Africa's Fintech Gauntlet: Building Financial Giants, A test of innovation and Resilience.

The world looks at African fintech and sees dazzling innovation: brilliant young minds building digital empires, leapfrogging old banks, and bringing millions of people online. We see the unicorns; the billion-dollar success stories and the revolutionary speed of mobile money.

But ask any founder trying to build a pan-African platform, and they'll tell you the real story is much tougher. Scaling a fintech across this continent isn't a smooth rocket ship ride; it is a grueling, constant negotiation. It means waking up to news of sudden currency devaluation that wipes out a quarter's profit. It means the engineering team has to spend days writing code that works during a power cut. It means trying to get one product licensed 54 different ways.

The reality is this: operating an African fintech means constantly wrestling with fragmented regulatory chaos, profound infrastructure that breaks, crippling macroeconomic storms, and an intense, stressful fight for the best talent. The true test of these ventures isn't just their brilliant idea, but their sheer endurance.

The Regulatory Gauntlet and Policy Whiplash

A single African financial market under AfCFTA is an attractive vision. But for fintech that must actually operate in the markets themselves, it's far messier. Fintech face a patchwork of various national rules and uncertain, changing policies that raise cost, risk and unpredictability.

Licensing and compliance duplication: A fintech operating in, for example, Nigeria, Ghana, and Kenya cannot take for granted that one license or one regulatory regime would suffice for these three countries. Each country may have its separate licensing, different AML/KYC regimes, capital thresholds, and data-privacy obligations.

Policy whiplash: In response to exponential fintech market growth, governments enact sudden regulatory or supervisory changes. For instance, several African central banks have issued circulars that restrain crypto; Nigeria’s CBN a notable example, digital lending, or cross-border payments. It is such shifts that make fintech suddenly change course or halt operations.

Data sovereignty and localisation: Many African jurisdictions have regulations that demand customer data to reside within their borders or limit cross-border flows of data. For a pan-African fintech this may imply having separate data centers or cloud architectures for each country, which can compromise scale and efficiency. This is reinforced by the findings of one study, which points out that a lack of, or limited, harmonization of data protection regimes is a significant barrier.

Scale is impeded by regulation fragmentation: The most recent insight underlines that without harmonized regulation, interoperable systems, and stronger credit infrastructure, there will not be any cross-border scale.

For fintech entrepreneurs, this means every new country is almost like starting from zero-new regulators, new paperwork, often a new product version. For the engineers, this means rebuilding the infrastructure or compliance stacks per jurisdiction, while for the investors, it means layered risks.

Infrastructure Gaps: The Cost of Building from Scratch

While fintech in developed markets usually plug into existing rails, networks, and identity systems, many African markets require building or adapting foundational infrastructure; and that comes with a cost.

Payment rails and interoperability: Most real-time gross settlement systems or instant-payment frameworks remain in their infancy in most African countries. Interbank, mobile money, and fintech interoperability is generally weak. Failed transactions, delays, and opaque settlement processes raise several risks and costs.

Identity, address, and KYC challenges: Formal identity verification and geo-address systems are weak in large parts of Africa. Many customers might not have a national ID or be able to provide standard proof of address. Thus, one study remarked that low access to identity documents and formal address systems "makes fintech resort to expensive, high-friction and often unreliable biometric verification or agent-based KYC processes."

Operational resilience: Frequent power outages, inconsistent internet connectivity, and differences in quality for mobile networks mean that platforms have to be engineered for resilience, perhaps including USSD fallback, offline modes, multi-site data replication, and higher operational costs. Unreliable internet connectivity, poor mobile network access remains significant hurdles for delivering seamless services.

Gaps in human capital and digital literacy: Infrastructure is weaker, so customer servicing often requires more agent-networks, more manual oversight, and more training-all of which raise the cost per user compared to developed-market equivalents.

Consider a Fintech team launching in Nigeria and then Ghana. Their Nigerian stack may assume particular payment-rails, agent networks, and identity flows. Ghana may require an entirely different setup. The founder is constantly juggling between tech, operations, and compliance just to make the product function smoothly.

Macroeconomic Volatility and Profitability

Growth alone isn't a sure-fire guarantee of a sustainable business. For fintech operating across Africa, macro-risk, and profitability pressures often overshadow pure growth narratives.

Currency devaluation risk: Many fintech earn revenue in local currency-for example, from merchants or users in Nigeria, Ghana, Kenya-but pay key infrastructure, SaaS, cloud, engineering talent costs in USD or another hard currency. In such cases, when local currency devalues, their cost base goes up relative to revenue overnight. According to one McKinsey article, these are some of the macro-headwinds that temper sector growth.

