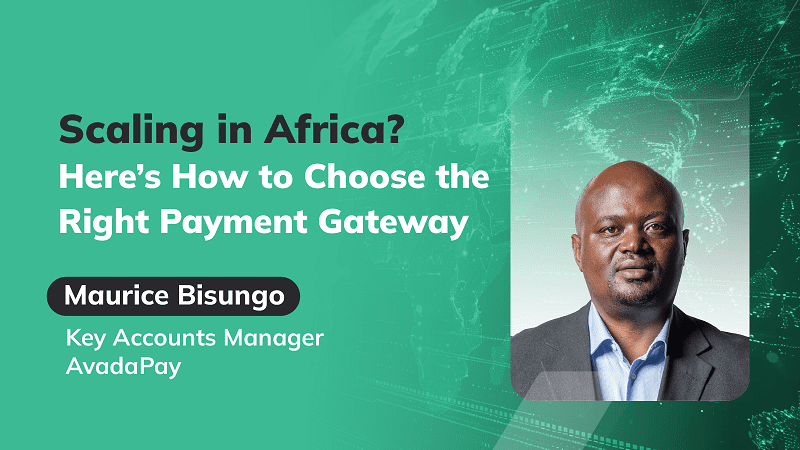

AvadaPay Unlocks African Market: Master Guide to Payment Gateways for Business Growth

Africa presents immense opportunities for business expansion, often highlighted by its burgeoning population, increasing internet penetration, and the transformative adoption of mobile money. While these factors are undeniably real drivers of growth, a less discussed but equally critical aspect for businesses is the efficient movement of funds into and out of these diverse markets. The strategic selection of a payment gateway can either significantly accelerate a company's growth trajectory or entirely impede it.

Unlike more unified markets such as Europe or North America, Africa's payment landscape is characterized by its significant fragmentation, with no single dominant rails provider. This diversity necessitates a deep understanding of local payment ecosystems. For instance, Kenya largely relies on M-Pesa for digital commerce, whereas Nigeria features a blend of mobile wallets like Opay and PalmPay alongside traditional bank transfers. In the Democratic Republic of Congo (DRC), transactions are distributed across various mobile money systems offered by Vodacom, Orange, and Airtel, with a considerable portion of the population still preferring cash. Businesses aiming for cross-border expansion in Africa must therefore navigate not only multiple currencies but also vastly different payment infrastructures.

Given this complex environment, identifying "the right gateway" involves several key considerations. Firstly, an effective payment gateway must extend beyond merely processing card payments. With card penetration remaining below 10% in many African markets, the most suitable gateways prioritize mobile money processing. Concurrently, they must also provide merchants the flexibility to accept other payment methods, including cards, QR codes, and Point-of-Sale (POS) transactions, where relevant to local market conditions. This multi-faceted approach ensures maximum reach and inclusivity for customers.

Secondly, a successful payment gateway in Africa requires a balance of local depth and regional breadth. A platform that claims integration across numerous countries but lacks robust partnerships with local banks and telecommunication providers in each market will prove inadequate. Businesses need strong assurances regarding compliance with local regulations for settlement flows and the reliability of customer payments, preventing issues arising from poorly maintained integrations. Local expertise ensures smooth operations and adherence to specific national requirements.

Thirdly, modern payment gateways should intrinsically incorporate communication capabilities. Payments rarely occur in isolation; they typically require immediate confirmations, alerts, and ongoing customer engagement. A customer completing a deposit in Uganda or making a purchase in Zambia expects instant feedback. In regions where internet penetration can be inconsistent, bulk SMS remains a highly dependable method for delivering these crucial reassurances and maintaining customer trust.

