform comes off. This story explains the...