Weekly recap of the crypto derivatives markets by BlockScholes.

The beginning of what a US Congressional Committee has dubbed “Crypto Week” saw the largest cryptocurrency by market capitalisation fly through multiple new ATH’s, touching a top as high as $123K. Since then, signs of profit-taking has seen BTC drop to $116K. All three measures of directional sentiment: volatility smiles skew, funding rates, and futures spot-yields all surged in response to the moves in the spot market, though have abated slightly since. ETH recovered to $3,000, the first time it hit that level since February 2025 and for a brief period of time, 25-delta 7-day OTM calls for ETH carried a more than 7% volatility premium relative to 25-delta put options at the same expiry. On the macro front, the past week has been characterised by increased tariff pressure from President Trump.

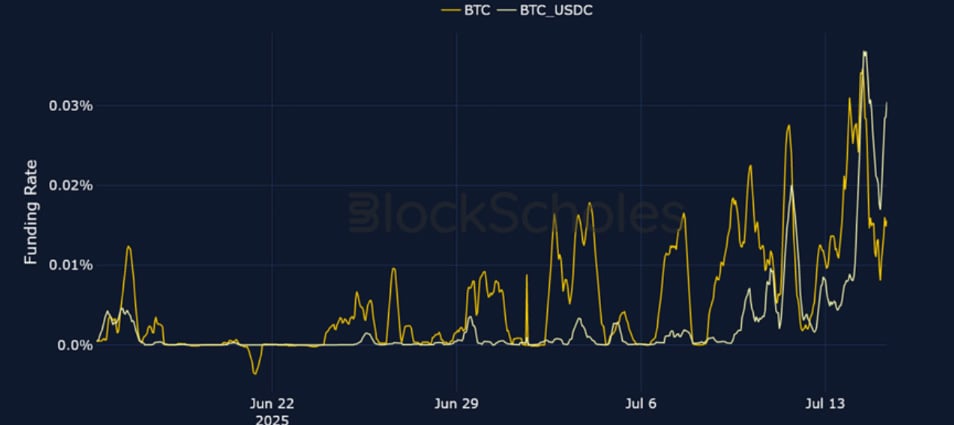

– Yesterday, BTC funding rates spiked to their highest levels since January 2025, as spot price rallied past $123,000.

– ETH spot price surged to $3,000, a level last seen in February 2025, spurring a jump in funding rates.

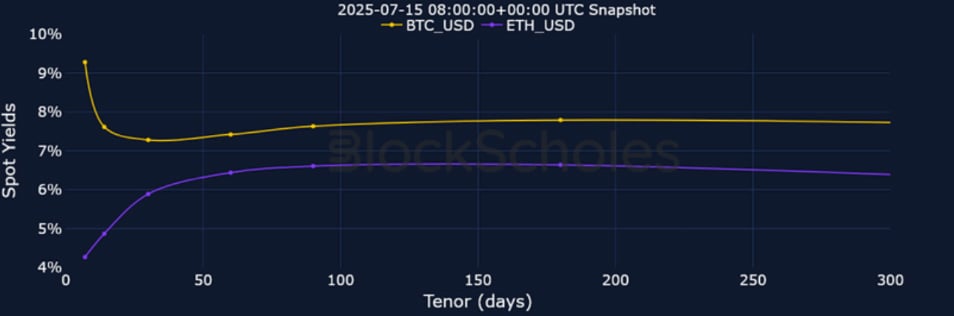

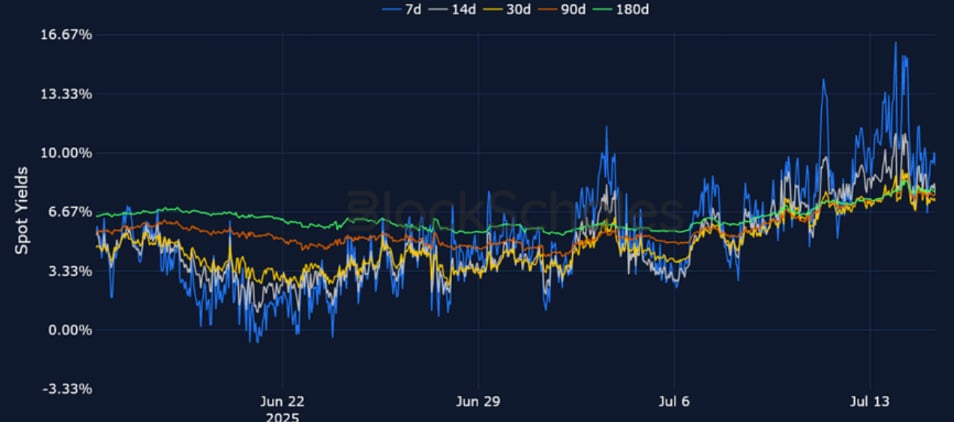

– Compared to a week earlier (July 8), BTC futures term structure is now inverted, as 7-day spot yields rose as high 16.28%.

