Why Are US Expats Renouncing Citizenship? The Hidden Tax Burdens Shaping Global Travel and Tourism Trends

Tuesday, March 11, 2025

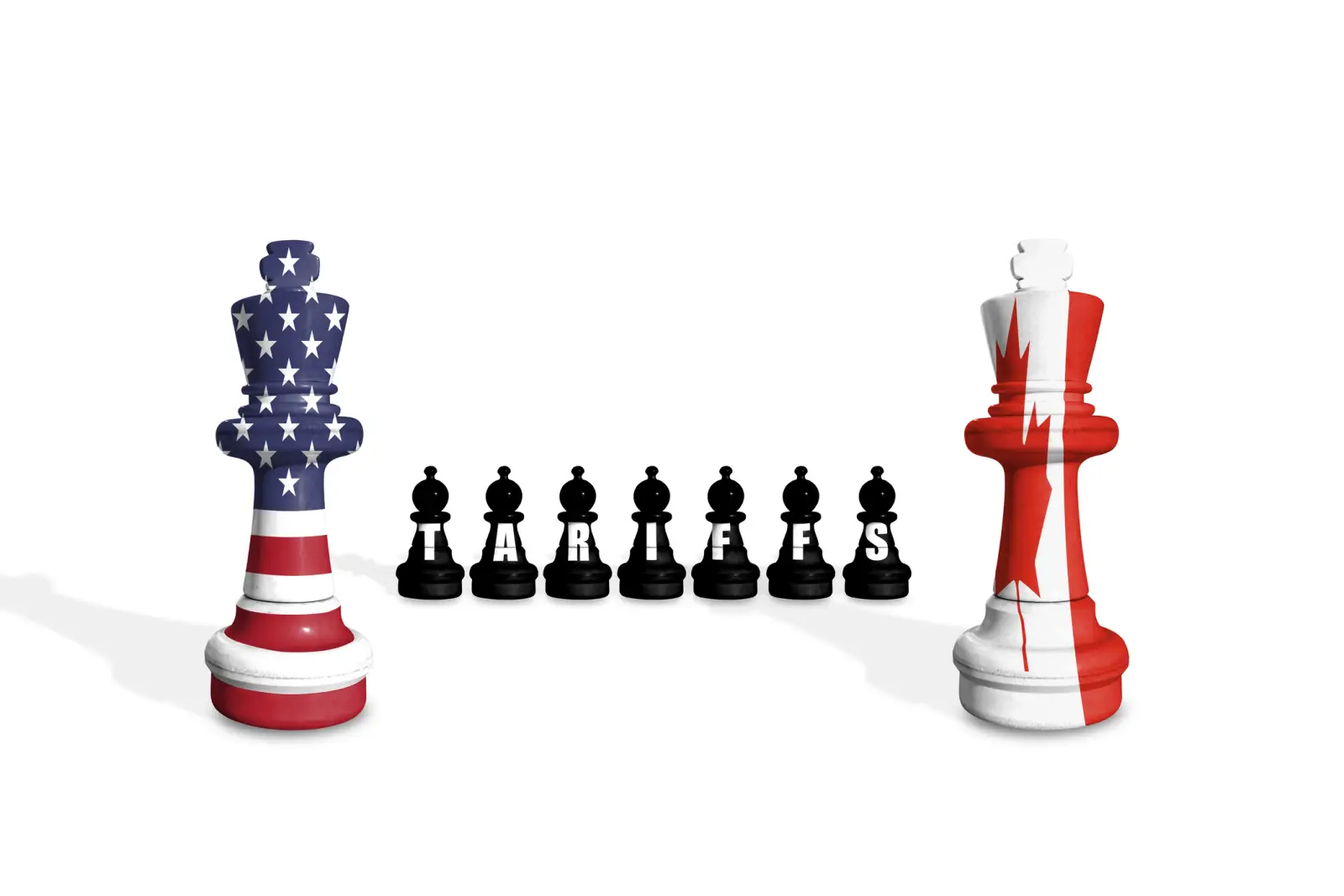

The number of Americans living abroad is estimated to be between three to nine million, a figure that might not initially seem significant. However, compared to other developed nations, the rate at which US citizens renounce their citizenship is noticeably high. This trend, which has grown since the 1990s and 2000s, is largely driven by complex tax obligations and financial reporting requirements.

For those in the travel and tourism industry, understanding these tax complexities is crucial. As more US citizens move abroad for work, travel, or a new life, renouncing US citizenship is no longer just a legal or financial decision—it’s an issue impacting global mobility, travel trends, and even international tourism economies.

Unlike most countries, the , meaning . Every year, they must report all income, including:

Even if they already , they are still required to file with the . While tax credits and foreign income exemptions exist, the sheer .

For US expats who travel frequently or run , these tax burdens become even more frustrating. Whether operating a , compliance with IRS rules can feel like an unnecessary and excessive challenge.

Many who renounce their US citizenship aren’t even individuals who consciously moved abroad. Instead, they are —people born in the US but who have lived their entire lives elsewhere. These individuals often have , yet they are still legally required to:

Between , obtaining a became due to:

Legal experts argue that these , with foreign governments even pressuring the US to reform its .

One of the most dreaded tax requirements for is the .

If a US citizen has a , they must file an with the . This includes:

For those engaged in , these rules create significant challenges. Imagine a travel entrepreneur running —keeping up with US financial disclosures can be overwhelming.

With , there are broader implications for the .

As renouncing , many explore alternative citizenship options in:

These programs allow former .

With growing , US tax policies will continue to shape . Some experts predict that:

For now, .

The global travel and tourism industry is experiencing a transformation, driven in part by tax burdens that make US citizenship more of a liability than an asset. Whether you’re a travel entrepreneur, an expat exploring new destinations, or a tourism professional, understanding these trends is essential.

For those who need help navigating US tax rules while living abroad, seeking expert guidance is crucial. 1040 Abroad provides specialized tax services to ensure compliance while maximizing global mobility. Book a consultation today and take control of your financial future while exploring the world!

Get our daily dose of news, by subscribing to our newsletters. Subscribe here.

Watch Travel And Tour World Interviews here.

Read more Travel News, Daily Travel Alert, and Travel Industry News on Travel And Tour World only.