Major Bitcoin and Ethereum Options Expiry on May 30 Detailed

A significant event unfolded in the cryptocurrency derivatives market on May 30, 2025, as a massive volume of Bitcoin (BTC) and Ethereum (ETH) options reached their expiration. This event, with data reported by Greeks.live, provided critical insights for traders navigating the volatile crypto landscape, highlighting shifts in market sentiment, potential price volatility, and intricate cross-market dynamics with traditional stock markets.

According to Greeks.live, a staggering 93,000 Bitcoin options expired on this date. These options had a Put-Call Ratio (PCR) of 0.89. While a PCR below 1.0 generally indicates more put options (bets on price decline) than call options (bets on price increase), a value of 0.89 can be interpreted as a relatively balanced sentiment, albeit with a slight bearish tilt. The maxpain point for these BTC options—the price at which the largest number of options would expire worthless—was set at a high $100,000. The total notional value of these expiring BTC options amounted to an impressive $9.79 billion.

Simultaneously, 624,000 Ethereum options also expired. The ETH options exhibited a Put-Call Ratio of 0.81, suggesting a somewhat stronger bearish sentiment among Ethereum options traders compared to Bitcoin. The maxpain point for these ETH options was $2,300, and their total notional value stood at $1.62 billion. The high maxpain points for both Bitcoin and Ethereum were noted by some analysts as potentially indicative of underlying bullish positions or expectations among a segment of traders, despite the PCR values leaning slightly bearish.

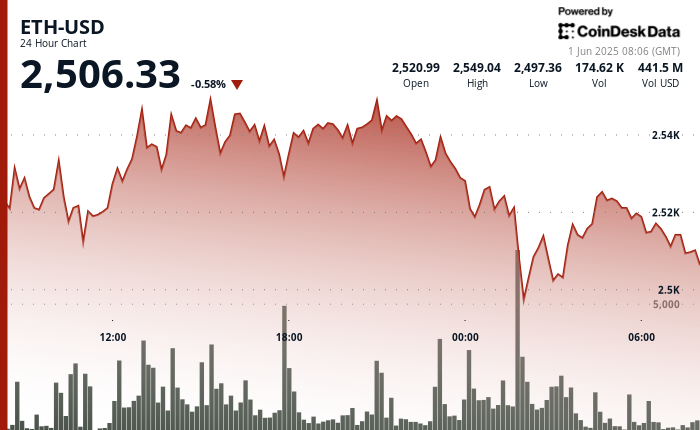

The combined notional value of nearly $11.41 billion for the expiring BTC and ETH options underscored the event's potential impact on market liquidity and sentiment. At the time of the announcement by Greeks.live, around 8:00 AM UTC on May 30, 2025, the market was closely watched. By 9:00 AM UTC, Bitcoin was trading around $94,500 on major exchanges like Binance (BTC/USDT pair), while Ethereum was hovering near $2,100 (ETH/USDT pair). Both cryptocurrencies were trading below their respective maxpain points, hinting at potential downward pressure or a period of consolidation as the market absorbed the impact of the expirations.

Such large-scale options expiries are often triggers for increased price volatility as traders adjust their positions. The expiration on May 30, 2025, was expected to lead to rebalancing activities, potentially creating short-term selling pressure, particularly as holders of out-of-the-money options unwound their positions. This scenario could present trading opportunities for scalpers and short-term traders. Indicative of heightened activity, 24-hour trading volumes by 10:00 AM UTC on May 30, 2025, (as per CoinGecko data) saw Bitcoin trading volume exceed 120,000 BTC (approximately $11.34 billion) and Ethereum volume surpass 2.1 million ETH (approximately $4.41 billion).

The trading implications extended to cross-market dynamics between cryptocurrencies and traditional stock markets. The bearish Put-Call Ratios hinted that some institutional players might be positioning for downside protection, a sentiment that could correlate with broader stock market behavior. For instance, the S&P 500 had dipped 0.3% to 5,250 on May 29, 2025 (4:00 PM EDT, Bloomberg data), and the Nasdaq Composite fell 0.5% to 16,800 on the same day (Yahoo Finance data), reflecting a risk-off sentiment. Such trends can lead to capital outflows from equities, potentially moving into safe-haven assets or even Bitcoin if it's perceived as a hedge, thereby impacting BTC/USD volatility. Traders were advised to monitor for increased volume spikes in crypto markets post-expiration, as institutional money flow often shifts between stocks and crypto during such high-impact events.

From a technical perspective, Bitcoin's BTC/USDT pair on Binance showed a Relative Strength Index (RSI) of 42 at 11:00 AM UTC on May 30, 2025. This reading suggested neither overbought nor oversold conditions but indicated a potential for bearish momentum if the RSI dipped below 40. Key support levels for Bitcoin were identified near $92,000, with resistance at $96,500 as of 12:00 PM UTC. Trading volume for Bitcoin reportedly spiked by 15% to 130,000 BTC in the 24 hours following the expiration, signaling heightened market activity.

For Ethereum, the ETH/USDT pair displayed a more pronounced bearish trend with an RSI of 38 at 11:00 AM UTC. On-chain data from Glassnode further supported this, revealing a 10% increase in ETH transfers to exchanges between 8:00 AM and 10:00 AM UTC on May 30, 2025. Such an increase in exchange inflows often suggests potential selling pressure as traders move assets to platforms for liquidation.

Despite some bearish indicators, institutional interest in Bitcoin remained noteworthy. Bitcoin ETF inflows saw a 20% uptick to $500 million on May 29, 2025, as reported by CoinDesk. This suggested some capital rotation into crypto assets despite weaknesses in the stock market, potentially providing a cushion against significant downside risks for Bitcoin.

In summary, the May 30, 2025, options expiration event for Bitcoin and Ethereum presented a complex but valuable window for traders to analyze market forces. The interplay of trading volumes, Put-Call Ratios, maxpain levels, correlations with stock market movements, institutional flows, and overarching market sentiment was expected to shape price action in the subsequent days. For informed trading decisions in this high-volatility environment, market participants were encouraged to closely monitor both crypto-specific metrics and broader equity trends, employing prudent risk management strategies such as tight stop-losses near critical support levels.