AI Power Play: SoftBank Eyes Staggering $30 Billion Investment in OpenAI

SoftBank Group Corp. is reportedly in talks to make an additional investment of up to $30 billion in OpenAI, according to The Wall Street Journal and Reuters.

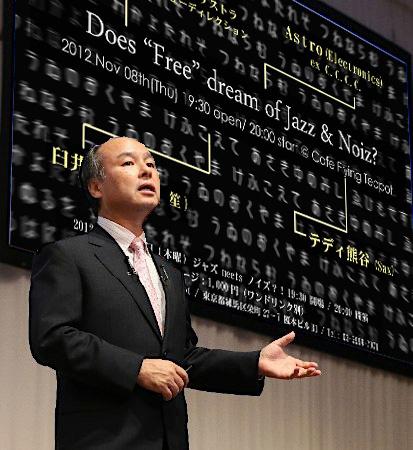

The potential deal would further deepen SoftBank’s financial backing of the ChatGPT developer and reflects CEO Masayoshi Son’s ambition to position the conglomerate at the center of the global artificial intelligence boom.

OpenAI is currently seeking fresh capital as part of a major fundraising effort, with ambitions to raise as much as $100 billion.

If successful, the round could value the company at a staggering $830 billion, underscoring investor confidence in OpenAI’s expanding influence across AI applications and infrastructure.

Masayoshi Son’s AI-Centric Strategy

The prospective investment aligns with Son’s broader vision to embed artificial intelligence across all devices and technologies. To support this strategy, SoftBank has been actively reshaping its portfolio, divesting from several high-profile assets to free up capital.

These moves include selling its stake in Nvidia Corp. and pausing acquisition talks with U.S. data center operator Switch Inc.

SoftBank is already a significant OpenAI stakeholder, having reportedly injected $22.5 billion last month to build an 11% stake in the company.

The group has also accelerated AI-focused acquisitions over the past year, including the $6.5 billion purchase of U.S. chip designer Ampere Computing and a $5.4 billion deal for ABB Ltd.’s robotics unit.

Financial Risks and Market Concerns

Despite being an early proponent of artificial intelligence, SoftBank has largely missed out on the global race to develop core AI hardware such as semiconductors and server infrastructure.

Its recent investment surge, combined with a decline in the value of Arm shares late last year, has raised concerns about the group’s financial resilience.

To fund its aggressive expansion, SoftBank has sold down shares in T-Mobile US, exited its Nvidia position entirely, and increased margin loans secured against its Arm holdings.

These developments prompted S&P Global Ratings earlier this month to flag potential risks to the company’s credit profile, highlighting the delicate balance between Son’s bold AI ambitions and SoftBank’s financial stability.

You may also like...

Arsenal Shaken: Saka Injury & Ødegaard Bench Sparks Leeds United Clash Drama

The final day of January kicks off a weekend of European football, with Premier League leaders Arsenal facing Leeds Unit...

Dr. Robby and Dr. Collins Face Peril: HBO's 'The Pitt' Series Expands Its Grim World

The Pitt's second season explores character evolution and departure, notably Dr. Collins' new life in Portland and Dr. R...

K-Pop Sensation ROSÉ Set to Make History with Groundbreaking 2026 Grammy Awards Performance

ROSÉ is set to make history at the 2026 Grammy Awards as the first solo K-pop artist to perform, alongside her three nom...

Hip-Hop Mourns: Swishahouse Founder Michael '5000' Watts Passes Away at 52

Houston hip-hop pioneer Michael “5000” Watts, founder of Swishahouse Records, has died at 52. Watts was instrumental in ...

Namibia Shakes Up National Park Fees by 2026 to Fuel Conservation! Tourists, Take Note!

Namibia will significantly revise its national park entrance and conservation fees starting April 1, 2026, primarily aff...

Berlin Court Rips Into Booking.com's Rate Rules, Unleashing Hotel Freedom!

A landmark German court ruling has found Booking.com liable for violating competition laws by enforcing rate parity clau...

Innovation Spotlight: Owllup Revolutionizes Income for Nigerians via 'Full-Circle Economy' Social Connections!

Owllup, founded by Chimaobi Stanley Anyanwu, is transforming Nigeria's tech and creator economy by providing mentorship,...

Cybersecurity Crisis: Hackers Abscond with ₦7.7 Billion in Telco Airtime and Data!

Nigeria's digital economy sees major developments with a ₦7.7 billion telco hack crackdown, Atsur's innovative digital i...