Fintech Giant Kuda Bank Eyes Global Domination with Tanzania and Canada Expansion!

Kuda, the prominent digital bank, is poised to launch its remittance services in Tanzania and Canada, an expansion that marks its strategic move beyond Nigeria into cross-border financial services. This significant update was shared with customers in a New Year's message, following successful testing of its services in both target countries. While specific launch dates have yet to be announced, this confirmation underscores Kuda's commitment to serving Africans abroad and facilitating more frequent international money transfers.

The planned launches are a direct follow-up to a robust 2025 for Kuda, which closed the year with strong transaction growth and broader usage across its savings, payments, and credit product offerings. The bank dedicated much of the previous year to enhancing its infrastructure, specifically to enable faster international money transfers, particularly in markets where it already holds operating licenses. This infrastructural groundwork is crucial as Kuda transitions from a Nigerian-centric digital bank to a comprehensive financial platform catering to regional and diaspora customers.

Kuda's 2025 performance highlights its growing influence and customer reliance. The platform processed over ₦29 trillion in total transactions, recording more than 1 billion individual transactions throughout the year. Savings activity on the platform exceeded ₦656 billion, while customers utilized more than ₦125 billion in overdrafts. The bank also paid out ₦797.6 million in interest to its users and efficiently processed 154.9 million bill payments. Furthermore, Kuda provided ₦2 billion in free transfers, demonstrating its value proposition to its expanding customer base.

This strategic expansion into markets like Tanzania and Canada positions Kuda closer to the substantial remittance flows within Africa and from its diaspora. For users, this move promises quicker and more affordable ways to send money internationally, particularly benefiting Africans living abroad who financially support their families back home. Moreover, it empowers Kuda to expand its operations from local banking into global financial services, reducing its dependence on third-party platforms for international transactions. This shift by Kuda, led by CEO Babs Ogundeyi, also reflects a broader trend among African fintechs to explore new markets, driven by increasing local competition and the maturation of digital banking adoption across the continent.

Successful execution of this expansion will hinge on several critical factors, including obtaining necessary regulatory approvals in the new territories, forging strong local partnerships, and effectively localizing its products to meet the unique needs of Tanzanian and Canadian markets. If successful, this expansion could profoundly transform Kuda from a leading digital bank focused solely on Nigeria into a preeminent cross-border financial institution serving a wider user base throughout Africa and its global diaspora.

Recommended Articles

Crypto Boom: Binance CEO Reveals Staggering 300 Million Users by 2025!

The crypto economy experienced unprecedented growth in 2025, adding 130 million new consumers and pushing total users pa...

FDA Warns of Listeria Contamination in Frozen Blueberries

:max_bytes(150000):strip_icc()/Health-blueberry-recall-ec4f28a0f16f4ebb9402823e6755e97f.png)

Over 55,000 pounds of frozen blueberries have been recalled in four U.S. states and Canada due to potential Listeria con...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

Tragedy in Canada: Police Identify Suspect in Deadly School Massacre, Shooter Named

An 18-year-old transgender individual identified as Jesse Van Rootselaar carried out a devastating school shooting in Tu...

Royals React as Canada Rocked by Deadly School Shooting: Nine Killed, Young Girl Fights for Life

A mass shooting at Tumbler Ridge Secondary School in British Columbia has left at least ten dead and dozens wounded, mak...

You may also like...

Premier League Giants Battle for USMNT Star Adams: Man Utd, Chelsea, Liverpool in Transfer Frenzy!

The latest football transfer market updates reveal intense activity among top clubs. Manchester United, Chelsea, and Liv...

Wemby's Relief: NBA Star Victor Wembanyama Speaks Out After Friend's Safe Return

San Antonio Spurs star Victor Wembanyama's longtime friend, Elijah Hoard, was safely located after going missing at Chic...

Iconic Comedy 'Scrubs' Makes Triumphant Comeback After 16 Years With Record-Shattering Ratings

The iconic medical sitcom "Scrubs" has made a triumphant return to ABC, drawing over 11 million viewers and achieving AB...

Streaming Shake-Up: HBO Max Merges With Divisive Rival, Promising Big Changes for Subscribers

The potential merger of Paramount and Warner Bros. Discovery is set to significantly reshape the streaming landscape, pa...

Twisted Sister Shocker: Sebastian Bach Joins for 50th Anniversary as Snider Steps Down!

Twisted Sister's 50th-anniversary shows are set to continue, with Sebastian Bach joining as the lead vocalist for select...

