Crypto Giants Take Notice: Franklin Templeton Boosts XRP & Cardano, Samson Mow Backs Saylor

Tuesday's crypto market narrative is significantly influenced by major institutional players, most notably the $1.69 trillion asset manager Franklin Templeton. The firm has expanded its EZPZ crypto index ETF to include a diverse range of altcoins: XRP, Cardano (ADA), Solana (SOL), Dogecoin (DOGE), Chainlink (LINK), and Stellar (XLM). This expansion marks a pivotal shift for the product, which previously held only Bitcoin and Ethereum, introducing its first real multi-asset representation from a financial behemoth.

The Franklin Crypto Index ETF (EZPZ) is positioned as an evolving fund with regulatory-gated additions and Coinbase custody. As of December 1, EZPZ reported a Net Asset Value (NAV) of $22.27, with $6.68 million in net assets, and a 15.3% return since its launch in February 2025. Its updated holdings show Bitcoin at 74.47%, Ethereum at 13.04%, XRP at 6.63%, Solana at 3.35%, Dogecoin at 1%, Cardano at 0.8%, Chainlink at 0.38%, and Stellar at 0.33%. While a relatively small ETF in dollar terms, such exposure decisions from a trillion-tier sponsor are crucial for market sentiment, fostering the narrative that traditional finance is broadening its crypto investment scope beyond just Bitcoin and Ethereum. XRP, in particular, has maintained a substantial cumulative inflow footprint across dedicated ETFs, collectively holding over $723 million in net assets, with daily flows on December 1 reaching $89.65 million across various tickers, indicating sustained activity.

In other significant developments, Strategy, a major Bitcoin corporate holder, has raised $1.44 billion in cash following $1.48 billion in MSTR share sales. This move has prompted a re-evaluation of Michael Saylor's previous stance as an absolute Bitcoin holder, positioning him now as a conditional seller. Bitcoin advocate Samson Mow has defended Saylor's strategy, characterizing it as building an "unassailable Bitcoin fortress," arguing that a dollar moat further strengthens this structure.

Market participants reacted with stress to Strategy's confirmation that Bitcoin sales are now an option, albeit not imminent. Saylor clarified that potential BTC sales could support equity through buybacks or adjust the firm's Net Asset Value (mNAV) if necessary. Strategy has emphasized robust debt coverage for 21 months and minimal real margin-call risk, noting that their NAV would only meet the debt level at a Bitcoin price of $10.4K. Despite these reassurances, Saylor's altered tone created doubt, leading to a 12% drop in MSTR equities. Observers pinpoint the mNAV dropping below 0.8 or 0.7 on a fully diluted basis as a potential trigger for the firm to consider a BTC sale to stabilize its share price, a scenario the market is closely watching. Mow, however, maintains that the cash reserve is a defensive strategy, making the "fortress" harder to attack.

Meanwhile, controversial CNBC host Jim Cramer hinted at a forthcoming discussion on Bitcoin's support map, following BTC's 40% decline from its October 2025 highs. Cramer interestingly framed crypto within a broader comparison between "physical AI" (robotics, real-world automation) and the "chatbot dogfight" dominating headlines, mirroring the current investment tilt toward hardware AI. In this context, Bitcoin is seen as a macro asset endeavoring to stabilize around the $80,000 zone, with risk capital currently being absorbed by the AI sector rather than crypto. His comments suggest he identifies definable price levels where buyers are likely to step in, contrasting with his prior skepticism towards Bitcoin.

The crypto market currently presents a setup poised for a decisive move, with Bitcoin's ability to stabilize above the mid-$80,000 area being critical. Bitcoin (BTC) is trading in the mid-$86,000 band; failure to push towards $88,000 could lead to a slide into the low-$84,000 area. XRP sits near $2.05, with a move towards $2.30 contingent on BTC stabilization. Cardano (ADA) remains around $0.63, lacking independent momentum and largely following Bitcoin's direction.

You may also like...

Premier League Giants Battle for USMNT Star Adams: Man Utd, Chelsea, Liverpool in Transfer Frenzy!

The latest football transfer market updates reveal intense activity among top clubs. Manchester United, Chelsea, and Liv...

Wemby's Relief: NBA Star Victor Wembanyama Speaks Out After Friend's Safe Return

San Antonio Spurs star Victor Wembanyama's longtime friend, Elijah Hoard, was safely located after going missing at Chic...

