Bitcoin Swings After White House Report Omits Reserve Details as U.S. Strategic Digital Asset Policy Unfolds

The price of Bitcoin has experienced significant volatility, reflecting ongoing uncertainty and conflicting statements from U.S. government officials regarding its strategic digital asset reserve. Following a sharp dip to $115,807.32, which occurred shortly after the White House released its highly anticipated 166-page report on digital assets, Bitcoin rebounded above $118,571.79. The initial market downturn was largely attributed to the report's failure to disclose the exact amount of Bitcoin held in the newly created U.S. strategic bitcoin reserve, a detail eagerly awaited by the cryptocurrency community.

Earlier in the year, President Donald Trump signed an executive order establishing this strategic bitcoin reserve and a U.S. Digital Assets Stockpile. At the time, White House AI & Crypto Czar David Sacks indicated that the U.S. government was estimated to own around 200,000 Bitcoin, though a complete audit had never been conducted. The executive order specifically directed a full accounting of federal government digital asset holdings, with a stated policy that the U.S. would not sell any Bitcoin deposited into the Reserve, intending to keep it as a store of value, akin to a "digital Fort Knox."

Photo Credit: Bitcoin Magazine

However, the silence on specific holdings in the recent White House report contributed to a brief but sharp market sell-off. New details began to emerge from a Freedom of Information Act (FOIA)request dated March 24, 2025, filed with the U.S. Marshals Service (USMS). The USMS officially confirmed on July 15, 2025, that it currently holds only 28,988.35643016 BTC, a figure significantly lower than previous estimates. This confirmation, obtained by journalist L0la L33tz, highlighted a discrepancy, especially considering the Department of Justice had been cleared to sell 69,370 BTC before Trump took office, with no public auctions announced since.

The narrative around U.S. Bitcoin policy continued to evolve with further contradictory statements. Initially, Bitcoin bulls were reinvigorated when Bo Hines, Executive Director of the President’s Council of Advisers for Digital Assets, stated in an interview that the U.S. understood the importance of the Strategic Bitcoin Reserve and believed in "accumulation," exploring "budget neutral" ways to buy BTC, such as utilizing tariff revenue, which had amounted to $150 billion in the previous six months.

Despite this positive outlook, the market faced another significant jolt when U.S. Treasury Secretary Scott Bessent confirmed that the U.S. would not be buying crypto for its strategic reserve. This statement led to Bitcoin sharply plunging to an intraday low of $117,719 on the Bitstamp exchange, following a new all-time high of $124,517 on the same day. The market experienced over $1 billion worth of crypto liquidations, predominantly long positions. Bessent clarified that while the U.S. would stop selling existing confiscated coins—a policy since the reserve's establishment—he explicitly ruled out new Bitcoin purchases. This caused the odds of the U.S. establishing its own strategic Bitcoin reserve in 2025 to collapse to 16% on Polymarket. He also confirmed that the government's total holdings of confiscated coins stood at up to $20 billion, making the U.S. the largest holder of top cryptocurrencies among all countries.

Photo Credit: Local News Patch

However, in a surprising turn, Treasury Secretary Scott Bessent subsequently walked back his earlier comments, indicating that the U.S. might buy more Bitcoin. This contradictory social media post puzzled the cryptocurrency community. Bessent's latest statement on X claimed that the U.S. Treasury is committed to finding "budget-neutral" pathways for acquiring more coins, echoing sentiments previously expressed by other officials. While Bloomberg had estimated a 30% chance of the U.S. buying Bitcoin in 2025, potentially using funds from the Exchange Stabilization Fund (ESF), the frequent shifts in official stance underscore the ongoing uncertainty.

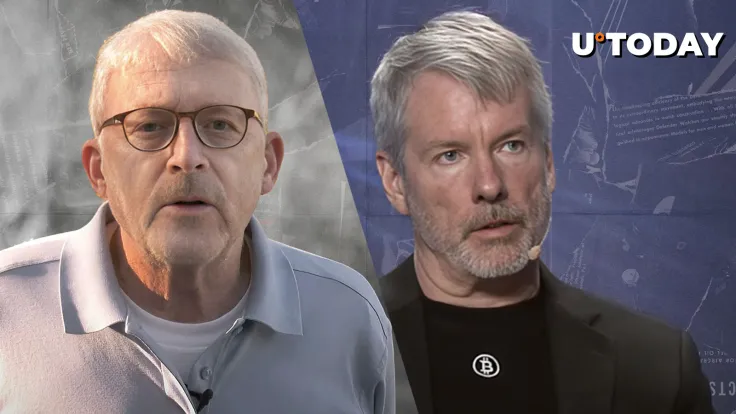

Michael Saylor, the executive chairman of business intelligence firm Strategy, remained unfazed by the market's recent plunge, asserting that "volatility is the gift to the faithful." Should the U.S. government indeed hold significantly less Bitcoin than initially thought and proceed with substantial purchases at current price levels, the resulting pressure on available supply could be immense, potentially driving the asset to new all-time highs as the U.S. aims to accumulate what it repeatedly refers to as "digital gold."

You may also like...

Hoops Immortals Crowned: Basketball Hall of Fame Class of 2025 Revealed

The Naismith Memorial Basketball Hall of Fame is set to induct its illustrious Class of 2025 this weekend, featuring NBA...

Super Falcons Dominate: Nigeria Claims Historic 10th WAFCON Title!

)

The Super Falcons of Nigeria clinched their record-extending 10th Women's Africa Cup of Nations (WAFCON) title with a dr...

Sith Lord's Blade Smashes Records! Darth Vader's Lightsaber Fetches 'Eye-Watering' $3.6 Million at Auction!

Darth Vader's original lightsaber from "Star Wars: The Empire Strikes Back" and "Return of the Jedi" has shattered recor...

Emmy Night 1 Shockers: 'The Studio' and 'The Penguin' Lead Creative Arts Awards as Industry Buzzes!

The 77th Emmy Awards are expected to continue the trend of "Emmy sweeps," with several high-profile series poised for ma...

Live Aid's Legacy: Untold Stories & The Stars Who Refused to Join

On July 13, 1985, Live Aid brought together a constellation of music stars across two continents to raise funds and awar...

Afrobeats Giants Clash: Burna Boy, Davido Lead AFRIMA 2025 Nominations

The 2025 All Africa Music Awards (AFRIMA) unveil a record-breaking list of nominees, with Nigerian giants Burna Boy and ...

Taylor Swift & Travis Kelce's Whirlwind Engagement Shakes Up Pop Culture

Pop superstar Taylor Swift and NFL tight end Travis Kelce are officially engaged, marking a significant milestone in the...

Oasis Rockers' Fiery Reunion Sparks Legal Battles & Fan Frenzy

The eagerly anticipated Oasis reunion tour is confirmed for 2025, with Andy Bell rejoining the band for 41 dates across ...