Global Tensions Silence the Decks: Charlotte de Witte Cancels Australia Tour Over Middle East Conflict Fallout

Belgian techno DJ Charlotte de Witte has cancelled her highly anticipated Australian shows, including performances in Sy...

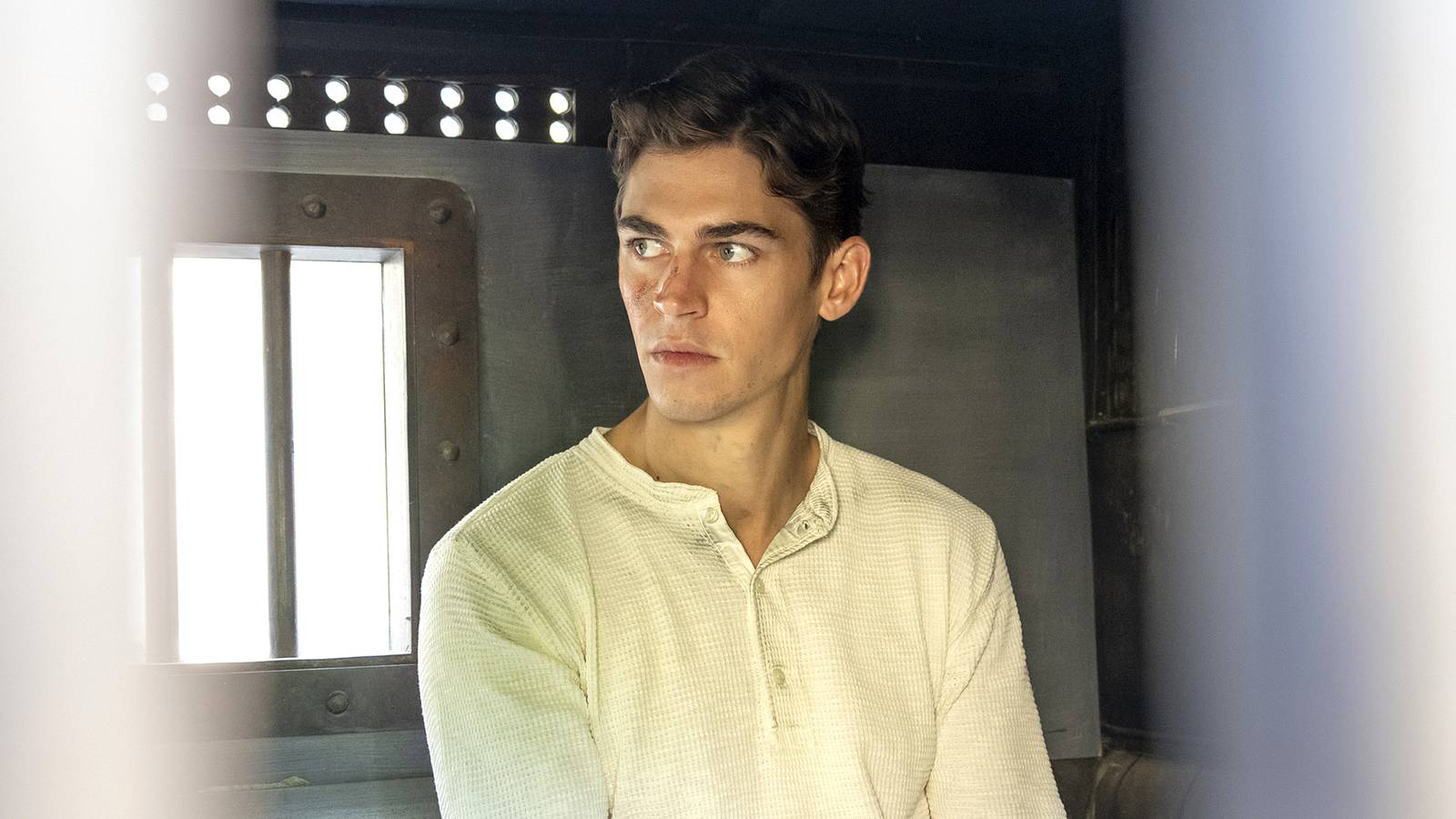

Fiennes Tiffin Teases Epic Sherlock Season 2 Showdown

The Prime Video series 'Young Sherlock' reintroduces a nascent Sherlock Holmes, portrayed by Hero Fiennes Tiffin, embark...

Middle East Tensions Ripple: Namibians Stranded in Dubai, Kenya Airways Launches Repatriation Flights Amid Iran Attacks

Middle East military tensions have prompted Kenya Airways to operate special repatriation flights to Dubai, aiding stran...