DealMakers AFRICA - Analysis Q1 2025

The return of Donald Trump to the U.S. presidency early in the quarter introduced uncertainty and recalibration in US-Africa investment dynamics, which is clearly reflected in the data captured by DealMakers AFRICA.

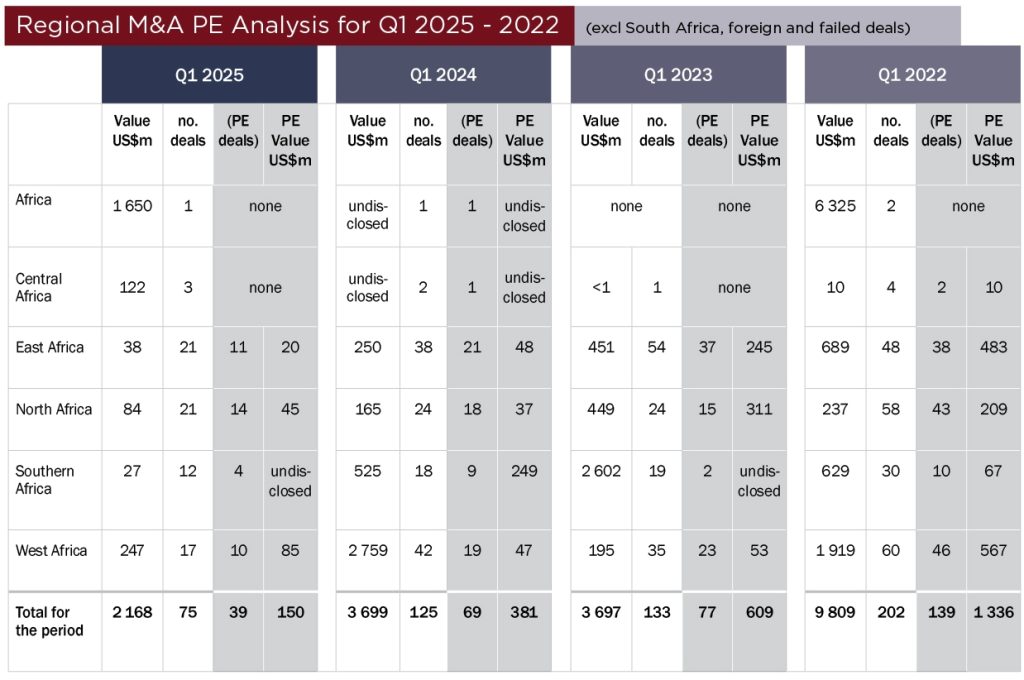

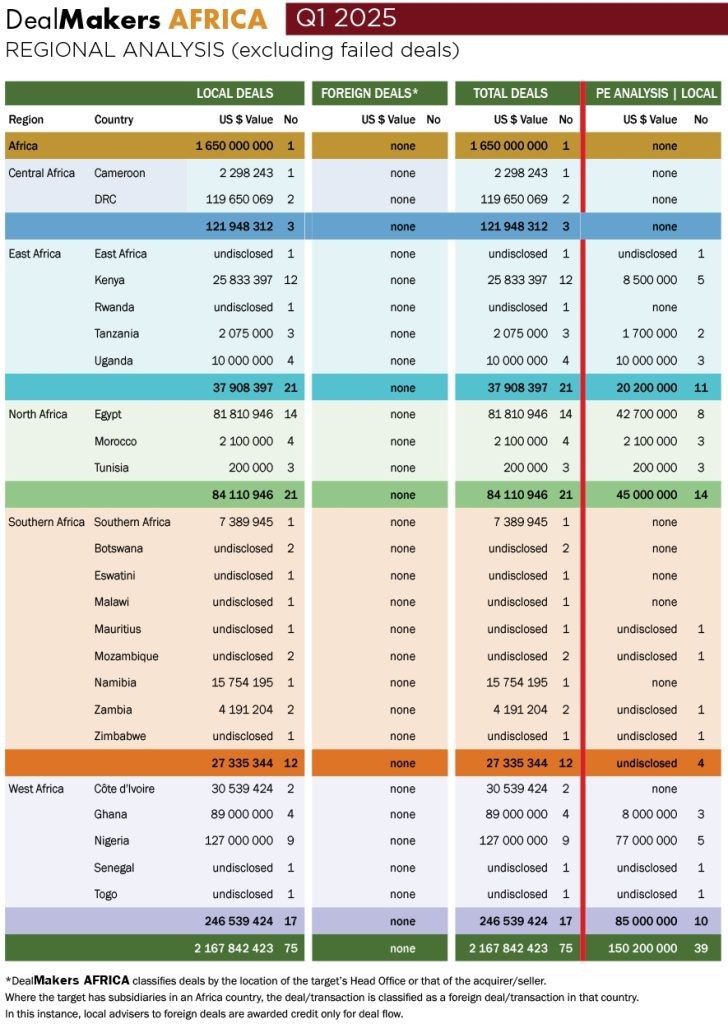

In the three months to end March 2025, deals on the continent (excluding South Africa and failed deals) numbered 75, valued at US$2,17 billion – this against 125 deals ($3,7 billion) in 2024, 133 deals ($3,69 billion) in 2023, and 202 deals ($9,8 billion) in 2022 – a noteable decrease over the period. Private equity investment, a key driver in M&A on the continent, fell 40% in Q1 year-on-year.

On a regional level, East and North Africa were the most active, accounting for 55% of deals captured in the quarter. Kenya remains the anchor for deal activity (12 deals) in the East African region, with the focus on financial services, healthcare and agritech. Tanzania and Uganda saw increased investor interest in infrastructure, manufacturing and logistics. East Africa’s energy transition saw an increase in M&A deals in the solar, wind and hydro sectors. Egypt remained the most active country in North Africa (14 deals), followed by Morocco (4 deals) and Tunisia (3 deals), with activity in the financial services, logistics and consumer goods sectors, and venture capital and private equity interest in fintech, healthcare and renewable energy. M&A activity in West Africa was dominated by Nigeria, which accounted for c.65% of deals announced in the region.

Africa represents a hotbed for fintech innovation. In fact, fintech was (by far) the dominant sector, accounting for c.50% of total investment for the quarter. Mobile connectivity and creative business models are leapfrogging traditional solutions, and one such fintech deal was LemFi’s $53 million raise which ranked in the top deals by value for the period. Interestingly, and unusually, the top deals by value reflect a broad range of sectors from mining to heavy industrials, fund raising and agriculture.

In the remaining quarters of 2025, M&A is likely to be influenced by whether the US clearly defines its Africa policy; but until such time, will likely remain subdued and inconsistent. However, sectors such as energy independence, critical minerals and digital infrastructure may still see interest, with dry powder waiting to be deployed in sectors with strong fundamentals and resilience to macroeconomic volatility. Despite global politics and potential trade wars, Africa provides massive market potential with good demographics and rapid urbanisation.