3 Dividend Stocks Offering Up To 6.5% Yield For Your Portfolio

The market has shown positive momentum, rising 1.6% over the last week and 12% over the past year, with earnings forecasted to grow by 14% annually. In such a dynamic environment, selecting dividend stocks with robust yields can provide a steady income stream while potentially benefiting from broader market growth.

| Valley National Bancorp (VLY) | 4.93% | ★★★★★☆ |

| Universal (UVV) | 5.37% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 6.85% | ★★★★★★ |

| Ennis (EBF) | 5.30% | ★★★★★★ |

| Dillard's (DDS) | 6.46% | ★★★★★★ |

| Credicorp (BAP) | 5.07% | ★★★★★☆ |

| CompX International (CIX) | 4.92% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.16% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.94% | ★★★★★☆ |

| Chevron (CVX) | 4.72% | ★★★★★★ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

★★★★☆☆

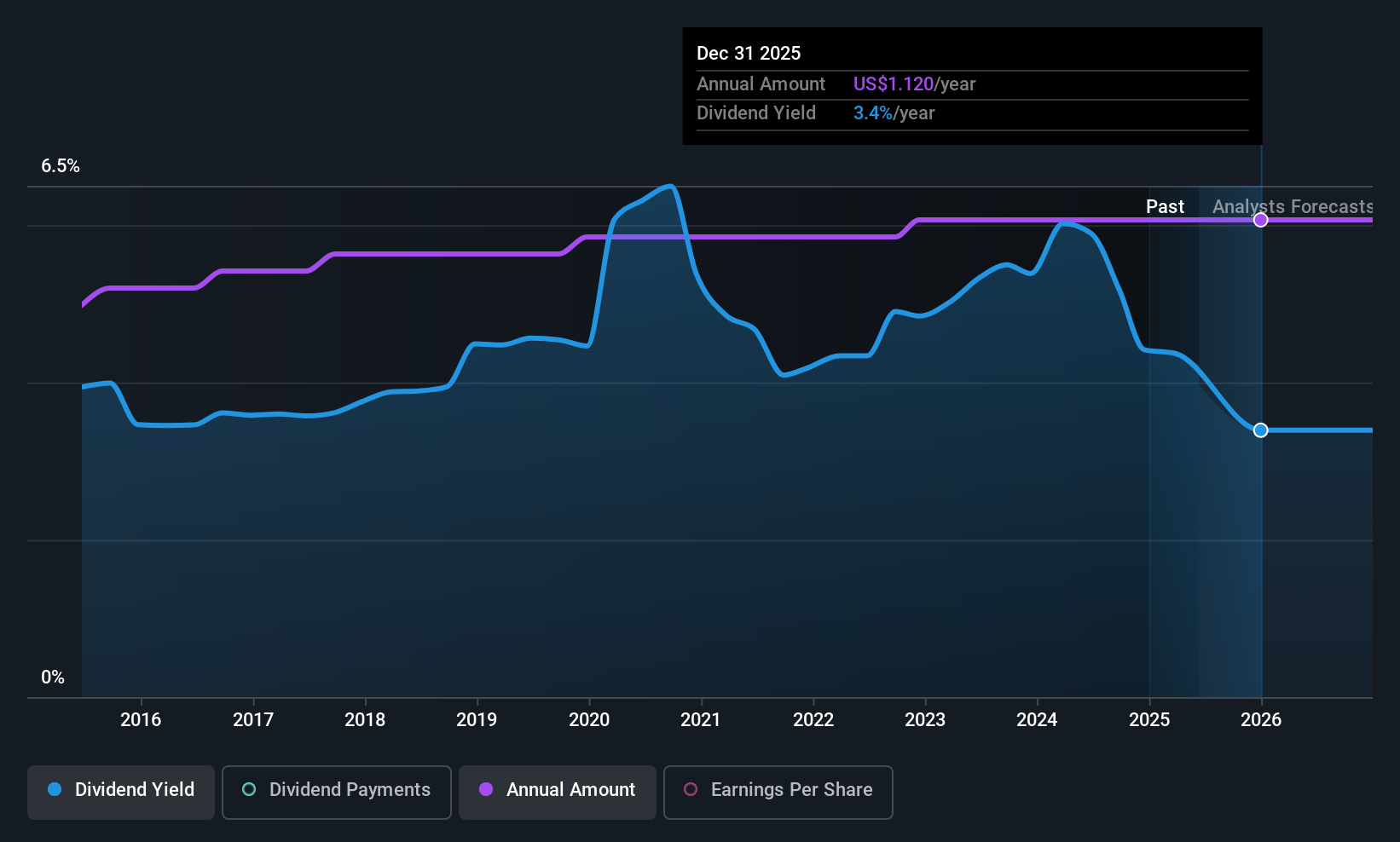

Isabella Bank Corporation is a bank holding company for Isabella Bank, offering banking and wealth management services to businesses, institutions, and individuals in Michigan, with a market cap of $236.60 million.

Isabella Bank Corporation's revenue from its retail banking operations amounts to $70.31 million.

3.4%

Isabella Bank recently declared a $0.28 per share dividend, payable June 30, 2025. The bank's dividends have been stable and growing over the past decade with a payout ratio of 56.7%, indicating earnings coverage. However, its 3.44% yield is lower than top-tier US dividend payers. Recent moves include listing on NASDAQ and expanding its buyback plan by 500,000 shares to enhance shareholder value while trading below estimated fair value by 35%.

