Unlocking growth: BoG's bold plan to cut lending rates

For decades, Ghana’s economy has operated with a credit system that effectively shuts out its most dynamic economic agents small and medium enterprises (SMEs), startups, and rural entrepreneurs.

The cost of borrowing has remained stubbornly high, dragging down investment, dampening household consumption, and limiting job creation.

While the Ghana Reference Rate (GRR) was introduced in 2018 to bring structure and transparency to bank lending, it has largely failed to translate macroeconomic improvements into affordable credit.

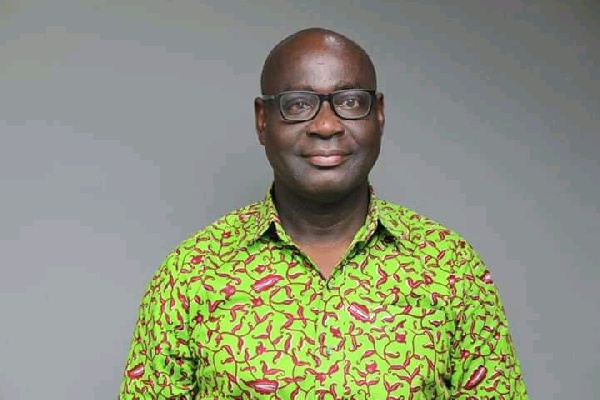

On June 19, 2025, the Bank of Ghana (BoG), under the leadership of Governor Dr. Johnson Pandit Asiama, announced a sweeping set of reforms aimed at slashing lending rates to single digits (below 10%) by 2029. Speaking at the launch of the Ghanaian Banker Magazine and the Chartered Institute of Bankers (CIB) Ghana’s new agenda, Dr. Asiama made it clear: “We are redesigning the architecture of credit in Ghana not tweaking it.”

This move is not merely fiscal; it is a reimagination of how access to money shapes economic freedom, entrepreneurial spirit, and inclusive growth. The stakes could not be higher.

Initially intended to reflect macroeconomic fundamentals, the Ghana Reference Rate (GRR) has fallen short of expectations. Though it draws from the BoG policy rate, 91-day Treasury bill rate, and a bank-specific risk premium, the GRR has remained detached from inflation trends and real economic needs.

For context, a GHS 1 million loan for 12 months at current rates costs borrowers nearly GHS 400,000 in interest. This isn’t growth capital it’s a barrier to ambition.

Ghana’s private sector is suffocating. 65% of businesses, according to the Association of Ghana Industries (AGI), identify expensive credit as the primary impediment to growth outranking taxation, unreliable utilities, and logistics.

The consequences are visible:

To turn this around, the BoG has proposed a multi-pronged reform agenda, focused on making the GRR relevant, responsive, and pro-growth:

Redesigning the formula to align with real-time macroeconomic shifts and lower the weight of inflationary pressures.

Equipping banks with artificial intelligence and big-data analytics to assess borrower risk more accurately and reduce reliance on excessive risk premiums.

Accelerating digital lending through the BoG’s sandbox and promoting fintechs that provide unsecured, character-based loans.

Providing tax relief and co-lending guarantees (e.g., via GIRSAL) for banks that lend to agriculture, manufacturing, and youth enterprises.

“Access to credit must not be a privilege for the few, it must become a tool of national development,” said Dr. Asiama.

The Ghana National Chamber of Commerce and Industry (GNCCI) estimates the reforms could release GHS 12 billion in dormant capital by 2028.

Local banks welcome reform but call for clarity in execution, strong data infrastructure, and BoG support in managing default risks.

Experts warn that the success of the GRR reform hinges on sustained inflation control, fiscal discipline, and currency stability. Inflation, though down to 24.2% (April 2025) from a peak of 54% (December 2022), remains volatile.

Ghana is not alone in this battle. Across the continent:

This is more than a monetary policy reform. The BoG’s strategy is a declaration of intent: to democratize credit, restore business confidence, and rebuild Ghana’s economic engine from the ground up.

Lower lending rates are not a luxury, they are a necessity for:

- Ghana aiming to industrialize and compete globally.

Yet, this path will require more than central bank resolve. It calls for discipline from the Ministry of Finance, innovation from commercial and universal banks, and boldness from the private sector.

If all hands commit to the reform, Ghana may not just cut lending rates, it may unleash an era of productivity, dignity, and economic freedom.