Analyst Reports Ethereum Daily Chart Signaling Strength Despite Market Uncertainty

Ethereum has consistently showcased remarkable strength in the cryptocurrency market, maintaining its position above crucial support levels and notably outperforming many other digital assets. This resilience is particularly evident amidst growing macroeconomic uncertainties. Since its lows in April, Ethereum's value has impressively more than doubled, reflecting an over 100% gain, and it continues to exhibit an upward trajectory with no apparent signs of deceleration. Despite significant selling pressure impacting global markets, Ethereum has remained steadfast, supported by consistent buying interest.

Prominent market analyst Carl Runefelt has offered a bullish outlook on Ethereum, emphasizing its sustained strength on the daily trading timeframe. According to Runefelt, should Bitcoin's price movement stabilize and trend sideways, Ethereum is well-positioned to capitalize on this by breaking out of its current consolidation triangle. Such a breakout could potentially position Ethereum to lead the subsequent phase of a broader market rally. His analysis underscores Ethereum's unique standing, not merely as the second-largest cryptocurrency by market capitalization, but as a potential key driver for the next altseason.

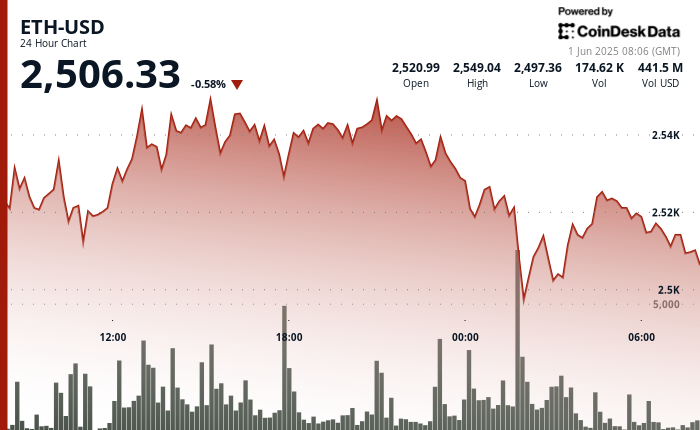

Currently, Ethereum is trading within a narrow consolidation range, which many investors interpret as a preparatory phase for its next significant price movement. Having rallied substantially since April, Ethereum is now confronting key resistance levels, specifically in the $2,650 to $2,700 zone. The asset has managed to hold firm above critical support levels, even with recent macroeconomic tensions such as rising US Treasury yields and ongoing geopolitical risks. Runefelt highlighted that Ethereum "refuses to dump on the daily timeframe," which he views as a strong indicator of its underlying bullish resilience.

From a technical standpoint, Ethereum's current consolidation pattern appears constructive for future growth. The cryptocurrency has established a pattern of higher lows since April and continues to trade above all major moving averages on key timeframes, reinforcing a positive outlook. The $2,300 level is increasingly recognized as a robust support base. Based on Runefelt's analysis, a successful clearance of the immediate resistance could set a bullish target at $3,100, while the primary downside risk remains pegged around the $2,300 support level. The current market dynamics, characterized by compressing trading volume and brewing volatility, suggest Ethereum is poised for a decisive move.

Analyzing Ethereum's daily chart, its current trading price is approximately $2,616. This places it just beneath the 200-day simple moving average (SMA), which is situated around $2,679 and has consistently acted as a resistance zone in recent weeks. Despite several intraday attempts to surpass $2,650, Ethereum has yet to achieve a definitive breakout by closing decisively above this level. The broader consolidation for ETH is occurring between $2,480 and $2,700, following its significant rally from April lows near $1,800. The 34-day Exponential Moving Average (EMA) at $2,406 and other shorter-term SMAs are trending upwards, suggesting that medium-term momentum continues to favor the bulls, although trading volume has been stable yet unremarkable, indicating a current lack of strong directional conviction from either buyers or sellers.

The potential future trajectory of Ethereum hinges on its ability to navigate the current consolidation. A clean daily close above the $2,700 mark could serve as confirmation of a breakout, potentially paving the way for a move towards the $3,000 psychological level and beyond. Conversely, if Ethereum fails to maintain its footing above the $2,480 support zone, a pullback could ensue, possibly leading to a retest of the 100-day SMA, which is currently located near $2,065. Market participants are therefore keenly observing these critical levels for signals of Ethereum's next major directional move.

In conclusion, Ethereum's ongoing performance not only solidifies its crucial role as a foundational layer of the broader digital asset space but also holds significant implications for the market at large. A decisive breakout from its current consolidation could ignite widespread momentum across various altcoins, potentially heralding the beginning of a new, dynamic phase in the current bull cycle and boosting overall confidence in the altcoin market.