EPF withdrawals made easier for PF members but this impacts your retirement corpus - The Economic Times

Even as many EPF subscribers continue to face difficulties accessing money parked in the nation’s foremost pension body, some have figured a way to tide over the cash crunch.

Following the Covid-19 pandemic, when the EPFO portal made partial withdrawal via the ‘Illness’ option easy for members, PF accounts have become a lifeline for those who have nearly exhausted their savings and want to avoid falling into a debt trap. But indiscriminate use of this facility could compromise individuals’ financial security in later years.

Indians have faced several upheavals in the past decade—demonetisation in 2016 and the pandemic in 2019—that fuelled pay cuts and layoffs.

Millennials, especially those in the nation’s workforce for not more than a decade, have been hit hard by these crises. Some had neither worked long enough to build an adequate corpus to rely on during uncertain times, nor were they young enough to have the safety net of working parents to support them.

Around 2020, the pandemic drove cashstarved millennials to break their EPFO piggy bank as it provided immediate liquidity without baggage.

Cut to the present: faced with a worry of rising defaults and increased debt of individuals, banks sharpened their screening process and became more cautious when giving loans. According to the RBI’s latest report, bank credit in the personal loans segment grew 13.7% during the fortnight ended 30 May, compared with 19.3% in the corresponding year-ago period. The central bank attributed this largely to moderation in growth of ‘other personal loans’, ‘vehicle loans’ and ‘credit card outstanding’. This essentially means the public has less hard cash. For some millennials, this liquidity crunch was a nudge to again dip into their retirement kitty.

Relaxations offered by the EPFO have made this easy. Subscribers can file Form-31 citing reasons such as ‘Illness’, ‘Natural Calamities’, ‘Power Cut’, among others. With the UMANG app, this process is very similar and reduced to barely a few taps of one’s smartphone.

The introduction of the Universal Account Number (UAN) system in 2014 has also made it easier for subscribers to access their EPF accounts across multiple employers. “However, in cases where an individual’s EPF history spans pre-UAN periods or involves outdated employer records, withdrawals can still be challenging and may require manual intervention,” says Amey Kanekar, founder of fintech startup FinRight Technologies, which streamlines PF withdrawals.

It is this ease of access that has brought, among some EPFO members, a lack of restraint.

Erick Massey is part of this segment. The first time the 34-year-old withdrew money from his PF account was in late 2021, months after the devastating second Covid wave.

Having spent the last 10 years working in various companies in Delhi, he is now pursuing an MBA in marketing from a university in Birmingham, England. Massey took an education loan to fund his pursuit. For related expenses, however, he cleaned out nearly 90% of his PF money—almost Rs.2 lakh—and cashed in all his equities. “I needed cash to buy the plane ticket and other stuff. I withdrew around 40% the first time in March 2024 and then the rest after a few days. I filled in ‘Illness’ as the reason on the EPFO website,” he explains.

Teacher

2019, during her first year of employment

April 2024,for regular personal expenses

Multiple small withdrawals across 6 years

Asked why he didn’t invest in systematic investment plans (SIPs) or other mutual funds, Massey says, “Unless I were saving large sums, I didn’t feel there was a point in putting away small amounts in SIPs as the returns would’ve been meagre.”

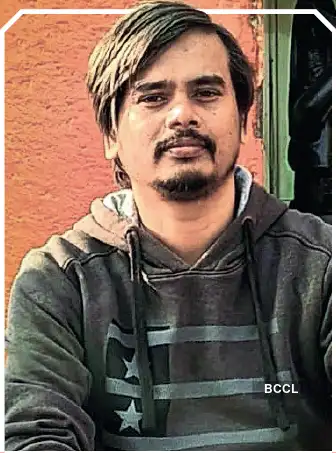

In Varanasi, media professional Shashwat Sajal, 37, has been more liberal with his PF withdrawals. He too went down this path in 2021 during the pandemic to fund his father’s medical expenses and thankfully it bore fruit. Subsequently, he had to lean on these savings more frequently—at least twice every year in batches of Rs.20,000-25,000, with ‘Illness’ being the reason he gave on the EPFO portal every time.

“I needed the money to meet household expenses and pay for some further health issues that my father faced,” says Sajal, who also liquidated all his stocks just as Massey had. When he last used the EPFO website in December 2024 to try and withdraw Rs.5,000, Sajal’s claim was restricted by the portal to Rs.1,500.

Marketing student

Late 2021, after second Covid-19 wave

March 2024, expenses related to higher education overseas

3 large withdrawals across 4 years

Then, there are younger EPFO members like Nadiya Hasan, who confesses to being a spendthrift.

An English teacher at a private school in Delhi, she had been taking out small amounts using the UMANG app since 2019, when she entered the workforce.

But in 2021, Hasan had to withdraw a major amount following a near-debilitating health emergency, albeit not due to Covid. She recovered soon and returned to teaching 3rd-5th graders English but developed a habit of treating her PF account almost as a current account.

“I used my PF money for everyday expenses for a long time,” she admits. “The UMANG app is too easy to use. I used to raise claims by submitting various reasons. If one was accepted and it couldn’t be submitted again for some time, I used to simply give another.”

Hasan’s expenditures were diverse— from buying stationery to engage her pupils, to pampering herself with impulsive e-commerce purchases. If her salary account fell short, she would transfer her PF money into a separate account to use as she saw fit. And she did it almost on a quarterly basis.

FOUNDER, FINRIGHT TECHNOLOGIES

Ideally, individuals should build a dedicated emergency fund covering 6–12 months of expenses in high-liquidity instruments like liquid mutual funds or sweep-in fixed deposits. These alternatives may be more suitable than depleting long-term retirement savings.

She, however, has no qualms in admitting that her spending habits could be a sort of compensatory mechanism after she got a new lease of life following her hospitalisation. “I live with my parents and have restrained myself financially for most of my life. But when I began earning, it gave me a newfound financial freedom,” Hasan adds.

With limited curbs in place, there’s growing concern that EPFO members may misuse this retirement instrument as a fallback for routine expenses, rather than preserving it to support a secure post-employment life as originally intended.

It is ideal for most members to keep their PF untouched and allow the deposits to accumulate interest over several years, so that this corpus stands one in good stead post-retirement. Kanekar cautions that using the PF as a recurring liquidity source defeats its primary purpose as a long-term retirement safety net. “Frequent withdrawals erode compounding benefits and could severely compromise retirement readiness.”

Media professional

2021, during second COVID-19 wave

December 2024, for expenses on household and father’s health

Over 6 withdrawals across 4 years

He also says that the ease of withdrawal through the ‘Illness’ option isn’t necessarily a loophole, but a “compliance blind spot”. “Introducing stricter documentation will increase the operational workload for the EPFO,” he notes. “Moreover, the 6x wage cap already serves as a safeguard against large or excessive illness-related withdrawals.”

“Ideally, individuals should build a dedicated emergency fund covering 6–12 months of expenses in high-liquidity instruments like liquid mutual funds or sweep-in fixed deposits. These alternatives may be more suitable than depleting long-term retirement savings,” Kanekar advises.

With a few thousand bucks, Massey’s PF account is still active though, to be of use some day when he returns to India.

Sajal, meanwhile, has sworn to exercise restraint and not touch this part of his salary.

Hasan is mending her ways, admittedly, having not taken a rupee out of her PF account since April. Asked if she ever considered investing in mutual funds or other instruments, she says she never felt the need to do so.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...