Antibody Discovery Strategic Business Report 2025 |

Dublin, June 02, 2025 (GLOBE NEWSWIRE) -- The "Antibody Discovery - Global Strategic Business Report" has been added to offering.

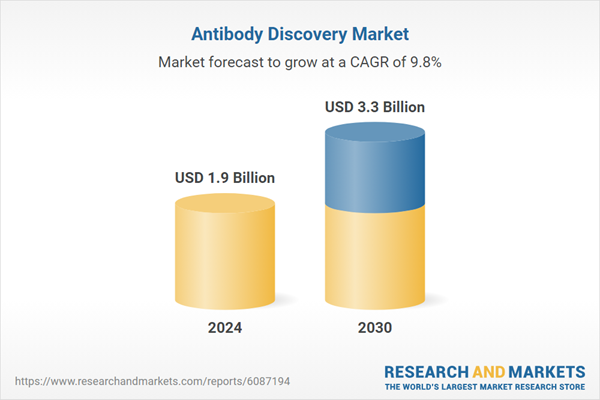

The global market for Antibody Discovery was valued at US$1.9 Billion in 2024 and is projected to reach US$3.3 Billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030.

This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions. The report includes the most recent global tariff developments and how they impact the Antibody Discovery market.

Antibody discovery is emerging as a cornerstone of modern drug development, driven by the escalating demand for targeted therapies across oncology, autoimmune disorders, infectious diseases, and rare conditions. Monoclonal antibodies (mAbs), bispecific antibodies, and antibody-drug conjugates (ADCs) are transforming clinical outcomes through their high specificity, tunable pharmacokinetics, and ability to engage or inhibit precise molecular targets.

The discovery phase - encompassing target identification, antibody generation, screening, and lead optimization - is critical to ensuring downstream therapeutic efficacy, safety, and commercial viability. As biopharmaceutical pipelines increasingly prioritize biologics over small molecules, antibody discovery is becoming an indispensable gateway to innovation.

A significant driver of this trend is the surge in demand for personalized medicine and immunotherapy, where antibody-based therapeutics are used to modulate immune response, block disease-associated pathways, or deliver cytotoxic payloads directly to tumor cells. The urgency created by the COVID-19 pandemic further underscored the importance of rapid antibody discovery, as neutralizing antibodies became pivotal in the therapeutic and diagnostic response to SARS-CoV-2.

Global interest in therapeutic antibodies is prompting pharmaceutical and biotech firms to accelerate discovery programs using faster, more predictive, and less immunogenic methods. As the market shifts from traditional hybridoma techniques to humanized platforms and next-gen in silico approaches, antibody discovery is positioned at the heart of biopharma R&D strategies worldwide.

Cutting-edge technologies are reshaping every stage of the antibody discovery process, enabling faster identification of high-affinity, developable antibodies with favorable safety and manufacturability profiles. Phage display and yeast display platforms have largely replaced traditional hybridoma-based generation, offering vast diversity libraries and rapid selection capabilities.

More recently, microfluidics, single B-cell screening, and high-throughput sequencing have revolutionized early-stage discovery by capturing naturally occurring antibody repertoires from immunized animals or convalescent human donors. These tools enable the isolation of rare, highly potent antibodies that would otherwise go undetected through conventional methods.

Computational biology and AI-driven design are also transforming the discovery pipeline by predicting binding affinity, stability, immunogenicity, and epitope specificity in silico. Machine learning algorithms are being trained on large antibody datasets to accelerate lead optimization, reduce experimental trial-and-error, and improve success rates in later development phases.

Humanization techniques - ranging from chimerization to full deimmunization - are being refined to enhance safety and reduce rejection risk. Additionally, CRISPR/Cas9 and transgenic animal models are being leveraged to generate fully human antibodies with precise specificity. These technology integrations are enabling rapid, scalable, and cost-efficient antibody discovery workflows that meet the high standards of regulatory and therapeutic rigor.

