Ethereum (ETH) Price Dips Near $2,500 Amid Whale Exit Concerns

Ethereum (ETH) experienced a significant price dip below the critical $2,500 mark on June 1, 2025, sparking concerns about potential whale exits before staging a modest recovery. The sudden spike in trading volume fueled speculation that major market players might be discreetly offloading their ETH holdings, leading to increased volatility in the cryptocurrency's value.

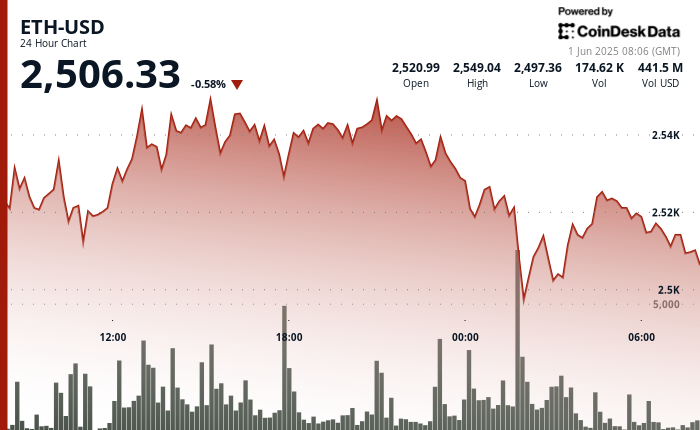

Ether's price movement on June 1, 2025, was characterized by choppy trading, with prices fluctuating between $2,497 and $2,549. According to CoinDesk Research's technical analysis data model, ETH saw sharp intraday volatility, falling from a high of $2,551.09 to a low of $2,499.09 before finding some stability around $2,506. Volume spikes were notably observed near midnight GMT, indicating active trading during these periods.

A high-volume sell-off in the final hour of trading triggered a crucial break below the $2,515-$2,520 support zone. This breach intensified concerns regarding potential institutional distribution, as Ethereum faced renewed downside pressure. The cryptocurrency subsequently tumbled below the $2,500 level as selling volume surged, compounded by a weakening in broader risk sentiment.

The negative market sentiment was partly attributed to global trade tensions and renewed U.S. tariff risks, which have prompted risk-off flows across financial markets. Digital assets, including Ethereum, are increasingly mirroring traditional markets in their reactions to such geopolitical uncertainties. Further supporting the institutional selling narrative, on-chain data revealed sizable ETH inflows to centralized exchanges. Most notably, a transfer of 385,000 ETH to Binance added weight to the speculation that institutional players might be trimming their positions.

Technical analysis highlights indicate that ETH traded within a volatile range of $48.61, representing a 1.95% fluctuation, between its high of $2,551.09 and low of $2,499.09. Price action had initially formed a bullish ascending channel before this pattern broke down in the final hour. Heavy selling pressure emerged near the $2,550 mark, with profit-taking activities accelerating into a sharp reversal. A particularly dramatic drop occurred between 01:53 and 01:54 GMT, where ETH plunged from $2,521.35 to $2,499.09 as combined volume exceeded 48,000 ETH across those two minutes.

Following the sharp decline, trading volume normalized, and the price of Ether recovered slightly, consolidating in a band around $2,504–$2,508. The $2,500 level is now acting as an interim support. However, market momentum remains fragile, with signs of distribution still evident in recent volume patterns. Market observers are closely monitoring whether buyers can successfully defend this critical psychological and technical level, or if Ethereum is poised for another leg lower in the near term.