– Similar to funding rates, ETH spot yields surged, though not to levels as high as those seen in BTC – stopping just short of 10%.

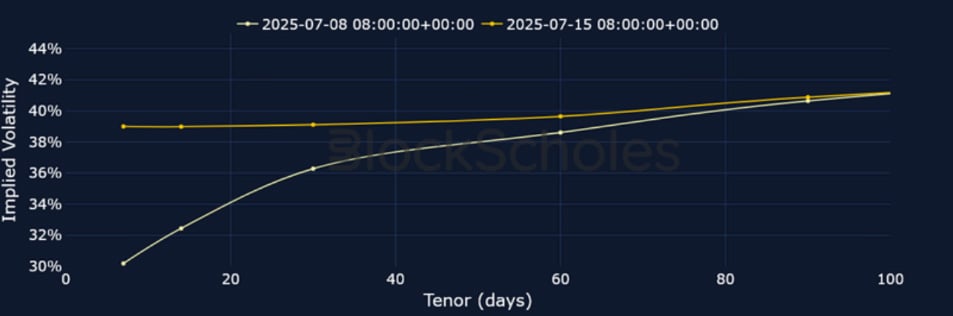

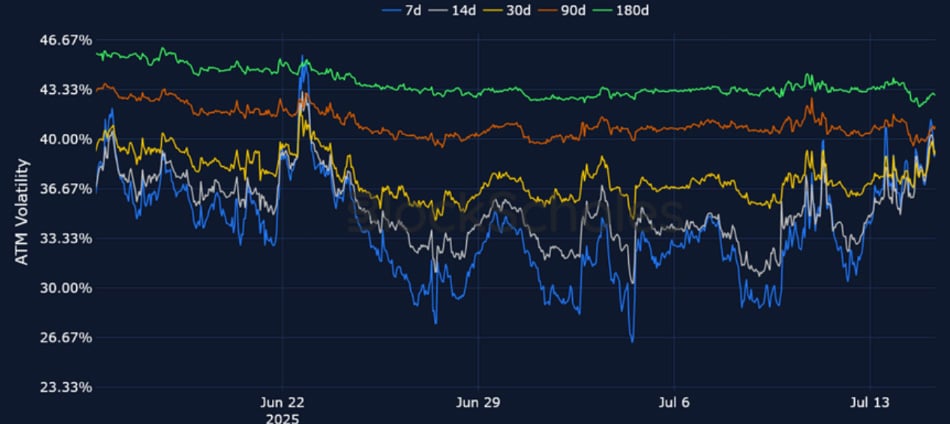

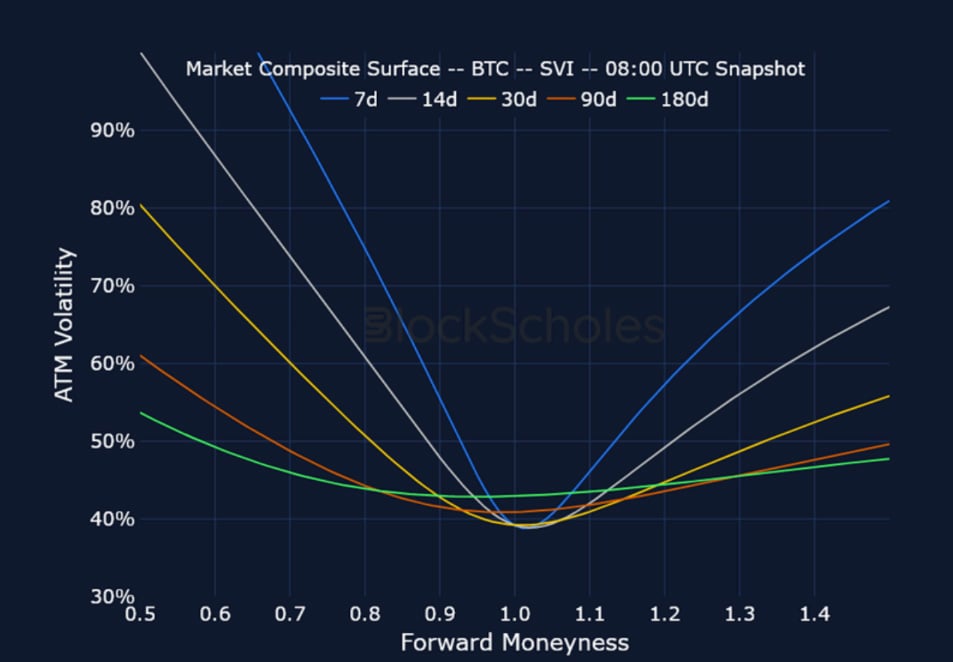

– After historically low levels of volatility, 7-day IV bounced 8 points over the past week, flattening the term structure.

