Bitcoin's Wild Ride: Price Dips Below $115K While Smart Money Buys the Dip

Strategy, a prominent corporate holder of Bitcoin, has further expanded its substantial digital asset portfolio with the acquisition of an additional 525 Bitcoin (BTC). This latest purchase, valued at $60.2 million, was executed at an average price of $114,562 per BTC, according to a recent SEC filing. This acquisition brings the company's total Bitcoin holdings to an impressive 638,985 BTC, solidifying its position as the largest corporate holder of the cryptocurrency. With this new addition, Strategy's overall average purchase price for its entire Bitcoin reserve now stands at $73,913 per BTC.

This consistent accumulation by Strategy comes amidst a broader and accelerating trend of institutional interest in Bitcoin. Corporate treasury holdings across various companies now collectively exceed 1 million BTC, representing approximately 5% of the total circulating Bitcoin supply. The year 2025 has seen a significant surge in this phenomenon, with a rapidly increasing number of new companies diversifying their treasuries into Bitcoin. This proliferation of corporate Bitcoin treasuries signifies a fundamental shift in how institutions perceive Bitcoin, moving beyond speculative interest to viewing it as a legitimate treasury asset. New companies are reportedly entering this space almost daily, each committing significant capital.

Despite Strategy's continued confidence and purchases, its stock (MSTR) has shown a more subdued performance relative to Bitcoin itself in 2025, recording a 14% gain compared to Bitcoin's 23% appreciation. The market dynamics surrounding institutional Bitcoin adoption are continuously evolving. While early 2025 witnessed Bitcoin's price surpassing $124,000, recent market action suggests a more measured investment approach, with price support consistently holding above the $110,000 level after a slight retreat from a recent high of $116,700.

The expansion of corporate Bitcoin holdings has had a discernible impact on market stability. Institutional holders are typically characterized by longer-term investment horizons, which has contributed to reduced market volatility. This trend has been particularly evident throughout 2025, as the number of Bitcoin treasury companies has more than doubled since January. This steady influx of corporate buyers has effectively established a new floor for Bitcoin's price, with market dips increasingly perceived as opportune moments for further accumulation by institutional players. Analysts anticipate that this trend of corporate Bitcoin adoption will persist, driven by improving regulatory clarity and increasing acceptance from traditional financial institutions. Strategy's latest, albeit modest, purchase reaffirms its unwavering commitment to its Bitcoin-centric treasury strategy, even in the face of short-term market fluctuations, indicative of a maturing market infrastructure and growing institutional comfort with Bitcoin investments.

Recommended Articles

MicroStrategy's Bitcoin Frenzy: $168M Haul Boosts Holdings to Staggering 717,131 BTC!

