Fintech Reality Check: Nigeria's Sector Shifts to Sustainable Growth in 2025

The Nigerian fintech landscape, once characterized by a frenetic gold rush, is now navigating a period of profound transformation, moving from an era of rapid user acquisition fueled by venture capital to an urgent focus on profitability. Initially, companies like Opay, with agents swarming streets, and Flutterwave, with its cross-border aspirations, leveraged massive VC investments to attract millions of unbanked Nigerians through zero-fee services, aiming to dominate digital payment rails.

This initial surge was fueled by Nigeria's vast population of over 200 million, where tens of millions remained unbanked by sluggish legacy institutions. Exploding mobile penetration, exceeding 150 million connections, effectively transformed phones into digital wallets. Foreign venture capital poured into the market, culminating in notable events like Paystack's over $200 million acquisition by Stripe in 2020 and Flutterwave achieving unicorn status with a $250 million funding round. Startups collectively raised billions, using these war chests to subsidize services and rapidly accumulate users, with the audacious belief that scale would eventually lead to profits, mirroring models like India's UPI and Kenya's M-Pesa. However, this strategy, which peaked in 2021 funding highs, began to show cracks as subsidies masked unsustainable bleeding margins.

However, this era of rapid growth and subsidized services eventually led to a harsh 'bloody hangover.' Global funding slowdowns, a dramatic freefall of the naira, and inflation rates soaring to 30% began to gnaw at operational costs. The industry's mantra shifted decisively from 'grow fastest' to 'profit or perish.' Titans such as Opay, Moniepoint, Flutterwave, and Paystack now grapple with the complexities of unit economics, where revenue per user must significantly outweigh sky-high acquisition and operational costs, stringent compliance requirements, and the necessity for revenue diversification. This pivot is not merely an evolution; it represents a brutal maturity rite, testing the resilience of nascent dreams against the anvil of profitability.

In response to these financial pressures, a significant pivot towards profitability and diversified revenue streams has become the new imperative for major players. For instance, Opay, boasting 50 million users and 500,000 agents, processes 100 million daily transactions and held a valuation of $2.75 billion in 2024. It has shifted from zero-fee models to engaging in lending and wealth management. PalmPay, with 35 million active users, saw its revenue skyrocket from $0.2 million in 2020 to $63.9 million in 2023, handling 15 million daily transactions, and is now extending its reach into B2B services. Moniepoint, primarily a B2B platform, secured a $110 million raise in late 2024 and is valued over $1 billion, becoming a leviathan in lending and embedded finance. Flutterwave, serving over 10 million merchants and valued at over $3 billion, continues its expansion across Africa and Europe, focusing on cross-border payments and API assaults. Paystack, post-Stripe acquisition, with over 60,000 businesses, is now integrating banking solutions and employing SaaS-based strategies for compliance.

Despite the prevailing challenges, the sheer volume of digital transactions underscores the profound impact of fintech in Nigeria. Mobile Money Operators alone processed ₦20.71 trillion (approximately $13.5 billion) in Q1 2025, marking an astounding 1,500% surge from ₦1.28 trillion in Q1 2021, according to Central Bank of Nigeria (CBN) data. Total digital transactions reached approximately ₦800 trillion in 2024, eclipsing traditional banks in both velocity and reach. However, volume alone does not equate to victory. Fintech entities are unleashing strategic counterstrikes: Moniepoint is deploying microloan arsenals for SMEs, Opay is piling on remittances and investment tools, and PalmPay's impressive revenue growth fuels B2B expansion. This strategic shift aims to increase average revenue per user (ARPU), transforming transactional floods into sustainable profit torrents, effectively seeking vengeance against the ghosts of the boom as scale now serves sustainability.

Looming alongside these operational shifts are significant macroeconomic and regulatory hurdles. The naira has plunged over 50% since 2023, drastically increasing FX costs for import-reliant operations. Inflation, oscillating between 20-30%, continues to crush margins, while capital controls throttle crucial inflows. Although funding flickered back to an estimated $2 billion in 2024 (as per Partech Africa) after the drought of 2022, and the number of licensed players doubled to over 430 by early 2025, regulators are circling. Overlapping jurisdictions among the CBN, SEC, and NDIC create a chaotic environment, which Kuda's Musty Mustapha laments as spooking investors and stifling innovation. At the 2025 FinTech Week, CBN Governor Olayemi Cardoso emphasized that "Trust is non-negotiable," announcing sandboxes for safe innovation, enhanced consumer shields, and cashless mandates that have turbo-charged adoption. In 2024, fines fell like guillotines, and licenses were revoked from reckless operators. Yet, there are positives; PalmPay's Chika Nwosu hails reforms as trust-builders post-naira redesign. Doomsayers, like Interswitch CEO Mitchell Elegbe, argue that 'Hand freebies to the poor, then charge? Unit economics doom most fintechs to dust.' Uzoma Dozie, former Diamond Bank head, skewers the numerous players, questioning if they are solving real pains profitably. Casualties have emerged, such as Cellulant’s Nigerian arm, which folded under the weight of subsidies. Globally, success stories like India's Razorpay, which conquered via AI-driven compliance fortresses, offer a potential blueprint for Nigeria's phoenixes to wield technology against turmoil.

