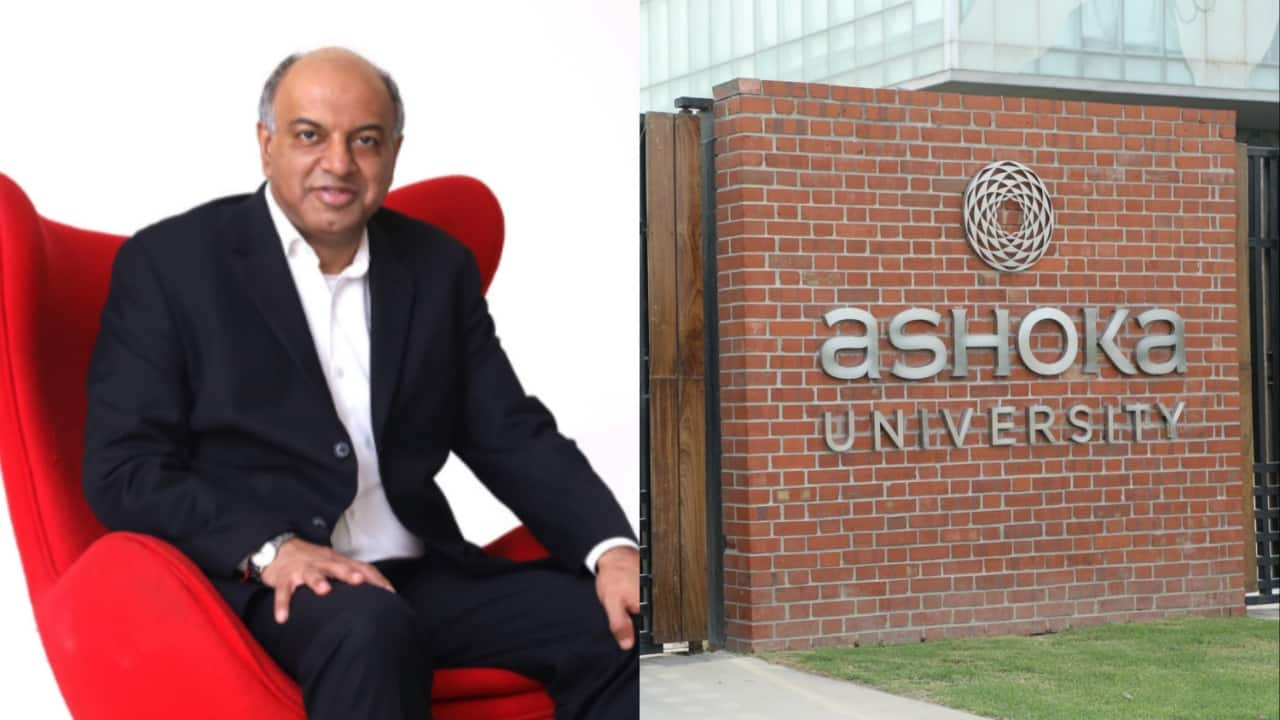

Ashish Dhawan's stock picks struggle: 8 stocks fall up to 50% in CY25

Investors in financial markets frequently monitor the portfolios of well-known market participants. In this context, ETMarkets has reviewed the latest investment disclosures of prominent investor Ashish Dhawan. According to the most recent data for the March 2025 quarter, Dhawan has publicly reported holdings in about 11 companies, with a combined value nearing Rs 3,003 crore as of April 29, 2025.

These investments represent positions where his stake exceeds 1%. A closer look at these holdings indicates that 8 of the stocks have posted negative returns ranging from 10% to 50% so far in calendar year 2025 (Data Source: ACE Equity, Trendlyne)

iStock

In CY25 so far, the stock has dropped by 52%, falling from Rs 10.35 to Rs 4.96. As of the March quarter, Ashish Dhawan holds a 1.57% stake worth Rs 14 crore (as of April 29, 2025).

ETMarkets.com

The stock is down 50% year-to-date, declining from Rs 662 to Rs 330. Ashish Dhawan owns 4.09% of the company, valued at Rs 201 crore.

ETMarkets.com

Shares have fallen 37% this year, from Rs 79 to Rs 49. Dhawan holds a 5.54% stake, currently valued at Rs 3.4 crore.

ETMarkets.com

The stock has declined 28%, from Rs 1121 to Rs 805. Dhawan’s 4.79% stake is worth Rs 250 crore.

ETMarkets.com

Shares are down 24%, from Rs 291 to Rs 222. Dhawan owns 3.77% of the firm, valued at Rs 213 crore.

ETMarkets.com

The stock has dropped 22%, falling from Rs 514 to Rs 404. Dhawan holds a 1.02% stake, valued at Rs 55 crore.

ETMarkets.com

Stock is down 21% YTD, from Rs 273 to Rs 217. Dhawan’s 4.08% stake is worth Rs 292 crore.

IANS

9/9

The stock has decreased 14%, from Rs 1609 to Rs 1384. Dhawan owns 1.77% of the company, valued at Rs 692 crore.

ETMarkets.com

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...