ChatGPT Price Shock: OpenAI Imposes VAT Hike on Nigerian Users!

OpenAI, the prominent artificial intelligence research company, has announced it will commence collecting a 7.5% Value-Added Tax (VAT) on its services offered to users in Nigeria. This new taxation policy is set to take effect from November 1, 2025. In an official email dispatched to its subscribers, OpenAI clarified that this move is a direct response to comply with Section 10 of the Value Added Tax Act, Laws of the Federation of Nigeria 2004 (as amended), along with adherence to the FIRS Information Circular 2021/19.

The 7.5% VAT will be uniformly applied across all paid OpenAI subscriptions and services billed within Nigeria. This includes popular offerings such as ChatGPT Plus and any other AI-driven services provided by the company. OpenAI has advised its Nigerian users possessing a valid Tax Identification Number (TIN) to update their account information by adding it to the payment section. This step is crucial for ensuring accurate tax documentation and compliance.

This development is part of a broader trend where Nigeria is intensifying its efforts to enforce tax compliance among foreign digital service providers operating within its borders. Several other global technology giants have already implemented similar VAT policies. For instance, Google initiated charging Nigerians VAT on its products in 2022. Moreover, companies like Netflix, Facebook, and Amazon have already integrated similar VAT directives for their Nigerian customer base, with recent reports indicating that Nigeria has successfully collected an estimated ₦600 billion in VAT from these foreign entities.

While the concept of VAT directives for foreign companies is not entirely novel in Nigeria, recent amendments to the Value Added Tax Act now explicitly mandate non-resident digital firms to directly collect VAT from their Nigerian users and subsequently remit these funds to the Federal Inland Revenue Service (FIRS). Despite these changes, government officials have consistently maintained that no new taxes are being introduced under President Tinubu's administration. Instead, the focus is on a comprehensive restructuring of existing tax frameworks, consolidating various levies, and rigorously ensuring compliance across the board. Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy & Tax Reforms, explicitly challenged critics to "point to one newly added tax."

OpenAI's adherence to these regulations further signifies the increasing integration of global technology firms into Nigeria's evolving digital tax ecosystem. This trend presents both advantages and disadvantages for the West African nation. On one hand, it enables Nigeria to generate significant income from international companies providing services to its citizens. On the other hand, it inevitably leads to increased costs for individual users and businesses that rely on these digital services. For example, a ChatGPT Plus subscription, currently priced at ₦31,500 ($20) per month, will see its cost rise to ₦33,862.50 ($22.43) with the inclusion of the 7.5% VAT. This price escalation could also have ripple effects on local AI startups, such as Decide and ChatATP, which have built their business models upon OpenAI's foundational infrastructure.

In an interesting move to mitigate the impact of this price adjustment on its Nigerian user base, OpenAI has recently introduced a more affordable subscription tier specifically for Nigerians, priced at ₦7,000 per month. This initiative aims to cushion the financial effect of the impending VAT charges, making its services more accessible despite the new tax obligations.

Recommended Articles

OpenAI Imposes 7.5% VAT on ChatGPT in Nigeria, Driving Up Costs

OpenAI is set to implement a 7.5% VAT on its services in Nigeria starting November 1, 2025, aligning with local tax regu...

Afriland Towers Inferno Horror: 10 Dead, Labour Blames Government Negligence

A tragic fire at Afriland Building on Lagos Island claimed 10 lives, prompting the Nigeria Labour Congress (NLC) to cond...

FG Unleashes N50 E-Levy on Opay, Palmpay, Moniepoint Users: New Tax Shake-Up for Digital Payments!

Nigeria's Federal government has initiated a N50 e-levy on fintech transactions above N10,000, effective December 1, 202...

Lagos Inferno: Afriland Towers and Mandilas Market Fires Claim Lives, Spark Safety Outcry

A tragic fire at Afriland Towers in Lagos Island claimed ten lives, with United Capital Plc and FIRS confirming staff fa...

Master ChatGPT's New Superpowers: Seamless Integrations with Spotify, Figma, and More!

OpenAI has rolled out new app integrations for ChatGPT, allowing users to connect accounts like Spotify, Booking.com, an...

You may also like...

Blazers Triumph Amidst Turmoil: Team Wins Day After Billups' Arrest

The Portland Trail Blazers navigate a sudden crisis after head coach Chauncey Billups' arrest in a federal investigation...

NBA Commissioner Adam Silver 'Deeply Disturbed' by Shocking Indictments

NBA Commissioner Adam Silver expressed deep concern over recent federal indictments involving Terry Rozier and Chauncey ...

