Ethereum (ETH) Price Dips Near $2,500 Amid Whale Exit Concerns

Ethereum (ETH) experienced a tumultuous trading session on June 1, 2025, marked by a significant price dip below the critical $2,500 threshold. The sudden plunge was attributed to a sharp spike in trading volume, fueling widespread speculation that major holders, or 'whales,' were quietly offloading their ETH positions. While the price did manage to bounce back above this key psychological and technical level, the market remains on edge, closely monitoring for further signs of instability or recovery.

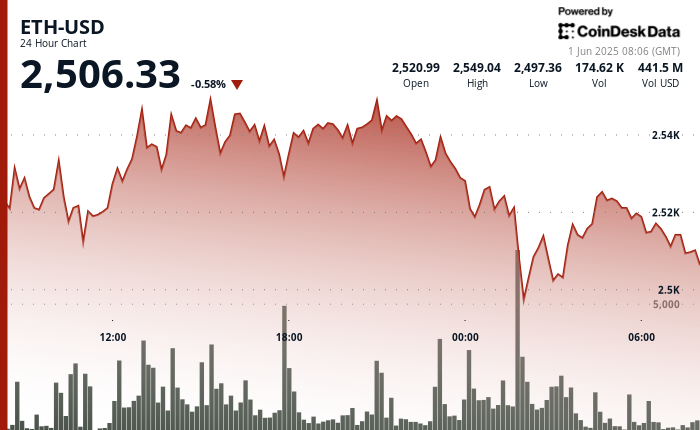

The volatility began as Ether slipped below $2,510 early on June 1, 2025, with prices fluctuating between $2,497 and $2,549 throughout the day. According to CoinDesk Research's technical analysis data model, ETH witnessed sharp intraday movement, falling from a high of $2,551.09 to a low of $2,499.09 before finding some stability around $2,506. A particularly concerning event was a high-volume sell-off occurring near midnight GMT, which caused ETH to break below the crucial $2,515-$2,520 support zone. This breach intensified concerns among market participants regarding potential institutional distribution, as large players might be strategically reducing their holdings.

The renewed downside pressure on Ethereum was not solely an isolated crypto-market event. It coincided with a weakening broader risk sentiment, exacerbated by global trade tensions and renewed U.S. tariff risks. These geopolitical uncertainties triggered risk-off flows across financial markets, with digital assets increasingly mirroring the reactions of traditional markets. On-chain data further substantiated fears of institutional selling, revealing sizable inflows of ETH to centralized exchanges. Most notably, a significant transaction of 385,000 ETH to Binance added to the speculation that institutional players were indeed trimming their positions. Despite a modest recovery that brought ETH to trade around $2,506, the market is intently observing whether buyers can successfully defend the $2,500 support level or if another downward movement is imminent.

A detailed technical analysis of ETH's price action on June 1, 2025, highlighted its volatile nature. The cryptocurrency traded within a $48.61 range, representing a 1.95% fluctuation, between its intraday high of $2,551.09 and low of $2,499.09. Initially, the price action formed a bullish ascending channel, but this pattern broke down decisively in the final hour of trading. Heavy selling pressure emerged near the $2,550 mark, where profit-taking likely accelerated, leading to a sharp reversal. A dramatic drop was recorded between 01:53 and 01:54, when ETH plunged from $2,521.35 to $2,499.09, with a combined trading volume exceeding 48,000 ETH across those two minutes. Following this intense period, trading volume normalized, and the price recovered slightly, consolidating within the $2,504–$2,508 band.

Currently, the $2,500 level is serving as an interim support for Ethereum. However, market momentum remains fragile, with clear signs of distribution still evident in recent volume patterns. The ability of ETH to hold above this critical juncture is being closely watched by traders and analysts, as it is likely to determine the near-term market direction. The defense or failure of this support will be a key indicator of whether Ethereum can stabilize or if it faces further declines in the immediate future.