Crypto Chaos: Bitcoin Crumbles as Trump Slams China with 100% Tariffs

The global cryptocurrency market recently experienced a significant downturn, with its total capitalization plummeting below the critical $120k support level within 24 hours. This sharp decline followed an announcement by United States President Donald Trump, who threatened to impose 100% tariffs on Chinese imports, effective November 1. In a post on Truth Social, President Trump accused Beijing of hostile actions, claiming it was attempting to hold the world 'captive' and sending letters to various countries detailing plans to implement Export Controls on every aspect of production.

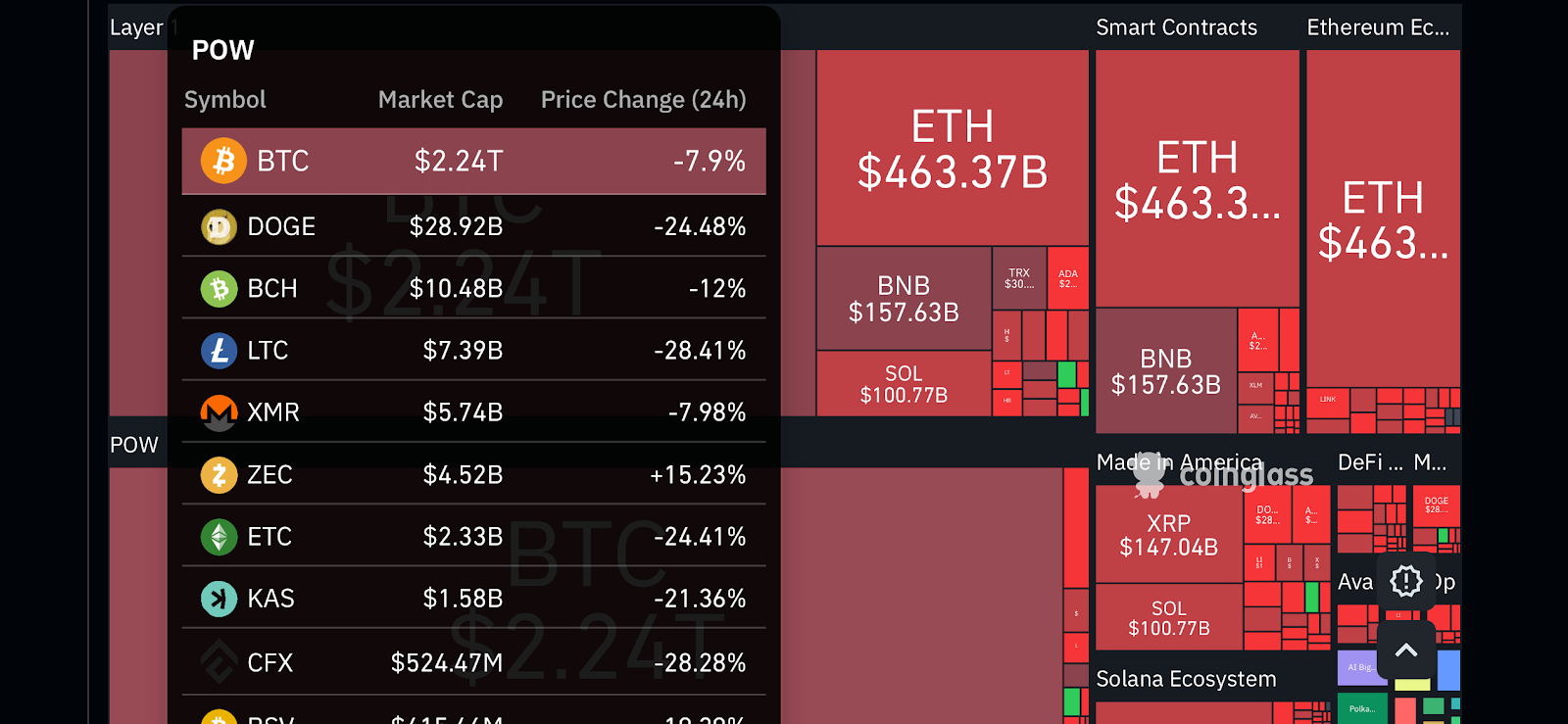

Before President Trump's tariff threat, Bitcoin (BTC) had recently achieved a new all-time high, trading at $121,300. However, in the wake of the announcement, BTC crashed below the $120k mark, reaching a new low of $109k on platforms like Binance. The impact was widespread, with Ethereum (ETH) dipping below $3,500 and Solana (SOL) falling below $150. Bitcoin's rapid drop resulted in a loss of over $10,000 in less than an hour, further declining under $114k before the situation worsened. This market instability wiped over $250 billion from the total crypto market capitalization, making it one of the largest single-day declines of 2025. As of press time, Bitcoin was trading at $112,296, reflecting a 7.91% decline, while Ethereum stood at $3,816, down 12.52% in value.

