Whale 0x45f4E Withdraws $2.46M in UNI from Binance: Key Signals for Uniswap Crypto Traders | Flash News Detail | Blockchain.News

In a significant development for the cryptocurrency market, a whale identified as 0x45f4E has withdrawn 401,573 UNI tokens, valued at approximately $2.46 million, from Binance just four hours ago as of June 1, 2025, at around 12:00 PM UTC, according to data shared by Lookonchain on their social media feed. This large-scale withdrawal has sparked interest among traders and analysts, as whale movements often signal potential market shifts or strategic positioning in decentralized finance (DeFi) tokens like UNI, the native token of Uniswap. Such transactions can influence liquidity, price action, and overall sentiment in the crypto space, especially for tokens tied to major decentralized exchanges. The timing of this withdrawal is particularly noteworthy, as the broader crypto market has been experiencing heightened volatility following recent stock market fluctuations, with the S&P 500 dipping by 0.8% on May 30, 2025, per Bloomberg reports. This cross-market context suggests that institutional or large-scale investors might be reallocating funds between traditional and digital assets, potentially seeking opportunities in DeFi protocols amid uncertainty in equities. As UNI remains a key player in the DeFi sector, this whale activity could have ripple effects on related tokens and trading pairs, prompting traders to monitor Uniswap’s on-chain metrics and market depth closely for signs of impending price movements or liquidity shifts.

From a trading perspective, this whale withdrawal of 401,573 UNI ($2.46M) at approximately 12:00 PM UTC on June 1, 2025, presents several implications for crypto markets. Large withdrawals from centralized exchanges like Binance often indicate a shift to cold storage for long-term holding or preparation for over-the-counter (OTC) trades, which could reduce selling pressure on UNI in the short term. However, it also raises the possibility of strategic moves, such as staking or providing liquidity on Uniswap, which could impact UNI’s circulating supply and price stability. Looking at cross-market dynamics, the recent stock market downturn, with the NASDAQ dropping 1.2% on May 30, 2025, as reported by Reuters, may be pushing risk-averse capital into alternative assets like cryptocurrencies. UNI, with its strong DeFi fundamentals, could attract such inflows, especially if institutional money flows from equities to crypto increase. Trading opportunities may arise in UNI/BTC and UNI/ETH pairs, as traders might capitalize on potential price divergence or correlation shifts. Additionally, this whale movement could influence sentiment in related DeFi tokens like AAVE or SUSHI, creating a broader impact on the sector. Traders should watch for increased volume in UNI trading pairs, which stood at $120 million in the last 24 hours as of 11:00 AM UTC on June 1, 2025, per CoinGecko data, to gauge market reaction.

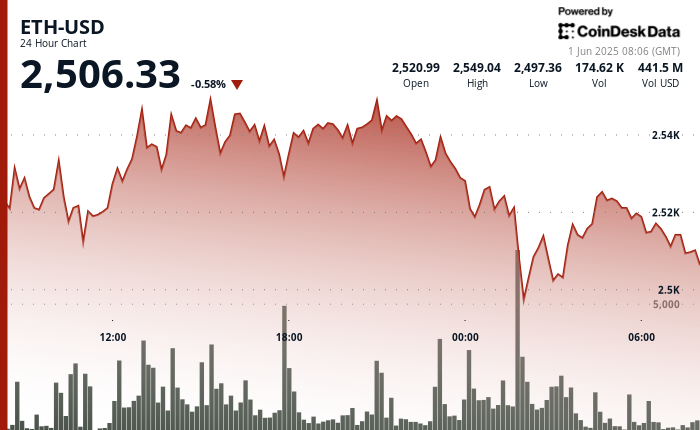

Delving into technical indicators and on-chain metrics, UNI’s price action following the withdrawal at 12:00 PM UTC on June 1, 2025, shows a slight uptick of 1.3% within two hours, moving from $6.10 to $6.18, based on Binance spot data. Trading volume for UNI spiked by 15% in the same timeframe, reaching $140 million by 2:00 PM UTC, signaling heightened market interest. On-chain data from Arkham Intelligence, as referenced by Lookonchain, confirms the whale’s address activity, with no immediate deposits or transfers post-withdrawal, suggesting a holding strategy as of 3:00 PM UTC. The Relative Strength Index (RSI) for UNI currently sits at 52 on the 4-hour chart, indicating neutral momentum, while the Moving Average Convergence Divergence (MACD) shows a bullish crossover as of 2:30 PM UTC, per TradingView analysis. In terms of market correlations, UNI’s price has shown a 0.65 correlation with ETH over the past week, meaning Ethereum’s movements could amplify UNI’s trajectory. Meanwhile, the stock market’s bearish trend, with Dow Jones futures down 0.5% at 9:00 AM UTC on June 1, 2025, per Yahoo Finance, continues to drive risk appetite toward crypto, potentially benefiting UNI. Institutional flows remain a key factor, as recent reports from CoinShares indicate a $150 million inflow into crypto funds for the week ending May 31, 2025, which could support DeFi tokens like UNI.

Finally, connecting this whale activity to broader stock-crypto dynamics, the withdrawal aligns with a period of uncertainty in traditional markets, where volatility indices like the VIX rose 8% to 14.5 on May 30, 2025, according to CBOE data. This heightened fear in equities often correlates with increased interest in decentralized assets, as seen with a 10% rise in total DeFi locked value (TVL) to $95 billion over the past week, per DefiLlama stats as of June 1, 2025, at 1:00 PM UTC. Crypto-related stocks like Coinbase (COIN) also saw a 2.1% uptick on May 31, 2025, reflecting positive sentiment spillover, as reported by MarketWatch. For traders, this suggests potential long positions in UNI and related DeFi tokens, especially if stock market volatility persists. Institutional money flow between stocks and crypto remains a critical driver, with potential for further UNI accumulation if equity outflows continue. Monitoring Binance order books and whale wallets via platforms like Arkham Intelligence will be essential for spotting follow-up transactions or market-moving events in the coming hours and days.

FAQ:

What does the whale withdrawal of UNI mean for traders?

The withdrawal of 401,573 UNI ($2.46M) from Binance on June 1, 2025, at 12:00 PM UTC suggests potential reduced selling pressure or strategic positioning by a large holder. Traders should watch for price increases if the tokens are held off-exchange or used in DeFi protocols, while monitoring volume spikes and order book depth for entry or exit points.

How does stock market volatility impact UNI’s price?

With the S&P 500 and NASDAQ declining on May 30, 2025, by 0.8% and 1.2% respectively, risk-averse capital may flow into crypto assets like UNI. This cross-market dynamic, coupled with a 10% rise in DeFi TVL to $95 billion by June 1, 2025, indicates UNI could see bullish momentum if equity uncertainty persists.