These requirements underpin the growing shift towards integrated platforms that consolidate payment and communication services within a single interface. AvadaPay exemplifies this trend, offering processing for mobile money, cards, and POS transactions across more than 20 African markets, with further expansion plans in progress. Such platforms empower businesses, like a retailer in Nairobi seeking to engage customers in Kinshasa or Lagos, to expand without the cumbersome process of onboarding a separate payment gateway for each new country. The iGaming sector provides a clear illustration: operators demand instantaneous deposits and withdrawals, whether through Airtel Money in the DRC or bank transfers in Nigeria. Integrated gateways enable these operators to scale across multiple countries while delivering a consistent and reliable user experience. This same principle applies to logistics and Fast-Moving Consumer Goods (FMCG) companies, where high volumes of low-margin transactions demand rapid and dependable processing daily.

In discussions with fintech partners and business owners, a common misconception surfaces: that selecting a payment gateway is merely a technical decision best left to the IT department. In reality, it is a profoundly strategic decision that directly influences a company's ability to scale effectively. The right payment partner will streamline cross-currency settlements, mitigate regulatory complexities, and significantly enhance customer trust. Conversely, an unsuitable partner can force businesses into manual transaction reconciliation and frequent apologies for failed payments. Artur Mildov, Chief Visionary Officer at Velex Group, aptly notes that payment gateways have evolved far beyond simple back-end infrastructure; they are now indispensable enablers of growth. In Africa's uniquely diverse market systems, the appropriate gateway can be the defining factor between a business constantly struggling with transactions and one successfully expanding into new regions. AvadaPay, a Velex Group portfolio company, embodies this vision by treating payment infrastructure as a strategic lever for business expansion, providing a unified platform that integrates mobile money, card, QR, and POS transactions. This integrated approach allows businesses to operate seamlessly across borders and achieve scale without the friction associated with managing multiple providers.

Africa's payments landscape is complex and will likely remain so for the foreseeable future. However, by choosing the right gateway, businesses can transcend single-market dependencies and strategically position themselves for regional growth. For companies committed to expansion across Africa, the decision of which payment gateway to employ is too critical to be an afterthought. It extends beyond the mere processing of payments; it is fundamentally about building robust trust with customers and ensuring operational continuity across an array of diverse markets. Platforms that skillfully combine efficient payment processing with reliable communication are demonstrating the practical success of this approach. For businesses ready to confidently scale in Africa, partnering with a payment gateway like AvadaPay, designed specifically for the continent's unique challenges, is a crucial step.

You may also like...

MMA Thriller: Hughes vs Nurmagomedov Rematch Ends in Eye Injury and 'Robbery' Claims

Usman Nurmagomedov successfully defended his PFL lightweight title against Paul Hughes in a highly anticipated rematch t...

Ruben Amorim on Brink? Man Utd Managerial Saga Deepens Amid Pressure and Sacking Rumors

Ruben Amorim faces mounting pressure as Manchester United manager amid a poor start to the season, leading to speculatio...

Death's Grand Design: 'Final Destination 7' Secures New Director!

New Line Cinema is reportedly eying Michiel Blanchart to direct the next Final Destination installment, following the ma...

Marvel's 'Daredevil: Born Again' Producer Breaks Silence on Season 1 Flaws, Promises Redemption!

<i>Daredevil: Born Again</i> Season 2 is poised to deliver a bigger, more cohesive narrative with Matt Murdock facing an...

50 Cent Mercilessly Mocks Diddy's 50-Month Sentence: 'I'm Available!'

Sean 'Diddy' Combs has been sentenced to 50 months in prison for violating federal prostitution laws, sparking an immedi...

Taylor Swift's 'Life of a Showgirl' Dominates Spotify, Smashes Records!

Taylor Swift has shattered multiple streaming records on Spotify with her new album, "The Life of a Showgirl," becoming ...

The 'Diddy' Dossier: What You Need to Know About Sean Combs' Impending Sentencing

Sean 'Diddy' Combs faces sentencing today in New York for prostitution-related convictions, potentially serving up to 20...

Royal Revelation: Prince William's Stark Pledge to Break From Past Monarchical Mistakes

Prince William has opened up about his childhood and his determination to provide a warm, secure, and stable upbringing ...