Funding and monetisation squeeze: The global tech investment environment has tightened, and African fintech are feeling the pinch. McKinsey found that fintech funding contracted significantly in recent years. Meanwhile, monetizing users remains hard, with low disposable incomes, high churn rates, heavy marketing costs, and an only gradually maturing regulatory environment relating to lending and merchant fees. Profitability can take longer than expected.

Trust, predation and backlash: Rapid growth in digital-lending apps sometimes with aggressive collection practices, high interest rates, and data usage has triggered consumer-trust issues and regulatory intervention. One article points to "exploitative practices of some fintech platforms — such as high fees, privacy violations, and coercive debt collection" undermining the ecosystem.

For the CEO, the nightmare scenario is that you launch in Country A, build a large user-base, monetise via lending + payments, but then the currency halves in value so your US-dollar cost doubles. Alternatively, you invest in rural expansion, but users churn or cannot pay so your unit economics collapse. Or, you face a regulatory clamp-down on lending and the business suddenly needs to pause.

Talent, Scaling and Governance

The internal operational risk and governance challenges become just as important as the customer-facing technology when fintech scale.

Scarcity of senior fintech talent: While Africa has a large pool of youthful developers, fintech often requires experienced engineers, payment-security specialists, deep-risk professionals, and compliance leads. According to McKinsey, more than 80 percent of fintech executives surveyed said it is “moderately or very difficult to hire tech and product-related or strategic talent on the continent.”