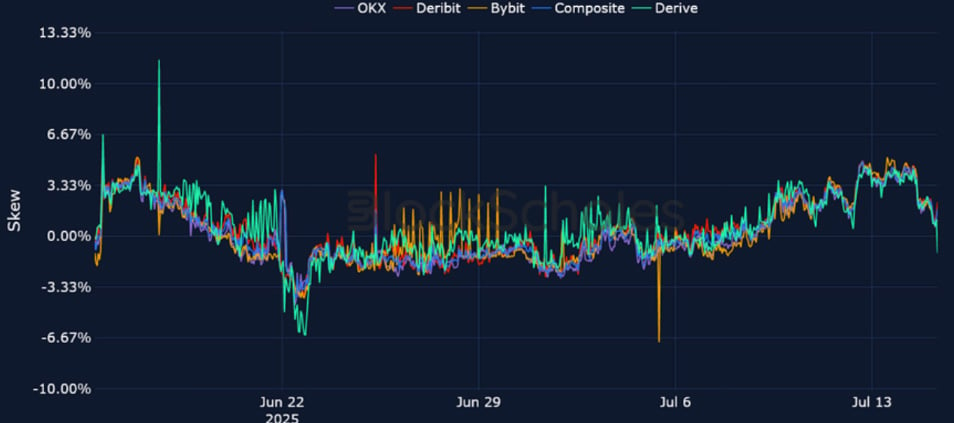

– The pullback in spot price from the ATH of $123K has seen skew shift from 6% towards OTM calls to 4% in favour of puts.

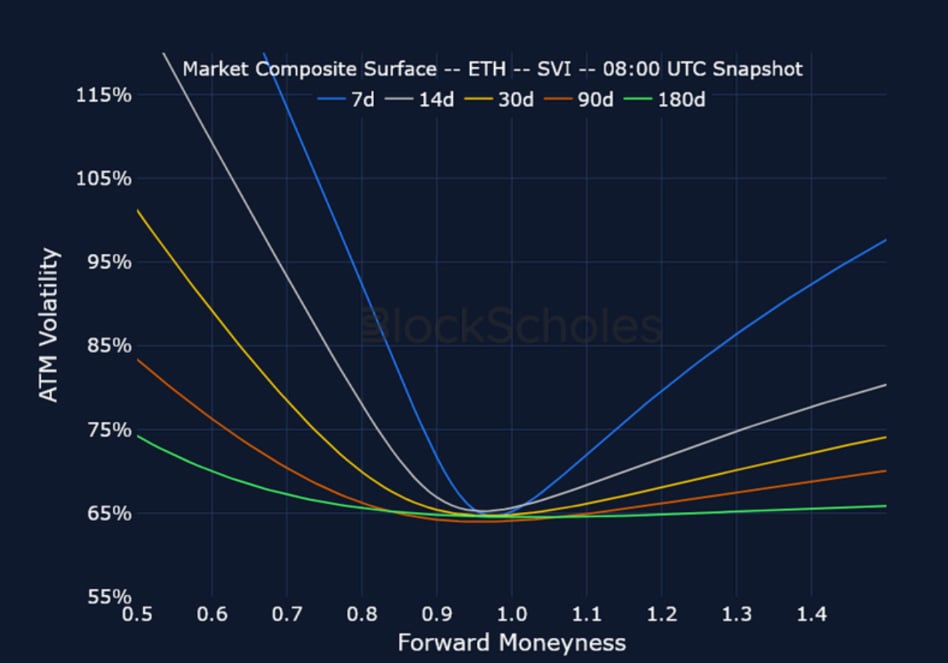

– ETH’s term structure of volatility is relatively flat, with outright levels between 60 and 63%.