Market demand for antibody discovery services and platforms is rising sharply across North America, Europe, and Asia-Pacific, where biopharma companies, academic labs, and contract research organizations (CROs) are intensifying efforts to expand antibody-based pipelines.

The U.S. leads in therapeutic antibody development, backed by significant biotech investment, advanced research infrastructure, and regulatory support for expedited biologic approvals. Europe, particularly Germany, Switzerland, and the U.K., is seeing strong growth in CRO-based discovery partnerships and academic spinouts. Meanwhile, Asia-Pacific - especially China, South Korea, and Japan - is becoming a major hub for antibody innovation, fueled by state-backed biotech programs, growing clinical trial activity, and rapid commercialization strategies.

Oncology remains the largest and fastest-growing therapeutic segment for antibody discovery, accounting for the majority of pipeline activity in monoclonal and bispecific antibodies. Immuno-oncology applications, such as checkpoint inhibitors and T-cell engagers, are expanding rapidly with significant investment in PD-1/PD-L1, CTLA-4, CD3, and CD20 targets.

Autoimmune and inflammatory diseases - including rheumatoid arthritis, psoriasis, and Crohn's disease - also represent major discovery areas, with antibody candidates aimed at cytokines and immune receptors such as IL-6, TNF-alpha, and IL-17. Infectious disease research continues to drive antibody discovery in the wake of COVID-19, with new programs targeting HIV, RSV, and influenza. Rare and neurological diseases, including ALS, Alzheimer's, and neuromyelitis optica, are emerging as high-value niches for precision antibody therapies. These diverse and expanding indications are propelling sustained investment and innovation in antibody discovery workflows across sectors.

The growth in the antibody discovery market is driven by several factors, including the rising prevalence of chronic and rare diseases, expansion of biologics pipelines, and breakthroughs in molecular screening and AI-assisted drug design. A central driver is the therapeutic success of antibodies already in the market - such as trastuzumab, adalimumab, and pembrolizumab - which continue to demonstrate the clinical and commercial potential of antibody-based drugs.

The robust deal activity between pharmaceutical giants and antibody discovery specialists is further catalyzing growth, as companies seek early access to differentiated platforms and promising candidates.

Increased outsourcing by biotech startups and mid-sized firms is also fueling market demand for discovery-as-a-service models, where CROs and specialized technology vendors provide end-to-end discovery capabilities from antigen design to humanized lead delivery. Advances in automation, sequencing, and data analytics are lowering the cost per discovery while improving success predictability, making antibody R&D more accessible to smaller players.

Moreover, government and institutional funding for pandemic preparedness, cancer immunotherapy, and biosimilar development are boosting both public and private sector involvement. As antibody therapeutics become increasingly central to precision medicine and immune modulation, a crucial question emerges - can antibody discovery platforms keep pace with the clinical complexity and specificity required for next-generation, globally accessible biologic treatments?

The report analyzes the Antibody Discovery market, presented in terms of market value (US$ Thousand). The analysis covers the key segments outlined below.

Global tariff negotiations across 180+ countries are reshaping supply chains, costs, and competitiveness. This report reflects the latest developments and incorporates forward-looking insights into the market outlook.

The analysts continuously track trade developments worldwide, drawing insights from leading global economists and over 200 industry and policy institutions, including think tanks, trade organizations, and national economic advisory bodies. This intelligence is integrated into forecasting models to provide timely, data-driven analysis of emerging risks and opportunities.

| No. of Pages | 224 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value (USD) in 2024 | $1.9 Billion |

| Forecasted Market Value (USD) by 2030 | $3.3 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

Some of the 41 companies featured in this Antibody Discovery market report include:

- FairJourney Biologics

- Genmab

- GenScript Biotech Corporation

- Harbour BioMed

- Icosagen AS

- ImmunoPrecise Antibodies Ltd.

- Isogenica Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/3vqbf7

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.