★★★★☆☆

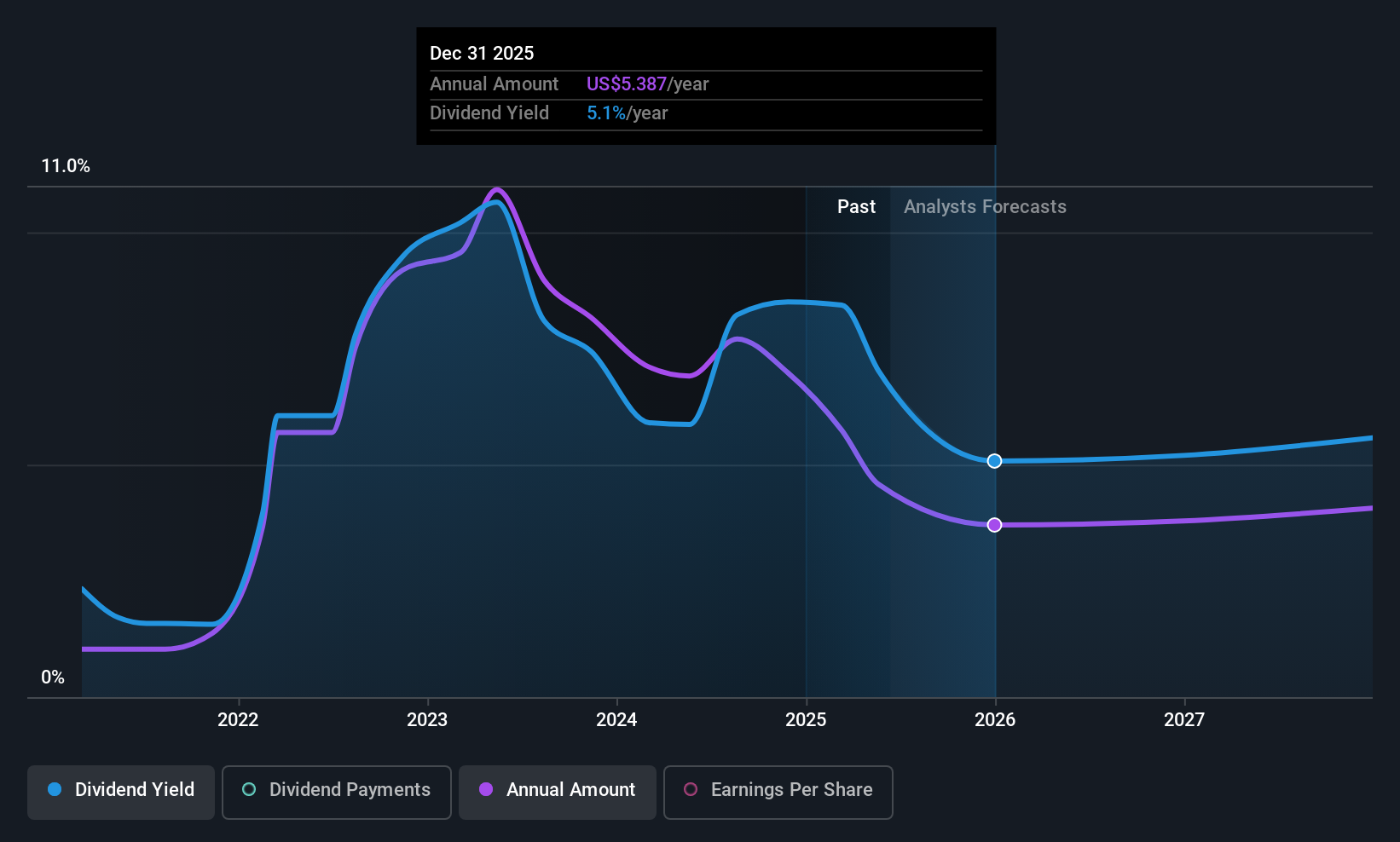

Chord Energy Corporation is an independent exploration and production company in the United States with a market cap of approximately $5.87 billion.

Chord Energy Corporation generates revenue primarily from the exploration and production of crude oil, natural gas liquids (NGLs), and natural gas, amounting to $5.04 billion.

6.5%

Chord Energy's dividend yield of 6.5% places it among the top 25% of US dividend payers, supported by a low cash payout ratio of 35.6%. However, its four-year history shows volatility and unreliability in payments. Despite trading at a significant discount to fair value, recent shareholder dilution and forecasted earnings decline may concern investors. The company recently affirmed a $1.30 per share dividend and completed a $218 million share buyback, reflecting efforts to enhance shareholder returns amidst fluctuating performance.