– ETH short-tenor smiles skewed towards OTM calls by 7% as its spot price rallied to $3,000, though has abated now to 3%.

CeFi COMPOSITE – BTC SVI – 9:00 UTC Snapshot.

CeFi COMPOSITE – ETH SVI – 9:00 UTC Snapshot.

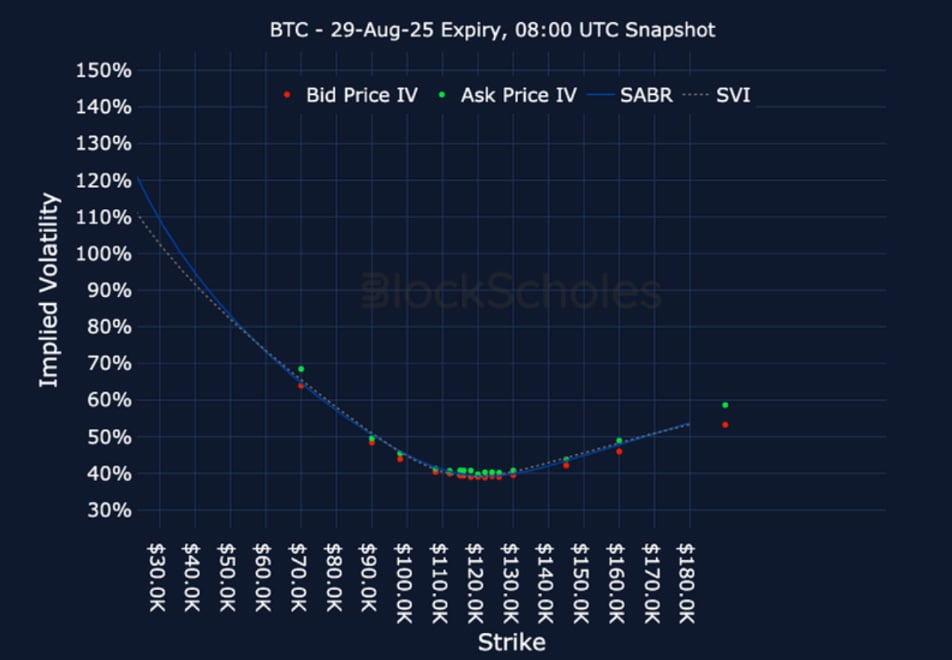

BTC 29-AUG EXPIRY – 9:00 UTC Snapshot.

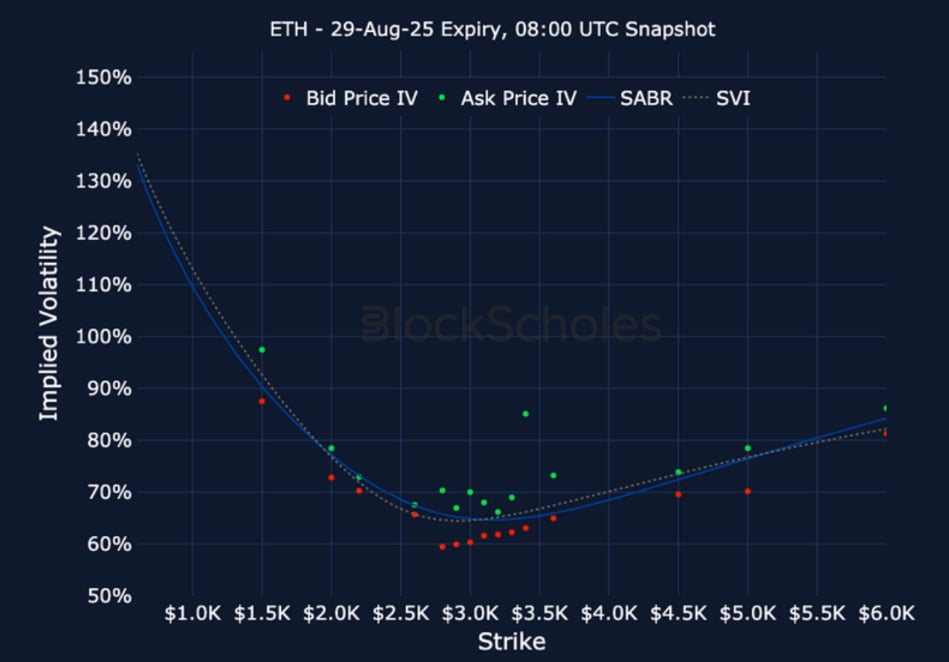

ETH 29-AUG EXPIRY – 9:00 UTC Snapshot.