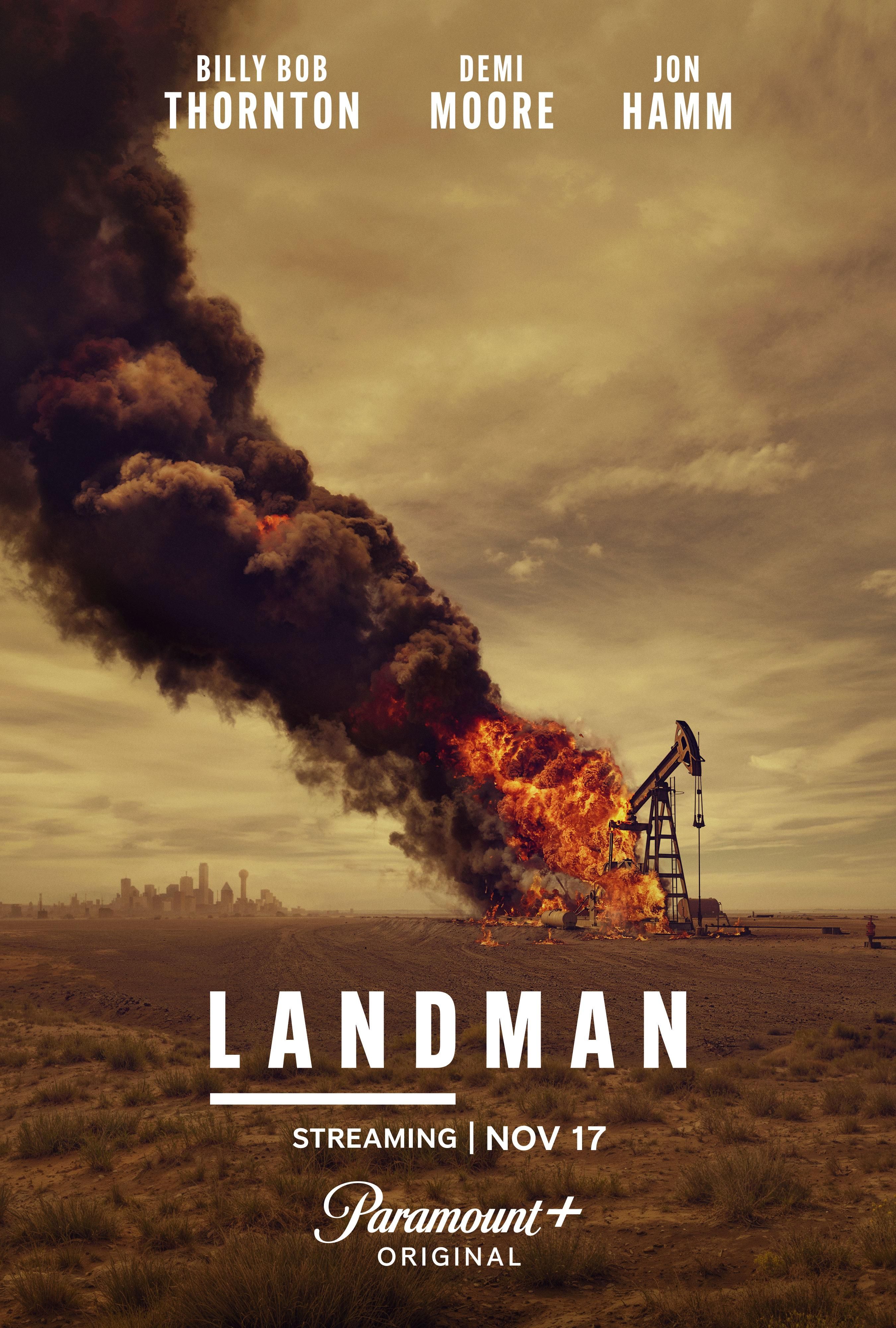

Hollywood's Next Frontier: Taylor Sheridan's Ambitious Plan for Texas

Taylor Sheridan's move to Texas has profoundly reshaped Fort Worth's economy, attracting significant investment and fost...

Tron: Ares Overtakes Infamous Disney Box Office Bomb, Shaking Up Studio History

Disney is facing significant box office challenges in 2025, echoing past struggles with mega-budget bombs like <em>The N...

Rock Royalty Joins Forces: Jon Bon Jovi Teases Bruce Springsteen & Jelly Roll Collabs

Jon Bon Jovi's newly expanded album, "Forever (Legendary Edition)," features exciting collaborations with Bruce Springst...

Emotional 2Pac History: 'Brenda's Got a Baby' Inspirations Reunited After Decades

The real-life inspiration behind Tupac Shakur's classic song "Brenda's Got a Baby" has found an astonishing continuation...

Discover Canada's Hidden 'Scottish Gem': A Town Preserving Highland Culture and Traditions

Discover Fergus, Ontario, Canada's 'most Scottish town,' where history, architecture, and culture deeply reflect its Sco...

Star Sonequa Martin-Green Teases Major Reagan Family Reunion for 'Blue Bloods' Spin-Off

Discover 'Boston Blue,' the new CBS spin-off that brings Danny Reagan to Boston, partnering with Lena Silver from a prom...