A Currency’s Quiet Pulse: The Rand's Subtle Rise and the Hope It Holds

Early Morning Ripples

In the soft light of Johannesburg’s dawn, the South African rand stirred—not with fireworks, but with a subtle nudge. On Monday, the currency found itself trading at around 17.7250 against the U.S. dollar, inching up roughly 0.2%from the previous. On paper, it was slight. Yet in the body’s economy—the shops, the factory floors, the people hustling to make ends meet—it was a small sign of breathing room, a tentative exhale in a long-held economic tension.

This minute movement—the rand growing a little stronger—reflects more than market mechanics. It reveals something deeply human: the fragile longing for stability, for growth grounded in data, dialogue, and careful hope.

SOURCE: gettyimages

Waiting for Manufacturing’s Whisper

Today’s buzz in financial circles rests on a singular pivot: June’s manufacturing output data. Statistics South Africa is set to unveil whether factory floors across the country are humming—or still idling in cautious pause. May showed a modest 0.5% year-on-year increase, but forecasts from Reuters and Nedbank suggest a slightly stronger performance: around 1% and 0.8%, respectively.

Why does this matter? Because manufacturing is not just production—it's a promise. It is the pulse of making, the hum of assembly, the labor of livelihoods. If these factories are stirring again, even in small increments, it could mean jobs returning, confidence being rebuilt, and the possibility that this long slide from growth might just be softly reversing.

Beyond the Numbers: Bonds and Tariffs

The rand’s subtle rise did not happen alone. Its strength is quietly supported by a broader shift in sentiment and policy.

On one side, uncertainty remains. South Africa still bears the weight of a 30% U.S. tariff on its exports—the steepest among sub-Saharan nations. That tax isn’t just an economic barrier; it is a reminder of how global politics can reach into local markets, reminding exporters, investors, traders that certainty is too rare.

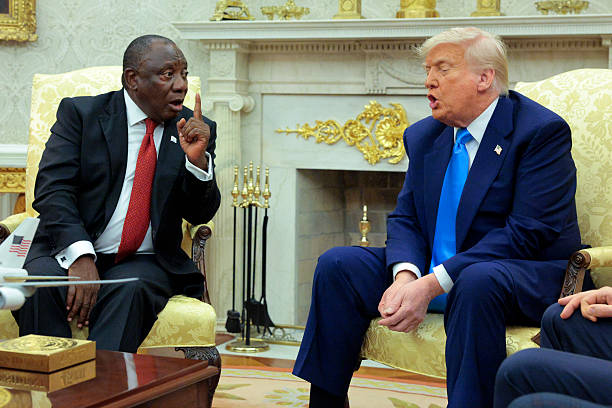

And yet, this week there are soft signs of diplomacy: President Ramaphosa’s office confirmed that he spoke with President Trump, and that detailed trade negotiations are being planned. Even a promise of conversation can calm markets.

SOURCE: gettyimages

At the same time, the benchmark 2035 government bond yield—a measure of investor trust in the country’s long-term future—remained unchanged at 9.63%. No spike. No collapse. Just stability—an unspoken nod that, for now, fragile faith remains.

The Currency as Mirror, Not Mechanism

Let’s be clear: these shifts are subtle. No dramatic leaps, no boom. But the rand’s gentle rise speaks more than numbers.

Imagine a shopkeeper in Durban hearing about this. Maybe diesel costs creep down a little—or importers quoting better prices because the dollar is weaker. Or a commuter, for whom any steadiness in exchange rate is a promise that transport costs might not force him deeper into planning how to commute less.

When a currency rises, even softly, it signals that the macro feels less chaotic. It can mean lower food prices, clearer business forecasts, and a break in the tension that budgets and instincts can feel.

SOURCE: gettyimages

A Broader Context: Gold’s Golden Support

This movement comes on the back of other quiet forces. A few days ago, gold prices rose, pulling up the rand in sympathy. South Africa, a major precious metals producer, often sees the rand benefit when global markets turn toward gold as a haven. Add to that a softer U.S. dollar—driven by expectations of lower American interest rates—and you get a confluence of positive signals, even against tariff uncertainty.