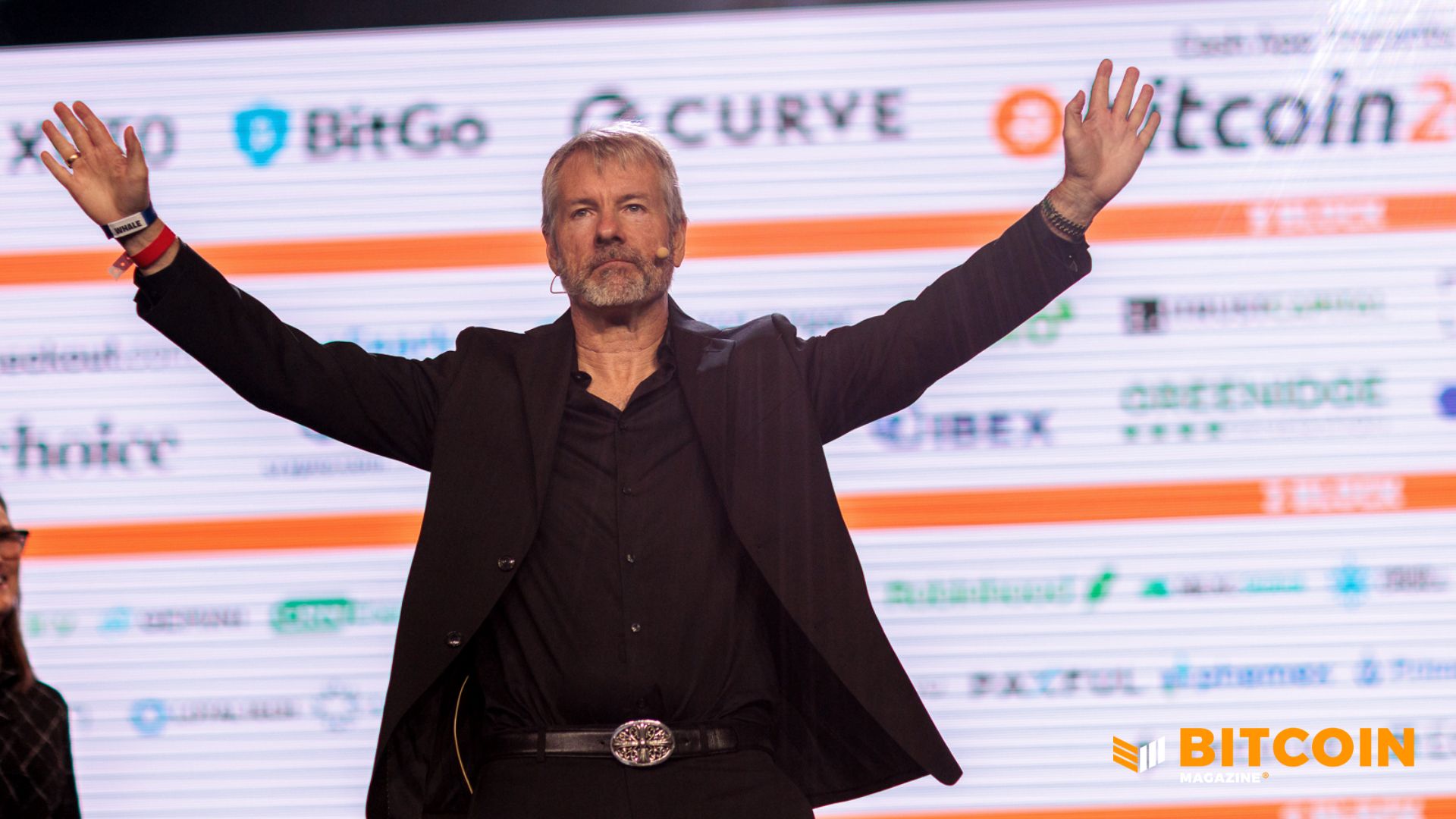

Strategy, the bitcoin treasury company led by Executive Chairman Michael Saylor, recently acquired an additional $168.4 ...

MicroStrategy's $261 Million Bitcoin Shopping Spree Fuels Crypto Hopes

Strategy, formerly MicroStrategy, has acquired an additional 2,932 Bitcoin for $264.1 million, bringing its total holdin...

BREAKING: Mystery 'Strategy' Amasses Staggering 700,000 BTC, Shaking Crypto Markets!

Strategy Inc. (MSTR) has significantly boosted its Bitcoin holdings, surpassing 700,000 BTC after acquiring an additiona...

Crypto Giant MicroStrategy Splurges $1.25 Billion on Bitcoin, Amassing a Staggering Horde

Strategy recently made significant Bitcoin acquisitions, raising its total holdings to over 687,000 BTC, while also succ...

Japan's Metaplanet Kicks Off 2026 with Massive 4,279 BTC Accumulation!

Japanese public company Metaplanet has started 2025 with a major Bitcoin acquisition, adding 4,279 BTC to its treasury. ...

Michael Saylor's MicroStrategy Strikes Again: Second $1 Billion Bitcoin Buy Confirmed!

Strategy, the world's largest publicly traded bitcoin holder, has made its second consecutive mega-purchase, acquiring 1...

You may also like...

Super Eagles Fury! Coach Eric Chelle Slammed Over Shocking $130K Salary Demand!

)

Super Eagles head coach Eric Chelle's demands for a $130,000 monthly salary and extensive benefits have ignited a major ...

Premier League Immortal! James Milner Shatters Appearance Record, Klopp Hails Legend!

Football icon James Milner has surpassed Gareth Barry's Premier League appearance record, making his 654th outing at age...

Starfleet Shockwave: Fans Missed Key Detail in 'Deep Space Nine' Icon's 'Starfleet Academy' Return!

Starfleet Academy's latest episode features the long-awaited return of Jake Sisko, honoring his legendary father, Captai...

Rhaenyra's Destiny: 'House of the Dragon' Hints at Shocking Game of Thrones Finale Twist!

The 'House of the Dragon' Season 3 teaser hints at a dark path for Rhaenyra, suggesting she may descend into madness. He...

Amidah Lateef Unveils Shocking Truth About Nigerian University Hostel Crisis!

Many university students are forced to live off-campus due to limited hostel spaces, facing daily commutes, financial bu...

African Development Soars: Eswatini Hails Ethiopia's Ambitious Mega Projects

The Kingdom of Eswatini has lauded Ethiopia's significant strides in large-scale development projects, particularly high...

West African Tensions Mount: Ghana Drags Togo to Arbitration Over Maritime Borders

Ghana has initiated international arbitration under UNCLOS to settle its long-standing maritime boundary dispute with To...

Indian AI Arena Ignites: Sarvam Unleashes Indus AI Chat App in Fierce Market Battle

Sarvam, an Indian AI startup, has launched its Indus chat app, powered by its 105-billion-parameter large language model...