Financial Titans Sound Alarm on Looming AI Bubble

Concerns are mounting among global financial institutions regarding a potential investment bubble in artificial intelligence (AI) technology. Both the Bank of England and the International Monetary Fund (IMF) have issued warnings, highlighting the increasing risk of a sharp market correction as tech stock prices, inflated by AI optimism, appear stretched beyond their fundamental worth. The U.K. central bank noted that stock market valuations, particularly for AI-focused technology companies, are comparable to the peak of the 2000 dot-com bubble, which was followed by a significant deflation and recession.

Economists are observing several potential symptoms of a bubble, including rapid growth in tech stock prices, which now comprise approximately 40% of the S&P 500. Adam Slater, lead economist at Oxford Economics, pointed to market valuations that seem “stretched” and a prevailing sense of extreme optimism despite considerable uncertainties surrounding the ultimate capabilities and economic yield of AI technology. IMF Managing Director Kristalina Georgieva echoed these concerns, cautioning that global stock prices, fueled by AI's productivity potential, could experience an abrupt turn in financial conditions, potentially dragging down world growth.

The economic promise of AI remains a subject of wide-ranging debate. While some highly optimistic projections foresee a transformation of the economy, leading to annual productivity gains not seen since post-World War II reconstruction, others are more conservative. Economist Daron Acemoglu of MIT, for instance, has predicted a “nontrivial but modest” U.S. productivity gain of just 0.7% over a decade, underscoring the broad spectrum of possibilities and the lack of consensus on AI’s long-term impact.

Investor attention has been drawn to a series of significant deals involving top AI developers and the companies producing the expensive computer chips and data centers essential for AI products. OpenAI, the creator of ChatGPT, despite not turning a profit, has reached a staggering market valuation of $500 billion, becoming the world’s most valuable startup. Its recent agreements with chipmakers Nvidia and AMD exemplify the substantial capital flowing into the sector. The Bank of England report warned that with tech stocks forming an increasingly large share of benchmark stock indexes, markets are particularly vulnerable if expectations regarding AI’s impact become less optimistic.

Downside risks to AI progress, as outlined by the Bank of England, include potential shortages of electricity, data, or chips, as well as unforeseen technological changes that could diminish the need for current AI infrastructure. These factors contribute to the fragility of current market conditions, prompting a cautious outlook from financial regulators.

Despite the cautionary notes from financial institutions, tech industry leaders largely remain optimistic about AI's future. Amazon founder Jeff Bezos characterized the current AI boom as an “industrial bubble” rather than a financial one, suggesting it could ultimately benefit society even if it bursts. He compared it to the biotech bubble of the 1990s, which, despite volatility, led to life-saving innovations. Bezos acknowledged that the excitement around AI can cloud investors’ judgment, making it difficult to distinguish between promising and unsound business ideas.

Sam Altman, CEO of OpenAI, also acknowledged that there would be “dumb capital allocations” and short-term fluctuations of overinvestment and underinvestment. However, he expressed strong confidence that over the long term, AI technology will drive a new wave of unprecedented economic growth, scientific breakthroughs, improvements in quality of life, and new avenues for creativity.

Nvidia CEO Jensen Huang highlighted a crucial transition in AI development, noting that leading AI developers are moving beyond basic chatbots that operated “basically at a loss” to more sophisticated “AI agents” capable of higher-level reasoning. These advanced systems can perform research, utilize tools, and generate highly useful information. Huang also addressed OpenAI’s funding, stating they would need to raise capital through exponentially growing revenue, equity, or debt.

However, as the initial hype surrounding AI agents begins to subside, businesses are scrutinizing whether these tools deliver sufficient return on investment (ROI). Forrester analyst Sudha Maheshwari succinctly predicted that “Every bubble inevitably bursts, and in 2026, AI will lose its sheen, trading its tiara for a hard hat,” suggesting a shift from speculative excitement to practical application and rigorous evaluation.

You may also like...

Man Utd Future Unveiled: Ratcliffe Sets Three-Year Prove-It Deadline for Amorim

Manchester United co-owner Sir Jim Ratcliffe has affirmed his support for manager Ruben Amorim, advocating for a three-y...

Ronaldo Reaches Historic Billionaire Status, Leaving Messi Behind!

)

Portuguese football icon Cristiano Ronaldo has made history by becoming the first footballer to achieve billionaire stat...

