Comment on Millionaire Interview Update 58 by MI-236

I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in June.

As usual, my questions are in bold italics and their responses follow…

OVERVIEW

I am now 50 years old. Predictably, AARP invites are showing up like every week now.

Been married for 22+ years. A gentleman does not reveal the age of a lady! (As one of the interviewees said.)

Note: when the original interview was published, it was literally a few days before my 47th birthday.

Yes, we are blessed with 3 awesome kids. Oldest is 18, the middle one is 14 and the youngest is 7 years old.

For and with our older daughter, this school year has been busy with college visits, college applications and then dealing with the FAFSA fiasco. The delays have impacted decisions, housing – everything.

Thankfully, it is all done now! We think we have figured out the best option for her and she will start college this fall.

My middle daughter got into the same magnet high school for technology and science in our area that our older daughter is graduating from, and is thriving.

Our youngest is finishing up 1st grade.

It’s incredible to see all three kids growing up, learning and figuring things out. They are more aware and certain than I was at their age. Clearly, my wife did a good job raising them!

We (still) live in Northern Virginia, essentially an exurb of Washington DC along the Dulles Toll Road.

We were Millionaire 236 published on April 19, 2021.

We had rescued a 4-week-old kitten that we found in the bushes of our community about 3 years back. This year, in January we rescued a 1 year old pup who is a mix of German Shepherd and Husky.

The doggo was given up to our local shelter back in November of 2023, then was adopted right around Thanksgiving. The family that adopted him then returned him to the shelter in January and that is when we adopted him.

He is such a baby and has anxiety issues and hates it when he is left alone. For a while, he was “my doggo” and now he is totally my wife’s doggo – follows her around everywhere, sleeps on her lap and is visibly distraught if she steps out even to go grocery shopping!

NET WORTH

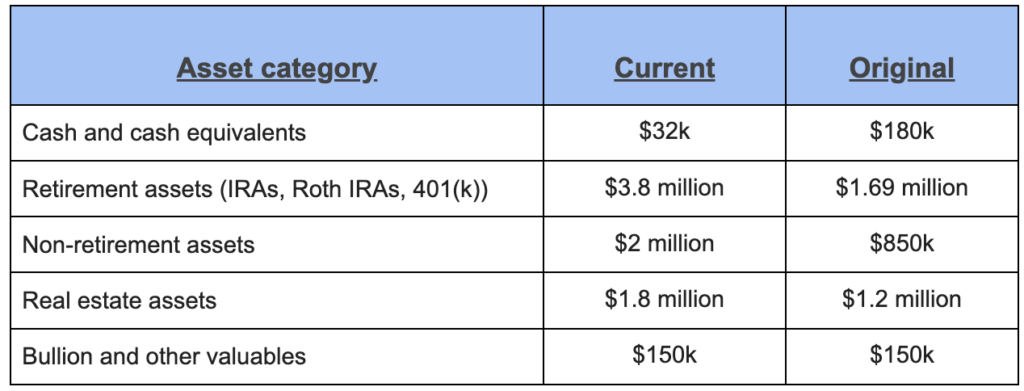

Our current net worth (as of May 26, 2024) is roughly $7.6 million.

When we did the original interview our net worth was around $3.4 million.

Here are the specifics and the changes/comparisons.

Seeing it this way, I am also surprised! We never really compared our net worth by these buckets/categories before.

The non-retirement accounts hold some cash around $50k, and there is around $150k in cash in the IRAs. More on that a little later.

Not included is educational savings accounts for the three kids which is an additional roughly $400k in total. Expecting that education for the kids will have a significant impact on our savings and net worth.

Cars are owned outright.