★★★★☆☆

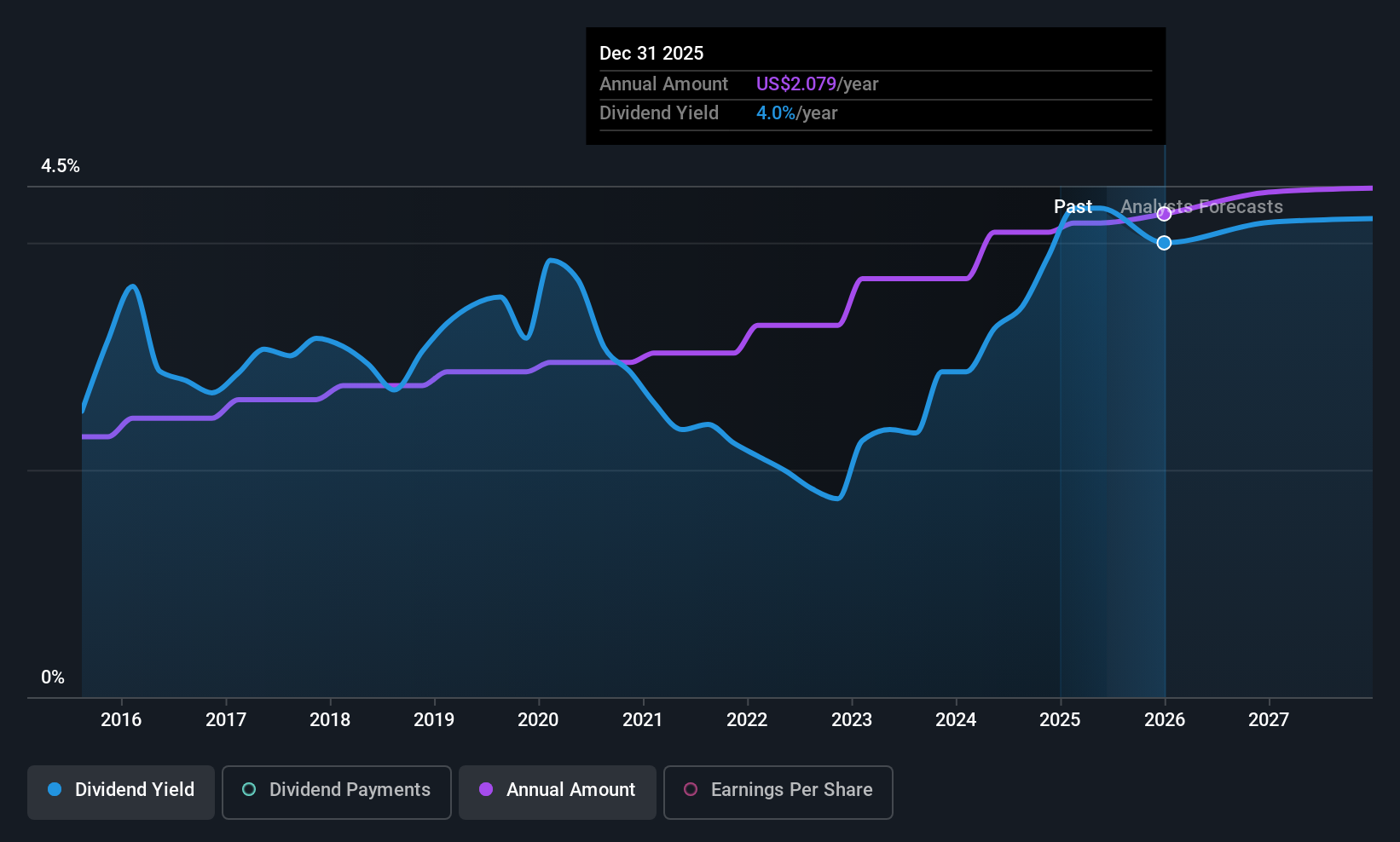

Archer-Daniels-Midland Company operates in the procurement, transportation, storage, processing, and merchandising of agricultural commodities and related products across various countries including the United States, with a market capitalization of approximately $23.38 billion.

Archer-Daniels-Midland Company's revenue segments include Nutrition ($7.40 billion), Carbohydrate Solutions ($12.00 billion), and AG Services and Oilseeds ($66.68 billion).

4.1%

Archer-Daniels-Midland's dividend yield of 4.11% is below the top 25% of US dividend payers, and while dividends have been stable over the past decade, they are not well-covered by cash flows, with a high cash payout ratio of 441.5%. The company's recent earnings report showed decreased net income and profit margins. Despite this, ADM affirmed a $0.51 per share dividend payable in June 2025, maintaining its commitment to returning value to shareholders amid financial challenges.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

We've created the for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

You may also like...

Diddy's Legal Troubles & Racketeering Trial

Music mogul Sean 'Diddy' Combs was acquitted of sex trafficking and racketeering charges but convicted on transportation...

Thomas Partey Faces Rape & Sexual Assault Charges

Former Arsenal midfielder Thomas Partey has been formally charged with multiple counts of rape and sexual assault by UK ...

Nigeria Universities Changes Admission Policies

JAMB has clarified its admission policies, rectifying a student's status, reiterating the necessity of its Central Admis...

Ghana's Economic Reforms & Gold Sector Initiatives

Ghana is undertaking a comprehensive economic overhaul with President John Dramani Mahama's 24-Hour Economy and Accelera...

WAFCON 2024 African Women's Football Tournament

The 2024 Women's Africa Cup of Nations opened with thrilling matches, seeing Nigeria's Super Falcons secure a dominant 3...

Emergence & Dynamics of Nigeria's ADC Coalition

A new opposition coalition, led by the African Democratic Congress (ADC), is emerging to challenge President Bola Ahmed ...

Demise of Olubadan of Ibadanland

Oba Owolabi Olakulehin, the 43rd Olubadan of Ibadanland, has died at 90, concluding a life of distinguished service in t...

Death of Nigerian Goalkeeping Legend Peter Rufai

Nigerian football mourns the death of legendary Super Eagles goalkeeper Peter Rufai, who passed away at 61. Known as 'Do...