The ripple effect of the U.S. President's announcement led to massive liquidations across the crypto market. Over $7.5 billion in positions were liquidated within just one hour. Data from Coinglass on Saturday, October 1, revealed extensive liquidations over a 24-hour period, with Bitcoin leading at $5.39 billion, followed by Ethereum at $4.45 billion, Solana at $2.02 billion, and XRP at $710.35 million. In total, 1,673,146 traders were liquidated within the 24-hour window, amounting to a staggering $19.38 billion in total liquidations. The single largest liquidation event occurred on Hyperliquid, involving an ETH-USDT pair valued at $203.36 million.

Despite the widespread panic and market volatility, institutional demand for Bitcoin demonstrated surprising resilience. Glassnode observed that 'Bitcoin ETF inflows have continued despite the recent pullback, showing that institutional demand remains steady even as derivatives traders get chopped.' This indicates that a strong undercurrent of structural buying is still supporting the market, helping to absorb volatility and stabilize price movements. Key takeaways from this event include Bitcoin dropping significantly below $120k, reaching lows of $109k; over $1 billion in positions being liquidated in under 24 hours; steep declines for Ethereum, Solana, and other major altcoins; and sustained institutional inflows into Bitcoin ETFs suggesting confidence in a long-term recovery, even as Trump's tariff threat rekindled trade war fears and impacted global risk assets.

Recommended Articles

Crypto Bloodbath: Bitcoin Plunges as Trump's China Tariffs Ignite Trade War Fears

Bitcoin's price plummeted today amid escalating U.S.-China trade tensions, as President Trump announced new tariffs in r...

Bitcoin Dips Below $120K, Yet Market Enters 'Euphoria Phase' as Analysts Eye Stunning $180K Peak!

Bitcoin's price is holding steady near $120,000 after a bullish start to October, fueled by ETF inflows and rate cut exp...

Bitcoin's Golden Future: Deutsche Bank Predicts Central Bank Embrace of Digital Gold

Deutsche Bank predicts a future where Bitcoin and gold co-exist on central bank balance sheets, viewing them as compleme...

Bitcoin's Relentless Ascent: BTC Shatters Records, Tops $123K and Alphabet Market Cap!

Bitcoin's price has surged to new record highs, propelled by the imminent merger of Nakamoto Holdings Inc. and KindlyMD,...

Bessent's Bold Bitcoin Declaration Sends Shockwaves: US Crypto Buy Looms as Prices Tumble

U.S. Treasury Secretary Scott Bessent's contradictory statements on Bitcoin purchases for a strategic reserve sent shock...

You may also like...

Benin Skipper's Bold Claim Ahead of Super Eagles Showdown Shakes Africa!

)

Benin Republic captain Steve Mounie has rallied his team ahead of a decisive 2026 FIFA World Cup qualifier against Niger...

AI Breaks New Ground: ‘Hanuman’ Film Secures Visionary Director, Promises Cinematic Revolution

“Chiranjeevi Hanuman – The Eternal,” directed by Rajesh Mapuskar and produced by Abundantia Entertainment and Historyver...

Crisis Averted? Animation Industry Grapples with Cash Crunch and Uncertain Future

The international animation sector faces significant challenges, stemming from U.S. market corrections and a strained co...

Can Technology Finally End Malaria?

Africa’s battle with malaria is entering a new era, powered by biotech innovation, genetic science, and digital health t...

Sudan Unlocks Communication: Missionaries Champion Sign Language for the Hard-of-Hearing

Comboni Missionaries in Sudan are developing a web platform to teach Sudanese Arabic sign language, aiming to enhance in...

'Task' Stars Reveal Shocking Episode 6 Twists: Character Death and Grasso's Betrayal Explored!

Episode 6 of HBO's 'Task' delivers a powerful blend of heartbreak, betrayal, and mounting guilt, centering on Detective ...

Morris Chestnut Unveils Major Shake-Up for Sherlock Holmes in 'Watson' Season 2

Season 2 of 'Watson' brings a dramatic twist with the unexpected return of Sherlock Holmes, forcing Dr. John Watson to r...

Adesua Etomi-Wellington's Fringe Gown Steals the Show, Demands Standing Ovation

Adesua Etomi-Wellington made a striking impression at "The Herd" premiere, showcasing a champagne gown that epitomized s...