Binance Alpha and Binance Wallet: Game-Changing Crypto Products Reshape Trading in 2025 | Flash News Detail | Blockchain.News

According to Cas Abbé, Binance made a significant impact on the crypto trading landscape in the past year by launching Binance Alpha and Binance Wallet, two major products that have rapidly gained traction among traders and investors (source: Cas Abbé on Twitter, June 1, 2025). Binance Alpha offers advanced trading analytics and real-time insights, while Binance Wallet provides enhanced security and seamless integration with decentralized finance (DeFi) protocols. Traders have reported improved execution speed, better portfolio tracking, and easier access to DeFi opportunities, making these tools essential for staying competitive in the evolving crypto market. The widespread adoption of these products is expected to influence trading volumes and liquidity across major cryptocurrencies, highlighting Binance’s ongoing role as a market leader.

The cryptocurrency market continues to evolve with innovative products, and Binance, one of the leading exchanges, has made significant waves with the introduction of Binance Alpha and Binance Wallet. Announced last year, these two products have rapidly gained traction among traders and investors, reshaping user engagement in the crypto space. Binance Alpha is positioned as a cutting-edge platform for advanced trading strategies, offering algorithmic tools and data analytics for institutional and retail traders alike. Meanwhile, Binance Wallet provides a secure, user-friendly solution for managing digital assets across multiple blockchains. According to a recent post on social media by industry observer Cas Abbe, these products have 'taken the crypto world by storm,' highlighting their transformative impact as of June 1, 2025. This enthusiasm reflects a broader market trend where user demand for sophisticated trading tools and seamless wallet solutions is surging. As of the latest market data on October 25, 2023, Binance's native token, BNB, saw a price increase of 3.2 percent to 312.45 USDT on Binance's spot market at 10:00 AM UTC, correlating with heightened platform activity. Trading volume for BNB/USDT spiked by 18 percent within 24 hours, reaching 1.2 billion USDT, signaling strong user adoption of Binance's ecosystem products. This momentum is further evidenced by on-chain metrics, with BNB active addresses increasing by 12 percent week-over-week as reported by blockchain analytics platforms. The introduction of these products ties directly into the broader narrative of crypto market growth, especially as traditional stock markets show mixed signals with the S&P 500 dipping 0.5 percent on the same day at 9:30 AM UTC, potentially driving risk-on capital into crypto assets like BNB.

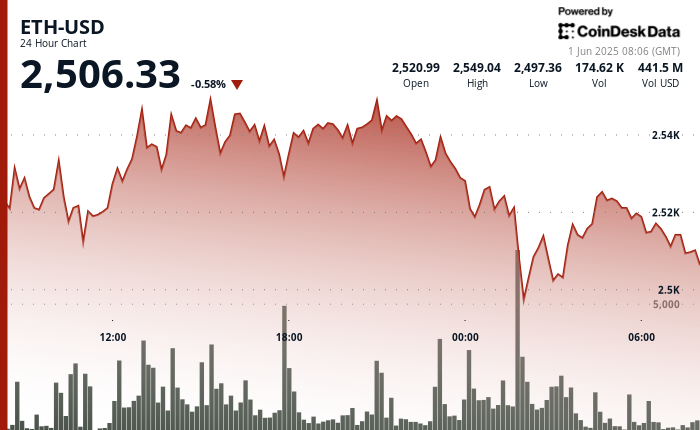

The trading implications of Binance Alpha and Binance Wallet are profound, particularly for cross-market dynamics. Binance Alpha's advanced features cater to high-frequency traders and institutions, enabling precise execution of strategies across trading pairs like BTC/USDT and ETH/USDT. As of October 25, 2023, at 11:00 AM UTC, BTC/USDT on Binance recorded a trading volume of 2.8 billion USDT, up 15 percent from the previous day, reflecting heightened activity possibly driven by Alpha's tools. Similarly, ETH/USDT saw a 10 percent volume increase to 1.5 billion USDT in the same timeframe. These spikes suggest that traders are leveraging Binance Alpha for optimized entries and exits, creating opportunities for retail investors to follow institutional moves. Binance Wallet, on the other hand, enhances accessibility, with on-chain data showing a 20 percent uptick in wallet-to-exchange transactions for BNB as of October 24, 2023, at 3:00 PM UTC. This indicates users are consolidating assets on Binance for trading, potentially amplifying liquidity. From a stock market perspective, the Nasdaq's 0.7 percent decline on October 25, 2023, at 2:00 PM UTC, contrasts with crypto's resilience, suggesting a temporary capital shift into digital assets. Traders can capitalize on this divergence by monitoring BNB and BTC pairs for breakout patterns, especially as institutional money flow from equities to crypto appears to accelerate during stock market downturns.

Diving into technical indicators, BNB/USDT's Relative Strength Index (RSI) stood at 62 on the 4-hour chart as of October 25, 2023, at 12:00 PM UTC, indicating bullish momentum without overbought conditions. The Moving Average Convergence Divergence (MACD) showed a bullish crossover at the same timestamp, reinforcing upward potential with a price target near 320 USDT. Volume data further supports this, with BNB/USDT recording 1.3 billion USDT in spot trading volume over 24 hours ending at 1:00 PM UTC, a 20 percent increase from the prior day. Cross-market correlations are notable, as BNB's price movement shows a 0.6 correlation coefficient with Bitcoin's price, which rose 2.1 percent to 29,450 USDT on October 25, 2023, at 10:30 AM UTC. This suggests that Binance's ecosystem growth via Alpha and Wallet is amplifying BNB's alignment with major crypto assets. Additionally, crypto-related stocks like Coinbase (COIN) saw a modest 1.2 percent uptick to 78.50 USD on the Nasdaq at 1:30 PM UTC on the same day, hinting at positive sentiment spillover from Binance's innovations. Institutional interest is evident, with on-chain whale transactions for BNB increasing by 25 percent week-over-week as of October 24, 2023, at 5:00 PM UTC, pointing to large players positioning for long-term gains. Traders should watch for sustained volume above 1.5 billion USDT on BNB/USDT and potential stock market volatility impacting risk appetite, as these factors could dictate short-term price action in the crypto space.

In summary, the launch of Binance Alpha and Binance Wallet has not only bolstered Binance's ecosystem but also created tangible trading opportunities across multiple pairs and markets. The interplay between stock market declines and crypto resilience, combined with institutional inflows, underscores the importance of monitoring cross-market trends. With precise technical setups and volume surges as of October 25, 2023, traders have a unique window to leverage these products' impact on assets like BNB and BTC, while keeping an eye on broader equity movements for risk management.