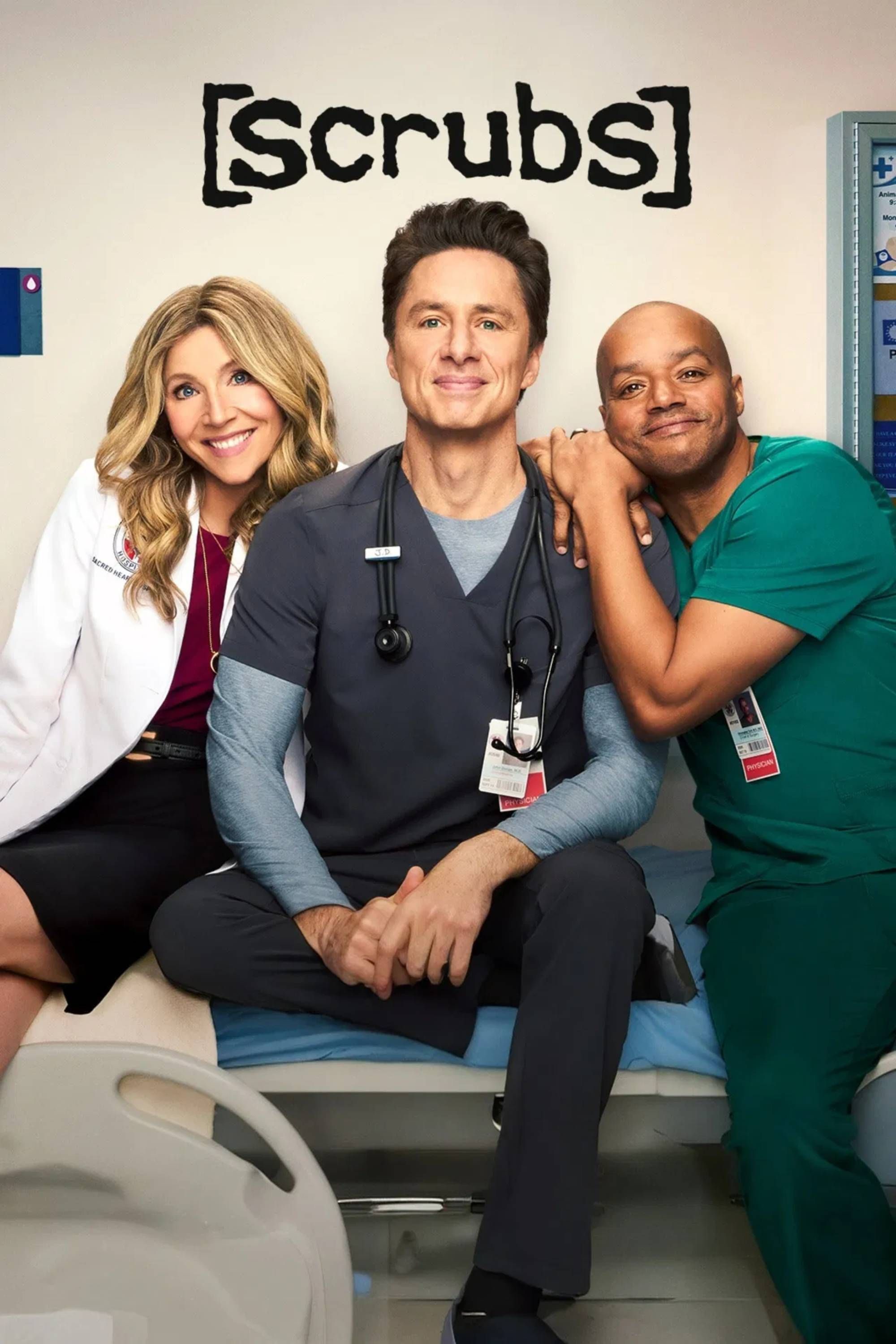

Iconic Comedy 'Scrubs' Makes Triumphant Comeback After 16 Years With Record-Shattering Ratings

The iconic medical sitcom "Scrubs" has made a triumphant return to ABC, drawing over 11 million viewers and achieving AB...

Streaming Shake-Up: HBO Max Merges With Divisive Rival, Promising Big Changes for Subscribers

The potential merger of Paramount and Warner Bros. Discovery is set to significantly reshape the streaming landscape, pa...

Twisted Sister Shocker: Sebastian Bach Joins for 50th Anniversary as Snider Steps Down!

Twisted Sister's 50th-anniversary shows are set to continue, with Sebastian Bach joining as the lead vocalist for select...

Global Tensions Silence the Decks: Charlotte de Witte Cancels Australia Tour Over Middle East Conflict Fallout

Belgian techno DJ Charlotte de Witte has cancelled her highly anticipated Australian shows, including performances in Sy...

Fiennes Tiffin Teases Epic Sherlock Season 2 Showdown

The Prime Video series 'Young Sherlock' reintroduces a nascent Sherlock Holmes, portrayed by Hero Fiennes Tiffin, embark...

Middle East Tensions Ripple: Namibians Stranded in Dubai, Kenya Airways Launches Repatriation Flights Amid Iran Attacks

Middle East military tensions have prompted Kenya Airways to operate special repatriation flights to Dubai, aiding stran...