Investors are digesting the recent rally while waiting for fresh guidance from the Federal Reserve and more clarity on U.S. trade policy.

This pullback comes as investors take a breather following strong gains and wait for political and economic developments. One key drag was Tesla (TSLA), which saw its stock decline after CEO Elon Musk reignited tensions with President Donald Trump.

The pressure is mounting as a July 9 deadline approaches. According to The Financial Times, the US has quietly scaled back Trump’s aggressive push for “reciprocal” trade deals. Rather than sweeping agreements, officials are now looking for more limited arrangements to avoid reigniting global trade tensions once Trump’s reciprocal tariffs resume next week.

This shift suggests a more flexible approach, likely to calm markets worried about another round of trade disruptions.

Earlier market indicators also showed:

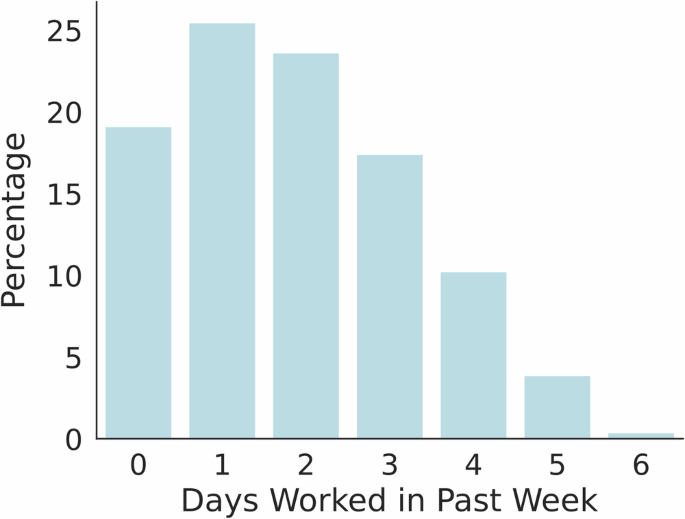

Another major factor for markets this week is Thursday’s job report. Investors are hoping for signs that the labor market is cooling, which would increase chances of a Federal Reserve rate cut. Right now, optimism is building that the Fed might act sooner to support the economy if job growth shows signs of slowing.

A weaker-than-expected report could strengthen the argument for cutting interest rates to boost consumer and business spending in the second half of 2025.

Markets got a boost after the U.S. and Canada resumed trade talks. Canada’s move to drop its proposed digital tax helped ease tensions, especially for big tech. However, questions remain about whether the U.S. will extend key tariffs beyond the July 9 deadline.

Traders are now betting on roughly 68 basis points in Fed rate cuts by the end of 2025, with even deeper cuts expected into 2026. All eyes are on Fed Chair Jerome Powell, who’s set to speak at a key ECB forum later today.

Big names like Nvidia, Microsoft, Meta, and Broadcom continued to fuel market momentum.

Top movers on Monday included:

Banks rallied after clearing the latest Fed stress tests, boosting confidence in the financial sector.

- : $551.64 (+0.65%)

| Key Event | Date |

| Fed Chair Powell’s speech | Today |

| ISM Manufacturing & S&P Global PMIs | Today |

| U.S. Jobs Report (Non-Farm Payrolls) | Thursday |

| Trump’s $3.3T tax and spending proposal | Ongoing |

Investors are closely tracking any signs of economic softening or policy shifts that could impact the Fed’s path forward. Markets will close early on Thursday, July 4, with trading ending at 1 p.m. ET due to the Independence Day holiday. That gives investors even less time to process key data like the job numbers, making every indicator this week feel more urgent.

With many traders already on vacation or trading lighter volumes, even small headlines—such as the Musk-Trump dispute or updates from the Senate—could lead to sharper moves in the stock market.

The US stock market today is in a cautious mood after rallying to record highs. Futures on the Dow, S&P 500, and Nasdaq are slipping slightly as investors track the fate of President Trump’s budget bill, developments in trade talks, and possible signals from the Federal Reserve. With a holiday-shortened week and key data coming up, Wall Street is watching every move closely.

Stay tuned as this high-stakes week unfolds—with Washington drama, economic signals, and tech tensions all shaping what happens next in the markets.

They’re pulling back after record highs as traders await key data and updates on Trump’s budget bill.

Yes, investors are closely tracking Senate progress as it may impact market momentum and policy outlook.

Read More News on

(Catch all the US News, UK News, Canada News, International Breaking News Events, and Latest News Updates on The Economic Times.)

Download The Economic Times News App to get Daily International News Updates.