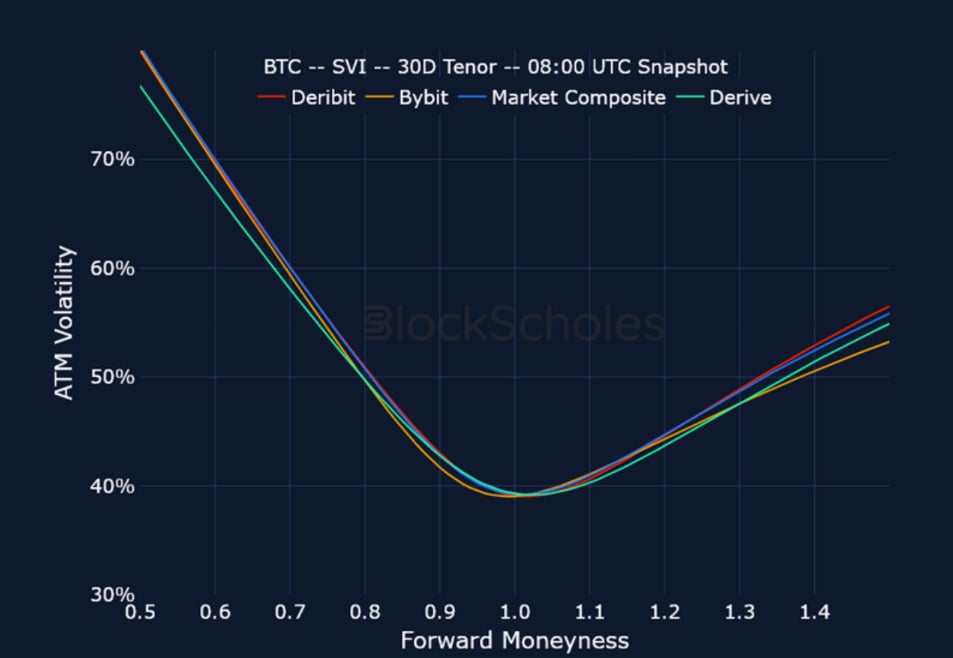

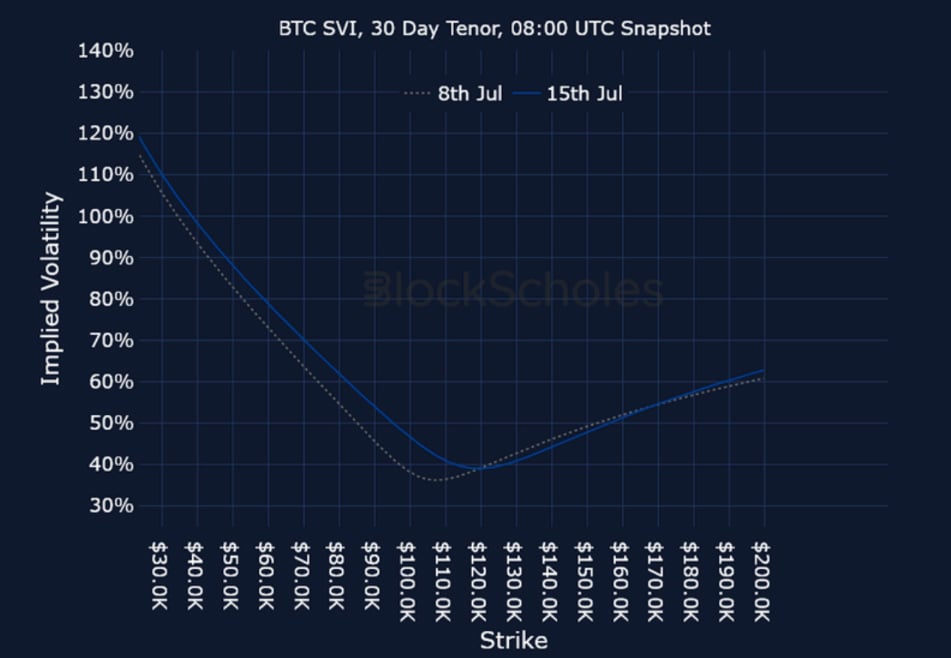

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

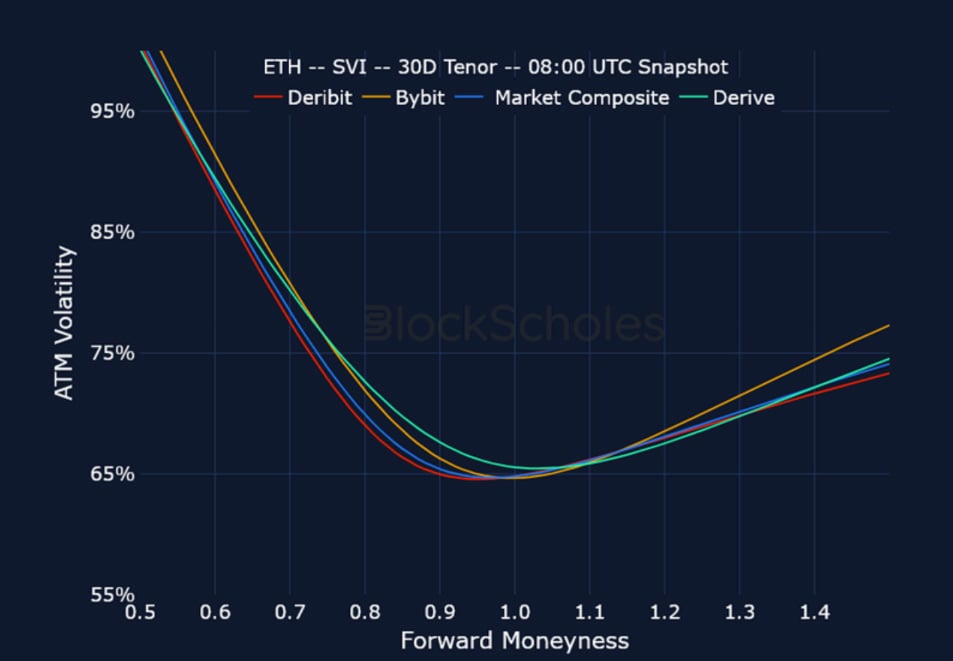

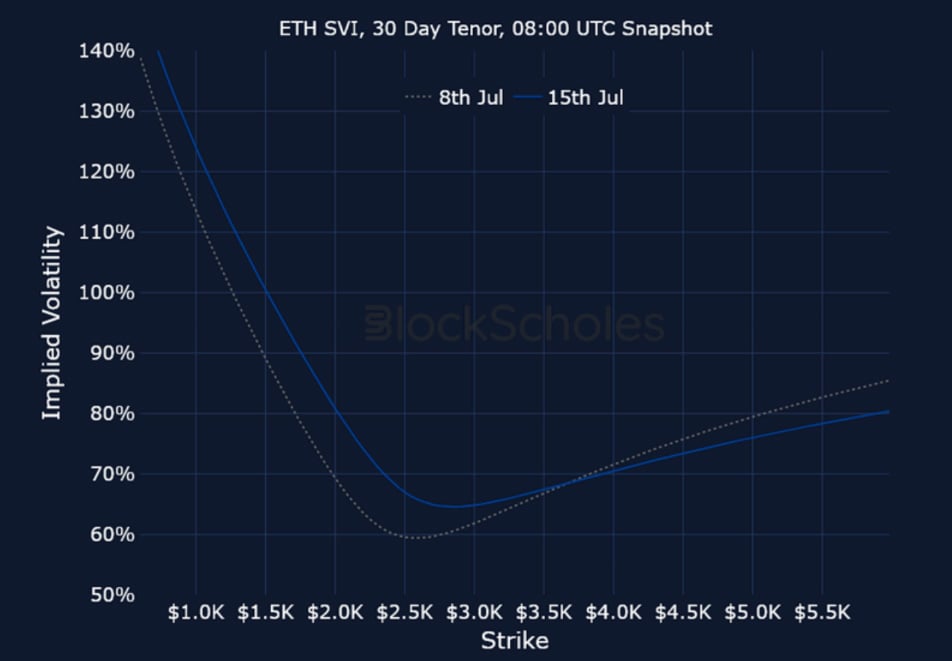

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

BTC SVI, 30D TENOR – 9:00 UTC Snapshot.

ETH SVI, 30D TENOR – 9:00 UTC Snapshot.

Trading with a competitive edge. Providing robust quantitative modelling and pricing engines across crypto derivatives and risk metrics.