What does that mean? It means that even amid geopolitical friction, basic economic flows—of mining, of monetary cycles, of debt expectations—still whisper possibility.

Why This Moment Matters

This isn't just about forecasting growth or flagging exchange rates. It is about carving breathing room in uncertainty.

South Africa’s economy carries the strain of logistics bottlenecks, waning confidence, and a mainland debt burden. But a softening in inflation expectations, a modest interest rate cut by the central bank to 7%, and a shift in target toward the lower band of 3% illustrate a monetary policy that’s trying to give people—and markets—a break.

If manufacturing data confirms a trend—if factories hum more softly, if bonds don’t wobble, if tariffs don’t freeze trade—then today's little rise may become the foundation for slow, steady resilience.

For ordinary South Africans, that’s not abstract. It’s about paying rent, buying fuel, planning futures—not with the dread of collapse, but with the hope that normal might return.

Around the Corner: What’s Next?

Today, markets look to manufacturing. Tomorrow, they'll watch mining output and unemployment figures. Later in the week, retail sales data will arrive.

But currencies, like the tides, are never still. A slight gain can just as easily be swept away by the next wave of global events — a shift in US interest rates, a change in commodity prices, or an unexpected political development. For South Africa, the question is not only whether the rand can hold its ground, but whether the broader economy can build the resilience needed to weather the inevitable storms ahead.

Each report is like reading a pulse. Combined, they sketch a portrait of whether South Africa can mend old cracks—whether policies are working, whether factories are humming, whether trade dialogues matter, whether gold’s shimmer can sustain trust.

But whether they sustain or shrink, the narrative will still rest on the faith that a currency can carry, if only softly, not just economics—but the quiet hopes of its people.

Conclusion: Small Gains, Big Echoes

This week’s gentle strengthening of the rand is not fireworks. It is a candle in the dark—more powerful than many think.

In the slow weave of daily life—from township taxis to supermarkets—such shifts can morph from currency numbers into relief. If inflation eases, if job markets stir, if debts become paths not prisons, the signal of growth perhaps would then transform into lived reality.

The rand’s rise is subtle. But in its quiet, we hear possibilities. And as long as that possibility holds, that is enough to let dawn feel a little brighter.

You may also like...

Bundesliga's New Nigerian Star Shines: Ogundu's Explosive Augsburg Debut!

Nigerian players experienced a weekend of mixed results in the German Bundesliga's 23rd match day. Uchenna Ogundu enjoye...

Capello Unleashes Juventus' Secret Weapon Against Osimhen in UCL Showdown!

Juventus faces an uphill battle against Galatasaray in the UEFA Champions League Round of 16 second leg, needing to over...

Berlinale Shocker: 'Yellow Letters' Takes Golden Bear, 'AnyMart' Director Debuts!

The Berlin Film Festival honored

Shocking Trend: Sudan's 'Lion Cubs' – Child Soldiers Going Viral on TikTok

A joint investigation reveals that child soldiers, dubbed 'lion cubs,' have become viral sensations on TikTok and other ...

Gregory Maqoma's 'Genesis': A Powerful Artistic Call for Healing in South Africa

Gregory Maqoma's new dance-opera, "Genesis: The Beginning and End of Time," has premiered in Cape Town, offering a capti...

Massive Rivian 2026.03 Update Boosts R1 Performance and Utility!

Rivian's latest software update, 2026.03, brings substantial enhancements to its R1S SUV and R1T pickup, broadening perf...

Bitcoin's Dire 29% Drop: VanEck Signals Seller Exhaustion Amid Market Carnage!

Bitcoin has suffered a sharp 29% price drop, but a VanEck report suggests seller exhaustion and a potential market botto...

Crypto Titans Shake-Up: Ripple & Deutsche Bank Partner, XRP Dips, CZ's UAE Bitcoin Mining Role Revealed!

Deutsche Bank is set to adopt Ripple's technology for faster, cheaper cross-border payments, marking a significant insti...