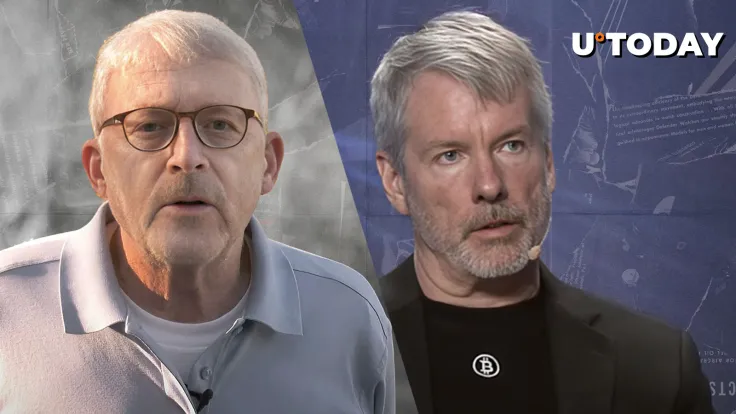

Bessent's Bold Bitcoin Buy Claim Sends Market Into Tailspin

The cryptocurrency market experienced significant upheaval earlier this Thursday, primarily driven by conflicting statements from U.S. Treasury Secretary Scott Bessent regarding the nation's stance on Bitcoin acquisition for a strategic reserve. Initially, Bitcoin, the leading cryptocurrency, saw a sharp collapse to an intraday low of $117,719 on the Bitstamp exchange after Bessent confirmed the U.S. would not be buying crypto. This dramatic plunge occurred on the very same day Bitcoin had reached a new all-time high of $124,517, highlighting extreme market volatility.

The market correction was not limited to Bitcoin, as altcoins also took a considerable hit. XRP, for instance, plummeted by 7% within minutes, briefly dipping below the $3 mark. Overall, CoinGlass data revealed that more than $1 billion worth of crypto was liquidated over a 24-hour period, with long positions accounting for the overwhelming majority of this wipeout, totaling $778 million.

Bessent's initial clarification stated that the U.S. policy, established in March, was to cease selling existing confiscated coins, while explicitly ruling out any new Bitcoin purchases. This stance dramatically affected market sentiment, causing the odds of the U.S. establishing its own strategic Bitcoin reserve in 2025 to collapse to a new all-time low of just 16% on Polymarket, a major cryptocurrency-based betting platform. He further clarified that the government's current holdings, comprised of confiscated coins, amount to up to $20 billion, making the U.S. the largest holder of top cryptocurrencies among all countries. BitTBO data also places China and the U.K. in the top three, though China is reportedly considering selling its substantial Bitcoin holdings to address a budget deficit.

However, in a surprising turn of events, Secretary Bessent later walked back his earlier comments, suggesting in a social media post that the U.S. Treasury might actually seek

You may also like...

Hoops Immortals Crowned: Basketball Hall of Fame Class of 2025 Revealed

The Naismith Memorial Basketball Hall of Fame is set to induct its illustrious Class of 2025 this weekend, featuring NBA...

Super Falcons Dominate: Nigeria Claims Historic 10th WAFCON Title!

)

The Super Falcons of Nigeria clinched their record-extending 10th Women's Africa Cup of Nations (WAFCON) title with a dr...

Sith Lord's Blade Smashes Records! Darth Vader's Lightsaber Fetches 'Eye-Watering' $3.6 Million at Auction!

Darth Vader's original lightsaber from "Star Wars: The Empire Strikes Back" and "Return of the Jedi" has shattered recor...

Emmy Night 1 Shockers: 'The Studio' and 'The Penguin' Lead Creative Arts Awards as Industry Buzzes!

The 77th Emmy Awards are expected to continue the trend of "Emmy sweeps," with several high-profile series poised for ma...

Live Aid's Legacy: Untold Stories & The Stars Who Refused to Join

On July 13, 1985, Live Aid brought together a constellation of music stars across two continents to raise funds and awar...

Afrobeats Giants Clash: Burna Boy, Davido Lead AFRIMA 2025 Nominations

The 2025 All Africa Music Awards (AFRIMA) unveil a record-breaking list of nominees, with Nigerian giants Burna Boy and ...

Taylor Swift & Travis Kelce's Whirlwind Engagement Shakes Up Pop Culture

Pop superstar Taylor Swift and NFL tight end Travis Kelce are officially engaged, marking a significant milestone in the...

Oasis Rockers' Fiery Reunion Sparks Legal Battles & Fan Frenzy

The eagerly anticipated Oasis reunion tour is confirmed for 2025, with Andy Bell rejoining the band for 41 dates across ...