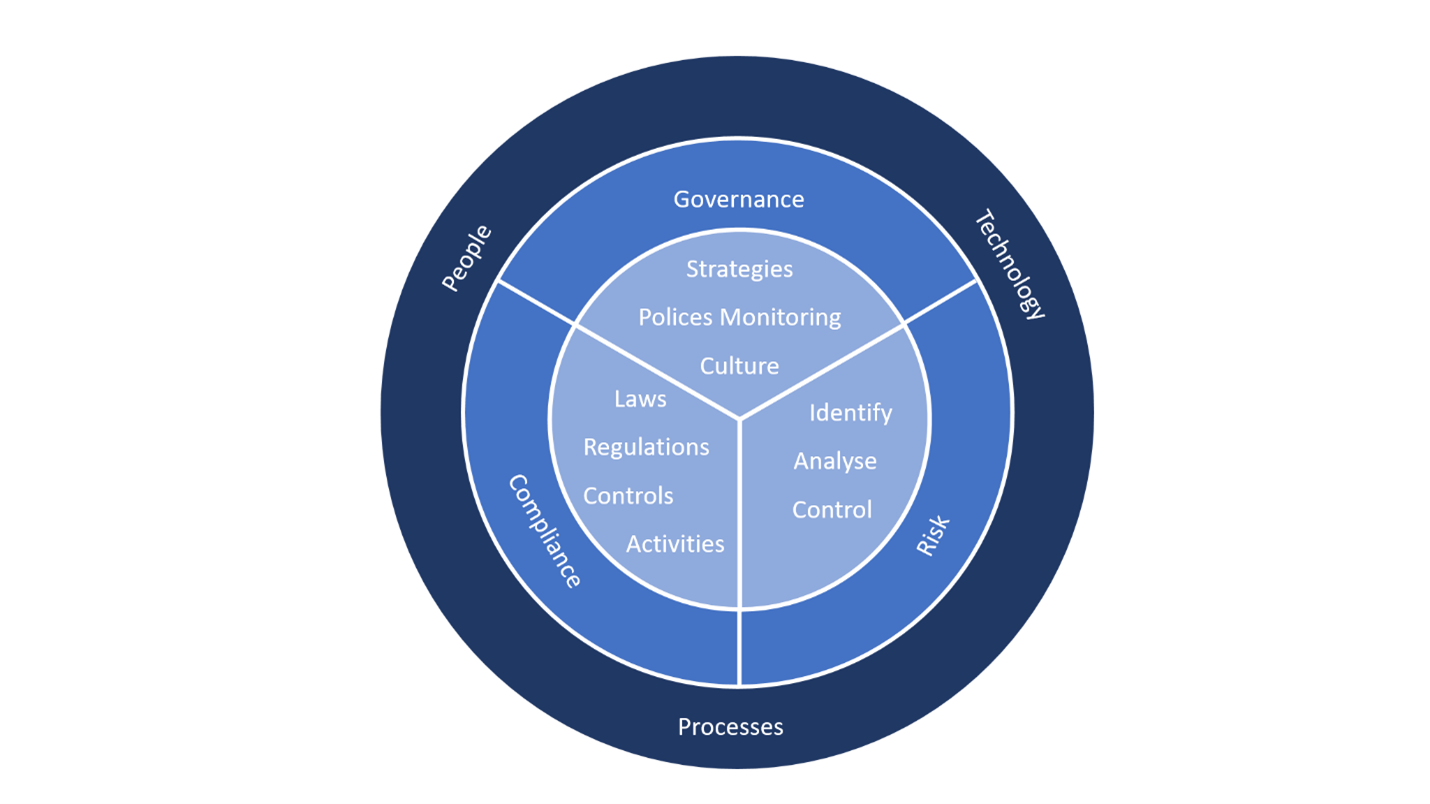

Corporate governance and internal controls: Many fintech startups prioritize speed and growth, but in financial services, that can be dangerous. Weak risk management, insecure platforms, and poor internal regulatory oversight create existential threats. As one journal article on South Africa put it, fintech introduce new regulatory risks alongside benefits.

Operational scaling versus culture: Aggressive entry into new markets, launching new product lines, hiring aggressively, this usually outpaces the maturing of internal systems, such as compliance, audit, technology operations, and customer-servicing. The result: an increased risk of platform failure, reputational risk, and regulatory enforcement.

Retention, geography and global competition: Engineers and fintech talent may migrate to more developed markets or global companies offering higher pay or more stable environments. For African fintech, this equates to higher salary bills or dependence on remote or hybrid talent, increasing cost and complexity.

For the co-founder building their fifth market entry, it's not just to get product-market fit anymore, it's to build compliance processes, hire senior risk folks, make sure we have audit trails, have fallback-systems for downtime, navigate local labour markets, manage culture across borders. It becomes an orchestration challenge.

The African fintech story is often told through the lens of rapid adoption, high valuations, mobile-money growth, and disruptive potential. Those narratives are true. But the more realistic story includes the systemic and operational hurdles: unharmonious regulation, infrastructure gaps, macroeconomic volatility, talent shortages, and scaling governance risk. For those fintech that do succeed, the differentiator will not be great product or large user base but resilience, localization, cost discipline, and strong governance. CEOs will have to think like operations leaders, not just growth hackers.

Investors, too, will have to evaluate not just user metrics but risk-management maturity, financial sustainability, and multi-jurisdiction competency. Policymakers will have to push harder for regulatory consistency, identity infrastructure, data-governance harmonization, and digital-payments rails. The promise is, in fact, very real. But the obstacles are equally so. The firms that overcome them will define

the next decade of African finance.

You may also like...

When Sacred Calendars Align: What a Rare Religious Overlap Can Teach Us

As Lent, Ramadan, and the Lunar calendar converge in February 2026, this short piece explores religious tolerance, commu...

Arsenal Under Fire: Arteta Defiantly Rejects 'Bottlers' Label Amid Title Race Nerves!

Mikel Arteta vehemently denies accusations of Arsenal being "bottlers" following a stumble against Wolves, which handed ...

Sensational Transfer Buzz: Casemiro Linked with Messi or Ronaldo Reunion Post-Man Utd Exit!

The latest transfer window sees major shifts as Manchester United's Casemiro draws interest from Inter Miami and Al Nass...

WBD Deal Heats Up: Netflix Co-CEO Fights for Takeover Amid DOJ Approval Claims!

Netflix co-CEO Ted Sarandos is vigorously advocating for the company's $83 billion acquisition of Warner Bros. Discovery...

KPop Demon Hunters' Stars and Songwriters Celebrate Lunar New Year Success!

Brooks Brothers and Gold House celebrated Lunar New Year with a celebrity-filled dinner in Beverly Hills, featuring rema...

Life-Saving Breakthrough: New US-Backed HIV Injection to Reach Thousands in Zimbabwe

The United States is backing a new twice-yearly HIV prevention injection, lenacapavir (LEN), for 271,000 people in Zimba...

OpenAI's Moral Crossroads: Nearly Tipped Off Police About School Shooter Threat Months Ago

ChatGPT-maker OpenAI disclosed it had identified Jesse Van Rootselaar's account for violent activities last year, prior ...

MTN Nigeria's Market Soars: Stock Hits Record High Post $6.2B Deal

MTN Nigeria's shares surged to a record high following MTN Group's $6.2 billion acquisition of IHS Towers. This strategi...