Agricultural Lubricants Market to Hit USD 7.52 Billion by

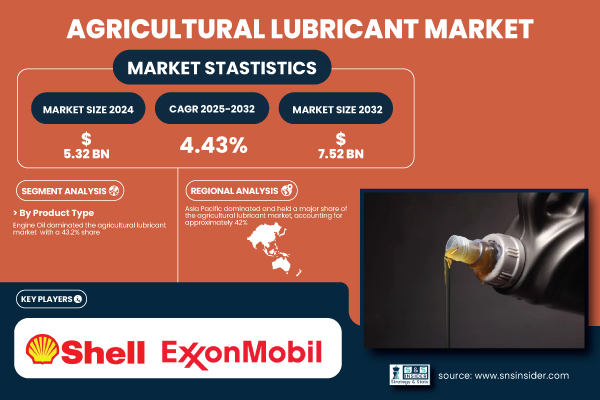

Austin, June 29, 2025 (GLOBE NEWSWIRE) -- The Agricultural Lubricant Market Size was valued at USD 5.32 billion in 2024 and is expected to reach USD 7.52 billion by 2032, growing at a CAGR of 4.43% over the forecast period of 2025-2032.

Rising Mechanization and Sustainable Practices Propel Global Demand for High-Performance Lubricants in Modern Agricultural Equipment

The Agricultural Lubricant Market is expanding rapidly due to increased mechanization and the rising need for efficient equipment maintenance. Growing global food demand has led to widespread adoption of advanced agricultural machinery, boosting lubricant consumption to enhance performance and longevity. The U.S. Department of Agriculture reported a 12% rise in mechanized farm equipment usage from 2022 to 2024. Manufacturers like John Deere and AGCO are developing lubricant-optimized engines, further supporting market growth. Additionally, the EPA’s push for environmentally friendly practices is driving demand for bio-based lubricants, which reduce ecological impact. Combined with growing farmer awareness of lubricant benefits, these developments are shaping a robust global market poised for steady growth over the coming years.

Download PDF Sample of Agricultural Lubricant Market @ https://www.snsinsider.com/sample-request/7035

The US Agricultural Lubricant Market had a market size of USD 779.41 million in 2024, with a highest market share of 67%.

The U.S. Agricultural Lubricant Market is growing steadily due to increased farm mechanization and the adoption of environmentally friendly lubricants. Organizations like the USDA and EPA support sustainable practices that encourage bio-based lubricant usage. For example, John Deere’s recent launches of advanced tractors with enhanced lubricant efficiency contribute to market growth by improving machinery lifespan and reducing emissions.

Key Players:

Agricultural Lubricant Market Report Scope:

| Report Attributes | Details |

| Market Size in 2024 | USD 5.32 billion |

| Market Size by 2032 | USD 7.52 billion |

| CAGR | CAGR of 4.43% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Integration of IoT-Based Lubrication Monitoring Systems Enhances Agricultural Equipment Efficiency. • Expansion of Large-Scale U.S. Farms Boosts Agricultural Lubricant Market Growth. |

If You Need Any Customization on Agricultural Lubricant Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/7035

By Product Type, the Engine Oil Dominated the Agricultural Lubricant Market in 2024 with a 43.2% Market Share.

This is due to its essential role in ensuring engine longevity and performance in farm machinery. The increasing adoption of advanced engine oils that offer better thermal stability and wear resistance has been pivotal. For instance, Shell’s Rimula series and Chevron’s Delo products have seen rising use among agricultural equipment operators. These oils help reduce downtime by minimizing engine wear during prolonged operations, which is critical during planting and harvesting seasons. The shift towards synthetic blends within engine oils further enhances fuel efficiency and reduces emissions, making it a preferred choice among environmentally conscious farmers and OEMs.

By Base Oil, Mineral Oil Dominated the Agricultural Lubricant Market in 2024 with a 64.1% Market Share.

The dominance is due to its affordability and wide availability. It remains the preferred base oil for many agricultural lubricants, particularly in developing regions where cost sensitivity is high. Mineral oils offer reliable lubrication properties and are compatible with a broad range of additives, making them versatile for engine oils, hydraulic fluids, and greases. Companies like ExxonMobil and BP continue to innovate within mineral oil formulations to meet evolving machinery demands, supporting the dominance of this segment. The established supply chain infrastructure for mineral oils also contributes significantly to their market leadership.

By Farm Equipment, the Tractors Dominated the Agricultural Lubricant Market in 2024 with a 55.8% Market Share.

The dominance is driven by their indispensable role in modern agriculture. The increasing use of tractors for plowing, planting, and harvesting has heightened the demand for specialized lubricants that withstand heavy loads and diverse environmental conditions. Leading manufacturers like John Deere and Kubota emphasize advanced lubricant technologies for tractors to improve fuel economy and extend engine life. Furthermore, government subsidies and modernization programs in countries like the U.S. and India have accelerated tractor adoption, further propelling lubricant consumption in this segment.

By Sales Channel, Aftermarket Dominated the Agricultural Lubricant Market in 2024 with a 58.3% Market Share.

Aftermarkets led the sales channel segment with a major market share in 2024, reflecting the critical role of maintenance and replacement parts in agriculture. As farm machinery ages, the need for regular lubricant replenishment rises, fueling aftermarket sales. Independent distributors and service centers offer a broad selection of lubricants tailored for specific equipment types and conditions, making aftermarkets more accessible to end-users. Brands such as Valvoline and Mobil frequently partner with aftermarket suppliers to ensure product availability, which enhances consumer confidence and drives growth in this channel.

Asia Pacific dominated the Agricultural Lubricant Market in 2024, Holding A 42% Market Share.

This dominance is attributed to rapid agricultural mechanization, especially in countries like China and India, driven by government initiatives to boost farm productivity. The region’s large farming population increasingly invests in tractors and combines, demanding reliable lubricants for upkeep. Additionally, rising environmental concerns have led to the introduction of bio-based lubricants, supported by regional regulations. Companies such as Sinopec and Indian Oil Corporation have expanded lubricant production capacities in Asia Pacific, further solidifying the region’s leadership.

North America Emerged as the Fastest Growing Region in the Agricultural Lubricant Market with a Significant Growth Rate in The Forecast Period

The growth is propelled by advanced mechanization, precision farming, and stringent environmental regulations encouraging eco-friendly lubricants. The U.S. EPA’s initiatives promoting bio-based lubricants and fuel-efficient machinery drive market expansion. Leading U.S. manufacturers like Chevron and Shell actively invest in R&D for sustainable lubricants, meeting the needs of technologically advanced farms. Additionally, government subsidies for agricultural modernization accelerate lubricant demand in this region.

Buy Full Research Report on Agricultural Lubricant Market 2025-2032 @ https://www.snsinsider.com/checkout/7035

Recent Developments

• October 2024: BMG launched Liqui Moly Flow Grease, enhancing agricultural machinery performance under harsh conditions with high-pressure, temperature-resistant lubrication solutions.

• September 2024: Moove Lubricants filed for a $250M U.S. IPO to expand its global presence in automotive and agricultural lubricant markets.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.