The regulatory landscape has seen significant shifts, including the 2021 naira redesign which sparked digital wildfire. By 2023, FX clamps began to choke remittances. In 2024, sandboxes were ignited, and $2 billion in funding was secured amidst compliance carnage. The 2025 Fintech Week mandated unity across the sector, coinciding with a detonation of Q1 volumes.

The endgame for Nigerian fintech presents a stark dichotomy: flames or a phoenix-like rise. The old days of chasing endless payments and free money deals are rapidly fading. Now, it is survival of the smartest, demanding that companies think carefully and eliminate waste. They are increasingly leveraging smart technologies like AI to navigate complex rules and regulations, while strategically discontinuing unprofitable products. New services, such as built-in loans and embedded payments within applications, are expected to crown the real winners.

Two distinct paths lie ahead in this battle for sustainability. The winning road will likely be trodden by large, rule-following companies like Moniepoint, which are poised to feast on business-to-business deals, especially if the naira stabilizes. These entities will augment their payment systems with additional services like loans to ensure robust growth. Conversely, the road to ruin awaits older companies that continue to offer excessive freebies, as escalating costs will inevitably consume them. This period is expected to lead to mergers and shutdowns, leaving only tough survivors scarred from the intense competition. Chasing profits is not extinguishing Nigeria's fintech dreams; rather, it is the refining fire that tests and builds true champions. These companies have already significantly boosted financial access, elevating banking penetration from 40% of Nigerians to over 60%, thereby connecting a larger populace to the digital world. However, in this volatile economy, rapid growth was merely a shiny lure; lasting strength, forged through profitability and resilience, is the true fire that burns away the fakes and paves the way for sustainable success.

You may also like...

If Procrastination were a person, It would be your cousin.

Procrastination isn’t just a bad habit, it’s that cousin who always shows up when you’re ready to work, convincing you ...

Have We Become Too Comfortable on the Internet?

We live online now; posting, performing, connecting. But somewhere between sharing and oversharing, the line blurred. Ha...

Digital Art & NFTs: How African Artists Are Monetising Creativity Online

African artists are reshaping the global art market through digital creativity and blockchain innovation. NFTs are givin...

When Circuits Conquer:What If AI Literally Took Over the World?

In When Circuits Conquer, a haunting sci-fi reflection, AI takes over the world — not with war, but with logic. Humanity...

HIV Breakthrough In South Africa: The Twice Yearly Jab That Might Change Everything.

South Africa is leaning towards a huge breakthrough in its health sector. Come April 2026, twice a year injections will ...

Water Wars – Drought and Conflict on the Nile, Niger and Limpopo Rivers

As climate change tightens its grip, Africa’s great rivers — the Nile, Niger, and Limpopo — are becoming flashpoints of ...

Silent Emergency In Swakopmund As Namibia Is Tested with Its First Mpox Case.

The Ministry of Health and Social Services of Namibia has declared the country's first ever outbreak of the Mpox virus i...

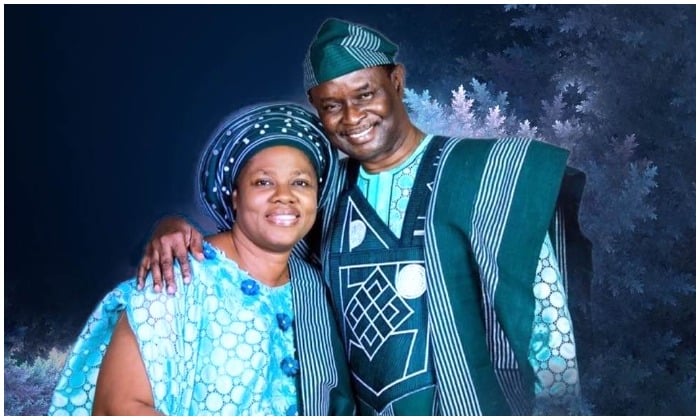

The Mount Zion Revolution: A Story of Faith and Film

In a world where entertainment often overshadows meaning, one ministry turned film into faith’s loudest microphone. From...