China's commodity futures market gains global spotlight at London expo - Chinadaily.com.cn

China's expanding commodity futures market drew wider attention at the 2025 International Derivatives Expo, or IDX, held from Monday to Wednesday in London, England.

Organized by the Futures Industry Association, the annual expo in the United Kingdom capital saw more than 1,000 participants from across the global derivatives sector, and China's participation was seen as part of its sustained efforts to open its futures market to international investors.

More than 20 major exchanges and institutions participated, including CME Group, the world's largest operator of financial derivatives exchanges, and Eurex, the leading European derivatives exchange.

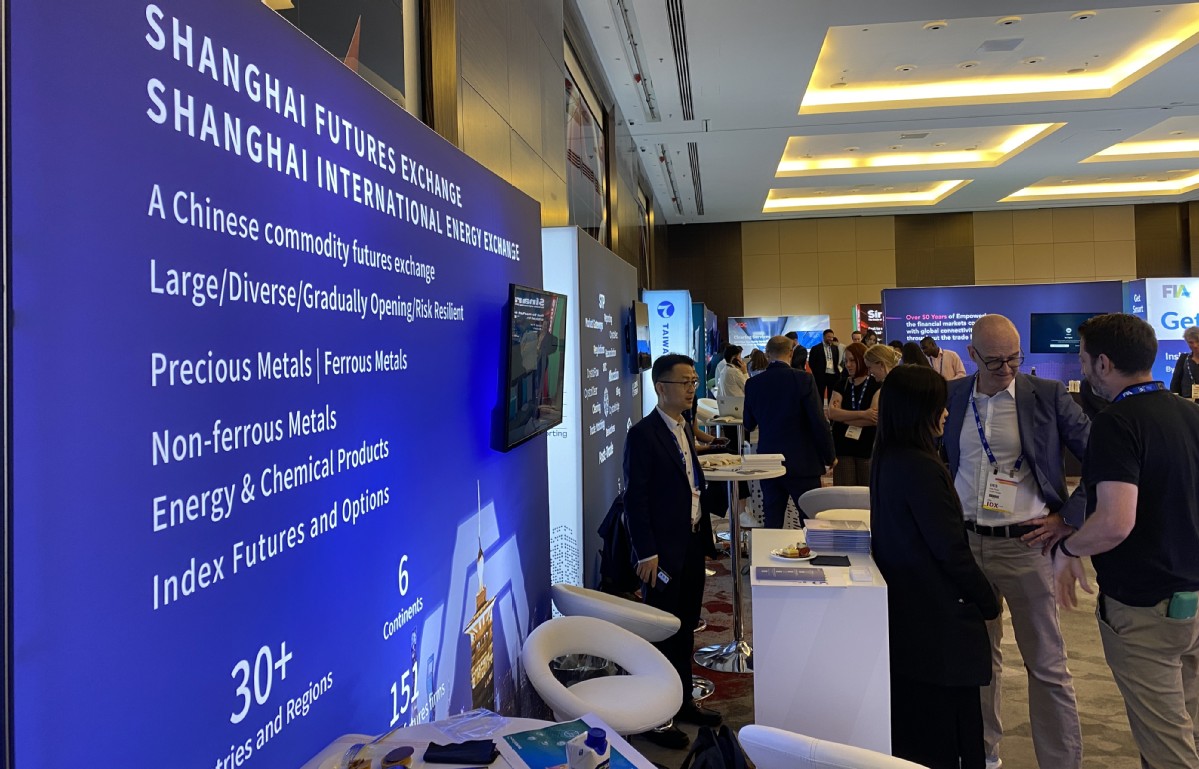

Three institutions from China – Shanghai Futures Exchange, Zhengzhou Commodity Exchange, and Dalian Commodity Exchange – presented their services at the expo.

It was the third time Shanghai Futures Exchange had joined IDX as an exhibitor and it hosted a panel discussion on Tuesday featuring experts from J.P. Morgan, Winton, BOCI, and JunHe LLP who talked about opportunities in China's commodity futures market.

According to data from the China Futures Market Monitoring Center, international interest in China's futures market continues to grow. As of the end of 2024, the number of overseas clients had increased by 17 percent year-on-year, while their open interest surged by 28 percent.

Currently, the Shanghai exchange offers 28 futures and options products to qualified foreign investors, with six international products directly accessible to foreign traders. The products span key sectors, including metals, energy, chemicals, and shipping.

The panel discussion was attended by more than 100 people and sparked in-depth debate on the evolving global economic landscape, regulatory shifts, and how China's commodity derivatives can serve as effective instruments for navigating market volatility.

Panelists noted that China's futures market, with its improving liquidity, increasing openness, and unique product offerings, is becoming an attractive option for a wide array of market participants amid persistent global economic uncertainties.

Experts suggested that institutional investors can diversify their portfolios and access more investment opportunities by engaging with China's market. Moreover, the successful track record of China's futures market in navigating recent turbulence in global commodity markets has bolstered investor confidence.