A couple of things we did…

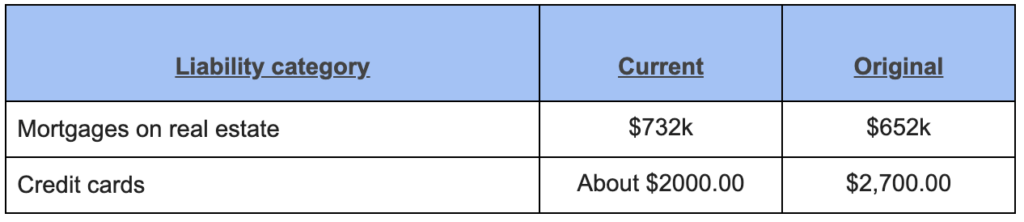

Thanks to my wife, who pushed that we refinance our mortgages when rates were low. We did and locked them in for 30 years.

Mortgage for primary residence is <3%. Mortgage for rental townhouse is <3.5%

This is essentially free money that lenders gave to us back in the day when interest rates and the rate of inflation were low. Right now, the institutions that are collecting the interest from us, they are not even making enough to cover the rate of inflation!!

Plus, paying as little as possible towards the mortgages allows us to invest and grow our wealth. This is where I disagree with those folks who believe in paying down their mortgages as fast as possible.

We took some cash out from our rental mortgage to pay for improvements and renovations to the rental townhouse. Other than that, I have been investing aggressively.

My concerns on commercial real estate, the failure of a few regional banks – we sold off all our investments in REITs and stocks in companies that develop commercial real estate. This is why we have some cash in our taxable and tax-advantaged investing accounts.

We invested in growth stocks.

As readers of ESI know and read – it is vitally important to avoid making mistakes that hurt our net worths, so we have been extra cautious but I still made mistakes – and I want to be clear that it was all my doing.

I sold covered calls and put options in our investing accounts to try and generate income during the time when the markets were down. Well, that turned bad real fast!

Some shares got called away and then we were saddled with the capital gains and the taxes that come with that! We lucked out on the put options that a margin call was not issued – we were able to cover the losses from the gains of the call options.

Invested in a friend’s startup – against my own best judgment and the advice of my wife. As the adage goes – when one gives a friend money, one is apt to lose both the friend and the money. I am still counting myself lucky that my wife has not kicked me out! 😉

Literally nothing – other than staying invested in our accounts, and putting money away each month into the 401k plan and 529 plans.

Well, one more thing I guess – I keep up with geopolitics, regulatory, financial, and economic news, and read continuously about investing, etc. so that I am learning and keeping up with macro and micro economic risks.

EARN

I am now Director for a delivery team at a large multinational company. I was VP of Technology and for a short time, CTO for a niche product company.

My role now is to figure out the best way to deliver cloud native solutions to our customers. My current role allows for a mix of hands-on tech work and then of course, I have to meet with clients, senior company people planning technology solutions.

Not much change really. My base salary is $ 225k.

There is a bonus component as well which is driven by individual performance as well as company performance. The company performance is less than stellar so I don’t expect much in terms of bonus.

Not included here is any income from dividends, interest income or from my trading activities.

Not included also is income from our townhouse which is rented out. That income is a complete wash when accounting for mortgage, taxes, insurance, maintenance costs and management fees.

It’s a marginal increase since the last interview, growing simply due to experience gained and the specific nature of the work. I have come to a point now where I realize that 50/60/80 hr work weeks don’t get me anything – the companies don’t care when it comes to handing out raises.

I needed to focus on my daughter’s college apps and college visits etc. this past year anyway.

No change.

I have dialed down my trading activities given some of the losses, plus in the years that I did make money trading – the tax bite was hefty and I prioritized spending time on family related things.

SAVE

Annual spending is trending now about $100k per year. Our spending in 2021 was on the low side due to the pandemic lockdowns, so I am reluctant to use that as the basis for comparisons.

Clearly now there is more travel than before, pricey kids’ activities have resumed, charitable giving went up and last but not the least, the cost of auto insurance, homeowner’s insurance and property taxes have just gone through the roof.

There is some impact to spending due to the increase in the cost of food and energy but that is not the biggest driver of the increase in spending.

From 2020/21 timeframe (original interview) to now, housing costs due to taxes and insurance are up by at least $15k. Cue the political commentary…..

