Crypto Boom: Trump Unlocks Digital Assets for Retirement Funds

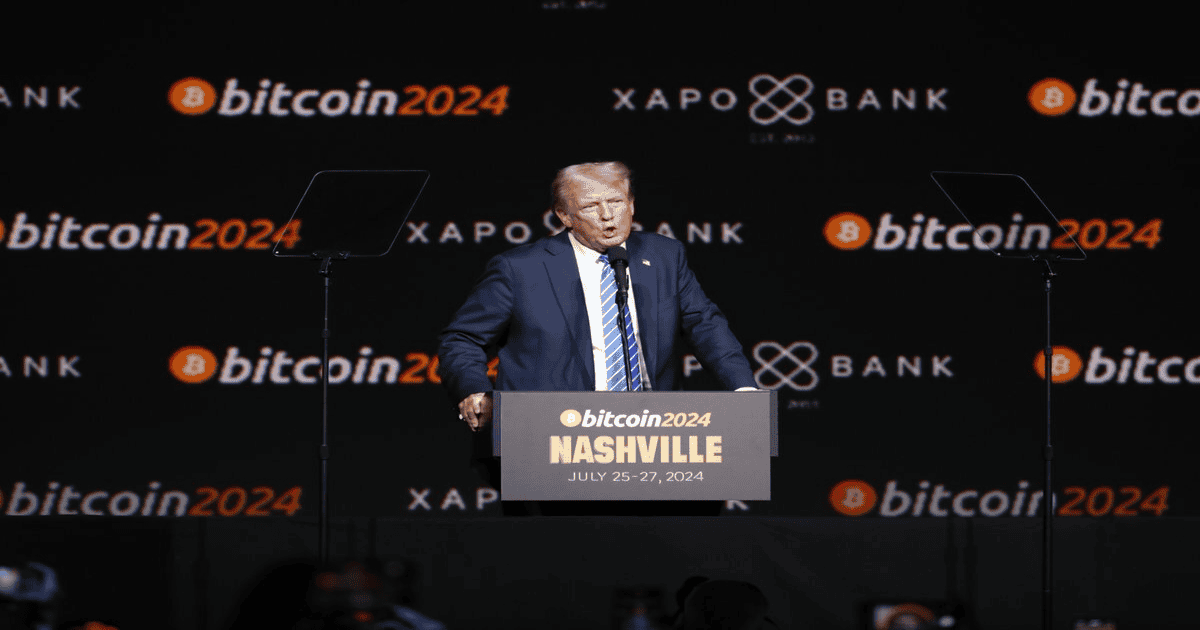

President Donald Trump has signed an executive order marking a significant shift in the landscape of American retirement savings, effectively unlocking the colossal $9 trillion U.S. retirement market to a broader array of alternative assets, including cryptocurrencies and private equity. This groundbreaking directive allows 401(k) plans to incorporate digital assets for the first time, reshaping how over 90 million U.S. workers save for their golden years. Historically, these plans have predominantly focused on traditional investments such as stocks, bonds, and mutual funds, with alternative assets like Bitcoin, Ethereum, private equity, and gold largely excluded due to perceived high fees, low liquidity, and stringent regulatory hurdles.

The executive order specifically instructs U.S. regulators to revise existing restrictions, particularly those under the Employee Retirement Income Security Act (ERISA), which governs 401(k) and other defined-contribution plans. Both the Labour Department and the Securities and Exchange Commission (SEC) are now tasked with clarifying fiduciary rules, thereby enabling plan sponsors to offer a wider range of investment options, including crypto, private equity, and real estate, within retirement portfolios. This move builds upon previous efforts by the Trump administration to ease crypto restrictions, notably following the Labour Department's reversal in May 2025 of Biden-era guidance that had discouraged crypto investments in retirement plans.

Industry experts view this as a transformative moment for digital assets. Nigel Green, CEO of deVere Group, stated, “This is a defining moment for crypto. The world’s largest economy is embracing digital assets. They now belong in long-term wealth strategies. This has global implications.” The sheer scale of the U.S. 401(k) market, holding roughly $9 trillion in assets (with the total defined-contribution market estimated at $12.5 trillion), suggests that even a modest allocation to crypto could unleash massive demand. Analysts anticipate hundreds of billions of dollars potentially flowing into digital assets, which is expected to spur infrastructure growth, innovation, and broader public acceptance.

