DeFi in Africa's FinTech: Unlocking a New Era of Financial Inclusion.

Africa is standing at a rare and powerful moment in its financial story. A continent of over a billion people, many still unbanked, many more underserved, yet buzzing with ideas, mobile phones, and ambition. For years, traditional banks built walls. Now, a revolution is building bridges.

This revolution is called Decentralized Finance, or DeFi for short and it is changing the rules of money.

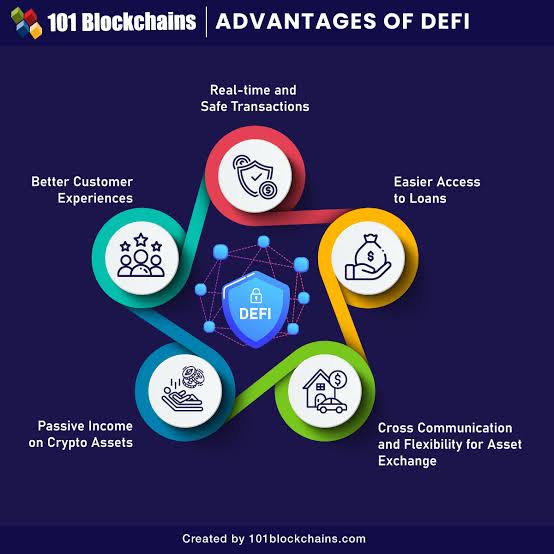

DeFi is a financial world powered by blockchain, with no middlemen, paperwork, or gatekeepers. With a smartphone and internet access, one can save, borrow, invest, or send money across borders. No branches. No queues. No barriers.

The African Opportunity: DeFi Matters Here More Than Anywhere Else

For years, the promise of financial inclusion in Africa has been slowed by the reality of high transaction costs, sluggish cross-border transfers, rigid credit systems, and a deep mistrust of traditional institutions.

In many places, the banks never arrived. Only technology did. And that is where DeFi comes in.

DeFi doesn't ask for permission or paperwork, let alone proof of status. It opens the door to all-comers, seamlessly connecting people across borders and handing them tools previously reserved for the privileged few.

That future is not too far away across cities like Nairobi, Lagos, and Accra; it is in the making.

Key Pillars of DeFi's Impact in Africa

Breaking Down Barriers to Access: At its core, DeFi is about access. People can plug into global finance with just a digital wallet, from the trader in Kumasi to the farmer in Eldoret. One can gain interest, take loans, or invest without ever having to enter a bank.

Take Ejara in Cameroon or Kotani Pay in Kenya, for instance, which are proving that it is possible to bring people who had been locked out into the borderless financial world that finally sees them.

Revolutionizing Remittances: Every year, Africans abroad send more than $95 billion back home. That's money for rent, school fees, and food on the table. But too often, it bleeds away in fees and delays - sometimes losing up to 10% along the way.

DeFi is updating that story. With stablecoins, or digital currencies pegged to the US dollar, money can move from London to Lagos in a matter of minutes, not days. Companies like Yellow Card are making this a reality, cutting out middlemen and letting families take more of what their loved ones worked hard to send.

Safeguarding Savings against Volatility: Saving money, to many millions living in economies dogged by inflation and crashing currencies, might be like trying to hold water in one's hands.

DeFi offers a form of digital safe harbor. By storing or earning yield on stablecoins, Africans can shield their hard-earned savings from local currency swings-and even grow them-without needing a foreign bank account.

Democratizing Credit and Lending: Getting a loan in Africa has always been tough and not to mention, unfair. Banks demand collateral that people don’t have and paperwork slows down everything.

But DeFi has changed the dialogue of the script. With the use of smart contracts, these are automated programs that don't need a bank to approve or enforce them, people can lend and borrow directly from one another.

Some African projects are even exploring new ways to assess creditworthiness using alternative data, like mobile money activity. It is finance, rewritten carefully for real life.

Navigating Hurdles: Road to Adoption

Of course, no revolution comes easy. But so much regulatory uncertainty lingers. Some governments ban crypto altogether; others hesitate, unsure of how to manage it. What is required is not punishment but rather clarity: rules protecting users without choking innovation.

Other realities are infrastructure gaps. A high mobile penetration does not mean fast, affordable internet or stable power-both very vital ingredients for the thriving of DeFi.

And then there is literacy, both digital and financial. Terms like "seed phrase" or "gas fee" can easily confuse even the most tech-savvy. Without proper education, people can easily fall prey to scams or even lose access to their money.

Last but not least, user experience matters. Most of the DeFi apps were built for crypto experts in the West, not everyday Africans; the next wave must be about familiarity in local languages and built in a way that shapes African habits for simplicity.

The Way Forward: Collaboration, Not Competition

The real magic will happen when traditional FinTech and DeFi stop competing but start collaborating. M-Pesa-like mobile money running on decentralized rails; local savings groups using blockchain for transparency and shared growth: that could be the shape of Africa's next decade in finance.

But that's going to take collaboration: governments, startups, blockchain developers, educators, all rowing in the same direction. Because no one can build the future alone. Africa shouldn't aspire to just get onto the DeFi movement rather, it needs to gravitate towards leading it. With the youngest population, unstoppable creativity, and a hunger for better access, the continent has all it takes to show the world what inclusive finance really means.

If the 2010s were Africa's mobile money decade, then the 2020s could be its DeFi revolution, one where financial inclusion stops being a buzzword and becomes a lived reality for millions.

You may also like...

Explosive Racism Claims Rock Football: Ex-Napoli Chief Slams Osimhen's Allegations

Former Napoli sporting director Mauro Meluso has vehemently denied racism accusations made by Victor Osimhen, who claime...

Chelsea Forges Groundbreaking AI Partnership: IFS Becomes Shirt Sponsor!

Chelsea Football Club has secured Artificial Intelligence firm IFS as its new front-of-shirt sponsor for the remainder o...

Oscar Shockwave: Underseen Documentary Stuns With 'Baffling' Nomination!

This year's Academy Awards saw an unexpected turn with the documentary <i>Viva Verdi!</i> receiving a nomination for Bes...

The Batman Sequel Awakens: Robert Pattinson's Long-Awaited Return is On!

Robert Pattinson's take on Batman continues to captivate audiences, building on a rich history of portrayals. After the ...

From Asphalt to Anthems: Atlus's Unlikely Journey to Music Stardom, Inspiring Millions

Singer-songwriter Atlus has swiftly risen from driving semi-trucks to becoming a signed artist with a Platinum single. H...

Heartbreak & Healing: Lil Jon's Emotional Farewell to Son Nathan Shakes the Music World

Crunk music icon Lil Jon is grieving the profound loss of his 27-year-old son, Nathan Smith, known professionally as DJ ...

Directors Vow Bolder, Bigger 'KPop Demon Hunters' Netflix Sequel

Directors Maggie Kang and Chris Appelhans discuss the phenomenal success of Netflix's "KPop Demon Hunters," including it...

From Addiction to Astonishing Health: Couple Sheds 40 Stone After Extreme Diet Change!

South African couple Dawid and Rose-Mari Lombard have achieved a remarkable combined weight loss of 40 stone, transformi...