VOXPOP | Nigeria as Africa's fintech and payments hub

Traditional payment systems in Africa are proving costly and inefficient, particularly for cross-border transactions. According to the World Bank, as of 2024, Africa remains the most costly continent to send money to, at 8.37% total cost (compared with a global average of 6.35%).

In this context, blockchain technology could work as an adhesive for the continent’s fragmented financial ecosystem. It offers a transformative alternative through decentralised, peer-to-peer networks that eliminate intermediaries.

Stablecoins have become particularly significant, accounting for 43% of sub-Saharan Africa’s crypto transaction volume and providing stability amid volatile local currencies.

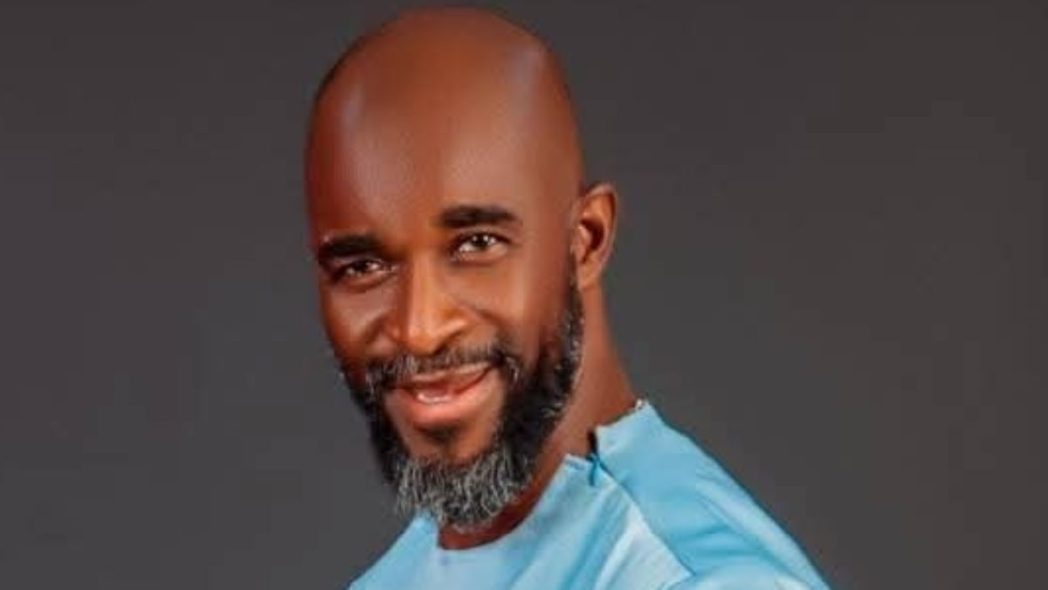

Nigeria ranks second globally in crypto adoption, and receiving approximately $59 billion in cryptocurrency value between July 2023 and June 2024. The country demonstrates crypto’s practical applications, from bill payments to retail purchases, moving beyond speculative trading towards real-world utility. At the Money 20/20 Europe conference in Amsterdam this year, Trade Finance Global (TFG) found out more from Adebusola Adegbuyi, CTO of meCash.

It’s also Africa’s second-largest technology hub, with one of the continent’s strongest fintech sectors: Nigerian tech startups attracted a record $747 million in investment in 2019, which accounted for 37% of funding in Africa.

meCash is positioning itself as a payment gateway for Africa using blockchain technology to facilitate faster, cheaper, and more secure money transfers. As 70% of African countries face foreign exchange (FX) shortages, stablecoins provide businesses crucial access to dollar liquidity, strengthening local economies whilst connecting Africa to global markets.