The timing of this order coincides with a surge in Bitcoin's value in 2025, reaching new all-time highs, propelled by factors such as increased corporate adoption, sovereign interest, and growing regulatory clarity. Green further emphasized the symbolic significance, noting, “Retirement savings are ultra-conservative. If crypto earns a place here, it can thrive anywhere. This breaks psychological and regulatory barriers. Crypto is now on the main stage.” This U.S. initiative could also set a global precedent, potentially influencing other economies to modernize their pension rules, with regulators in Europe facing similar pressures and highly crypto-adoptive regions in Asia closely observing developments.

Beyond direct investment opportunities for workers, asset management giants like BlackRock, Apollo, and Blackstone are poised to significantly benefit from this policy shift. These firms have actively lobbied for years to gain access to retirement funds, recognizing them as a crucial growth frontier. BlackRock, for instance, has plans for a 401(k) target-date fund that could include 5-20% private investments by 2026, while Apollo and Empower are actively developing similar products. For individual investors, the order opens new avenues for diversification beyond traditional stocks and bonds, with private equity and cryptocurrencies offering historically higher potential returns, such as Bitcoin outperforming the Nasdaq in five of the last six years.

However, these opportunities are accompanied by significant risks that investors must consider. Crypto markets are inherently volatile, subject to rapid price fluctuations. Private equity investments, while potentially lucrative, often come with high fees, illiquidity, and less transparency compared to public markets. Experts caution about potential fiduciary risks under ERISA. Michael Ryan, founder of MichaelRyanMoney.com, acknowledged the “revolutionary” nature of the move for sophisticated investors but warned that “The average American doesn’t understand blockchain. A 50% crypto drop could spook retirees.” Despite these concerns, Green remains optimistic, asserting, “With diversification and oversight, the benefits are compelling. Investors want exposure to the future. This lets them build it safely.”

The current executive order expands upon a 2020 Labour Department letter from Trump's first term, which had permitted private equity within target-date funds under strict conditions—a stance later affirmed by the Biden administration. Now, the order pushes further, actively encouraging a wider spectrum of alternative assets. Regulators are directed to act swiftly, with the Labour Department and SEC exploring rule changes to clarify how fiduciaries can safely incorporate these assets. The integration of Bitcoin exchange-traded funds (ETFs) and other crypto products into 401(k) plans is expected to follow. The crypto industry hails this as a watershed moment, with Green concluding, “Institutional capital from retirement accounts was the final frontier. This makes crypto’s integration into traditional finance irreversible.” This order solidifies a broader trend of crypto gaining legitimacy, mirroring actions in states like North Carolina and Wisconsin, which are already allocating retirement funds to Bitcoin and Ethereum ETFs, and reflecting growing political momentum evident in recent crypto-friendly bills passed by the House. The U.S. move, in an interconnected global capital market, is seen as a signal to the world that “Crypto is here to stay.”

You may also like...

Plastic Bans Across Africa — Who’s Leading and How It’s Changing Everyday Life

Africa is leading a quiet environmental revolution. From Kigali to Nairobi, plastic bans are transforming markets, habit...

What If All That Glitters Is Gold?

We’ve spent our lives being warned not to trust what shines. But what if that warning made us blind to real beauty? What...

Raye: Bold Voice, Big Consequences?

Raye, the Corp Member who criticized the government over Nigeria Economic Hardships. When the governed questions the...

Africa's Algorithm Advantage: How Young Creators Are Cashing In on the AI Gold Rushument

From Nairobi to Lagos, a new generation of African creators, writers, and marketers are using AI technologies like ChatG...

Pels' Season Opener In Jeopardy As Looney Sidelined By Knee!

New Orleans Pelicans center Kevon Looney has been diagnosed with a left knee injury, sidelining him for two to three wee...

Kings' Star Murray Bags Massive $140M Extension!

Sacramento Kings forward Keegan Murray has secured a five-year, $140 million rookie contract extension, cementing his ro...

Netflix Drops Must-Watch Military Dramedy: New Film Earns Stunning 92% RT Score

Netflix's new dramedy "Boots" tells the poignant story of a closeted gay teenager navigating the U.S. Marines in the 199...

Hollywood Mourns: Iconic Star Diane Keaton's Cause of Death Revealed

Oscar-winning actress Diane Keaton has died at 78 due to pneumonia, her family confirmed. Tributes have poured in for th...