Clearly, we are fortunate in many ways, we are employed and there is income, the interest rate on our mortgages is fixed and below the rate of inflation and we have an emergency fund. We are not renting and/or trying to buy a home in this market.

At the same time, this is unsustainable in our opinion. I expect insurance costs to continue to rise given the pace and scale of natural disasters in the country.

Yet, along with health care costs, guess what the media and the political parties talk about when it comes to inflation.

Starting this year, I will be eligible for catch-up contributions for my 401k and I intend to use that limit. We also continue to invest in the kids’ 529 plans.

Recent changes to the laws around 529 plans make them so much more useful and portable.

Nothing bad on the “save” side of things, we are saving less than before now simply due to the increase in spending. We are not worried since our retirement seems secure, unless of course we end up in another dot-com crash or another 2008 type meltdown.

As the kids leave the nest and become independent, some spending will naturally fall.

INVEST

As I stated in my last interview, we were moving towards investing in growth stocks in the sectors we understand. We did that.

We still have some savings invested in ETFs that mirror the S&P 500 Index and the Total Stock Market Index, but we are definitely skewed toward growth stocks now.

Good – our net worth grew along with the size of our investable/liquid assets.

Bad – made some mistakes as detailed above and figured out what others have said before – that day trading and “easy money” is not so easy after all. Also, NEVER give money to friends, unless you want to lose both.

MISCELLANEOUS

None more than normal I would guess, and nothing more than other mentors in the forum.

Trying to figure out the growth stocks to invest in, and as a result of moving to individual stocks, I keep up with geopolitics, regulatory, financial and economic news, and read continuously about investing etc. so that I am learning and keeping up with macro and micro economic risks.

Good – our net worth grew along with the size of our investable/liquid assets.

YTD – our assets grew 27.3% (cumulative).

TTM – our assets grew 44.4%.

Income has seen some growth as well, although not as much as I would like or as much as I could have. Now that our oldest daughter’s college stuff is settled, I will start to look around for the next move.

Several decisions are just easier once the financial cushion exists. I was in a car crash about 2 yrs back which totaled our 2003 Toyota Highlander.

We had owned it for almost 20 years and then we had to buy another vehicle – we were able to negotiate a relatively better deal from a dealer given that we were going to pay all cash.

What is worse is clearly the unsustainable growth in the cost of insurance and property taxes. Property taxes are up since home values are up, therefore assessments for tax purposes have also risen substantially.

The 2017 tax cuts limited SALT deduction to $10k which also hurts. Quite simply, the home we live in now, we could not afford to buy solely on the basis of our income.

Keep it simple.

Invest in yourself and your mental, emotional, and physical health. When investing in assets, always do your due diligence.

Practice stealth wealth. No one needs to know about your assets and your wealth.

My wife frequently threatens to disown me since I prefer to go everywhere in “comfortable”/rumpled t-shirts, baseball cap, and jeans/shorts. Neckties are collecting dust. Suits bought many years ago are moth-balled and likely won’t fit me anyway.

Our cars are reliable, non-fancy transportation.

NEVER give money to friends and family if you expect that money to be returned that is. Personally – our extended family is also unaware of the details of our financial situation – as I learned – if it’s hard to say no to a friend who asks for money, it is almost impossible to deny a family member, so it’s best to not invite the conversation at all.

The one annoyance right now is the financial advisors with our brokerage accounts who keep setting up one-on-one/check-in meetings – my accounts are now part of their “private wealth management” service line or something. When that happened and why I have no clue.

Make sure you and your partner are in sync and do talk to your kids about money.

Use a password manager/vault solution, and ensure you have MFA enabled on all your online accounts. Yes, it can be annoying, but better that than the alternative.

Vote, get engaged, and be a part of the solution.

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...

:max_bytes(150000):strip_icc():focal(749x0:751x2)/prostate-cancer-stories-42-061225-3599bf33e25b49bbb5cafec4d364c31f.jpg)