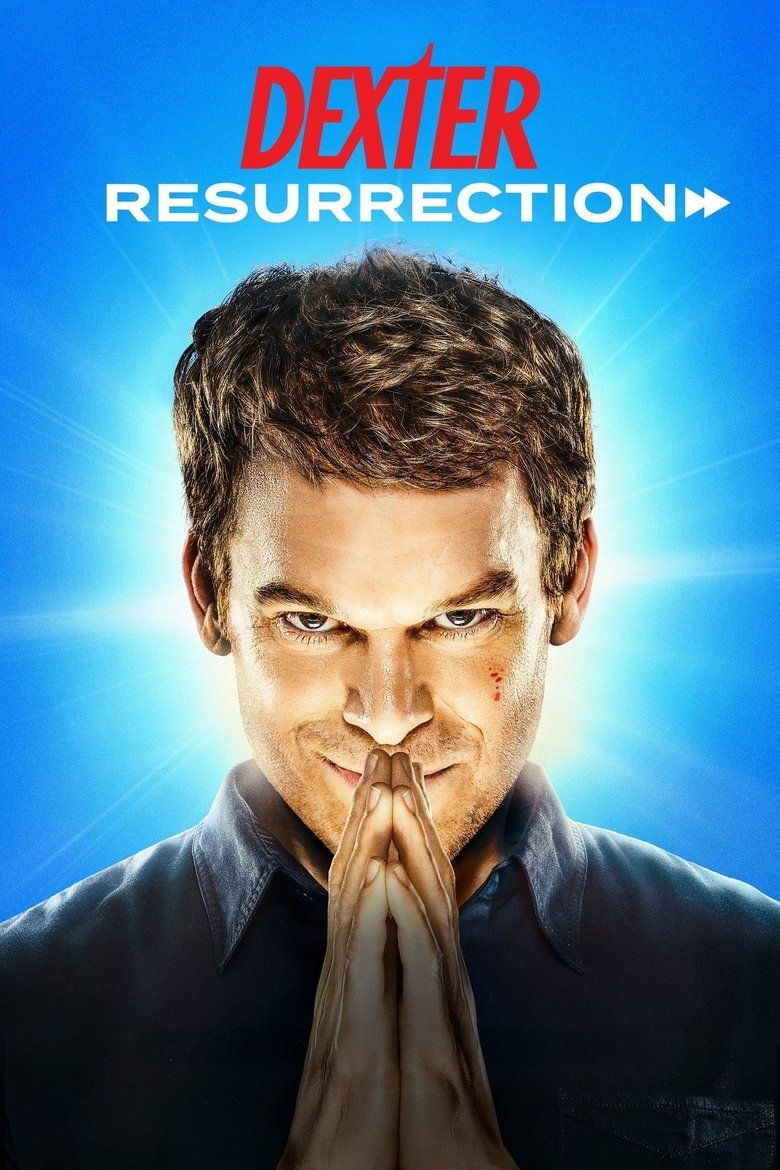

Paramount+ Shocker: 'Dexter: Resurrection' Scores Season 2 Renewal After Month-Long Wait!

Paramount+ has officially renewed “Dexter: Resurrection” for a second season, signaling the highly anticipated return of...

Taylor Swift's 'Showgirl' Takes the World by Storm: Travis Kelce's Reaction and Record-Breaking Potential

On his 'New Heights' podcast, Travis Kelce reacted to Taylor Swift's new album, 'The Life of a Showgirl,' specifically t...

Louis Tomlinson's Heartbreak: Reflecting on Liam Payne’s Devastating Passing

Louis Tomlinson opens up about the profound impact of Liam Payne's death, describing the loss as "impossibly difficult."...

Brooklyn Beckham's Legal Woes Mount As He Faces Another Setback!

Brooklyn Beckham faces ongoing legal battles for his Cloud 23 hot sauce business, narrowly resolving a trademark dispute...

Dolly Parton Shakes Off Death Rumors Amid Terrifying Health Scare!

Country music icon Dolly Parton has personally addressed and debunked swirling rumors about her health, assuring fans sh...

Malala's Powerful Abuja Visit: Advocating for Girls' Empowerment from Pottery to Policy

Nobel Laureate Malala Yousafzai recently visited Nigeria to advance girls' education, engaging with local champions, you...